Wall Street Awaits Earnings: JPMorgan vs. Wells Fargo

As October 11 approaches, analysts and investors are closely watching the stock performance of JPMorgan Chase & Co JPM and Wells Fargo & Co WFC. Both banks are gearing up to announce their third-quarter earnings, sparking interest in their stock trajectories.

JPMorgan: Positive Signals Ahead

For its upcoming report, JPMorgan is projected to earn $4.01 per share on revenues of $41.66 billion. Currently, the stock is trading at $213.42, slightly above the analyst consensus target price of $207.17. Analysts rate JPMorgan stock as Overweight.

Recent estimates from firms like Oppenheimer, Morgan Stanley, and Deutsche Bank give an average price target of $229.67, indicating a potential upside of approximately 7.53%.

Chart created using Benzinga Pro

Technical indicators suggest a robust outlook for JPMorgan. Its share price ranks above the eight, 20, and 50-day simple moving averages (SMAs), signaling strong bullish momentum. Additionally, with the stock trading above its 200-day SMA of $195.79, the overall market trends remain positive.

Wells Fargo: Cautiously Optimistic

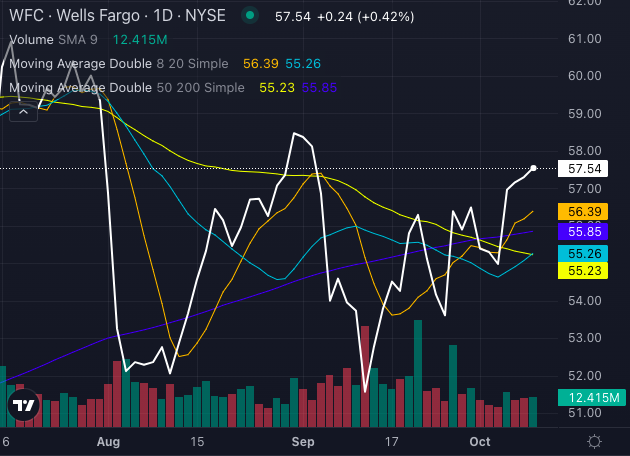

On the other hand, Wells Fargo is estimated to report earnings of $1.28 per share alongside revenues of $20.4 billion. Currently, shares are priced at $57.54, below the consensus target of $59.80, leading analysts to rate Wells Fargo stock as Neutral.

However, analysts from Wolfe Research, Evercore ISI Group, and Morgan Stanley project an average price target of $66.67. This suggests a promising upside of 15.86% for Wells Fargo.

Chart created using Benzinga Pro

Positive signals are evident from Wells Fargo’s technical indicators as well. The stock stands above its eight, 20, and 50-day SMAs, reinforcing a positive sentiment. Additionally, it exceeds its 200-day SMA of $55.85, adding to the optimistic outlook for the short term.

Read Also: How To Earn $500 A Month From Wells Fargo Stock Ahead Of Q3 Earnings

Final Thoughts

Both JPMorgan and Wells Fargo exhibit bullish trends in their stock performances. New York’s JPMorgan appears to possess a sharper technical advantage, indicated by stronger analyst ratings and a higher current share price compared to its moving averages.

Despite the lower current price, Wells Fargo’s consensus price target shows greater upside.

As both banks prepare for their earnings announcements, investors are paying close attention to see if these bullish indicators will translate into favorable results.

While Wells Fargo offers attractive potential growth, JPMorgan’s robust technical and analyst support may make it the frontrunner as a financial stock ahead of earnings.

Read Next:

Market News and Data brought to you by Benzinga APIs