JPMorgan US Quality Factor ETF Shows Strong Potential Upside

At ETF Channel, we analyzed the underlying holdings of the ETFs within our coverage. We compared the trading prices of each holding against their average analyst 12-month forward targets, ultimately calculating the weighted average implied analyst target price for the ETF itself. For the JPMorgan US Quality Factor ETF (Symbol: JQUA), we found the implied analyst target price to be $66.47 per unit.

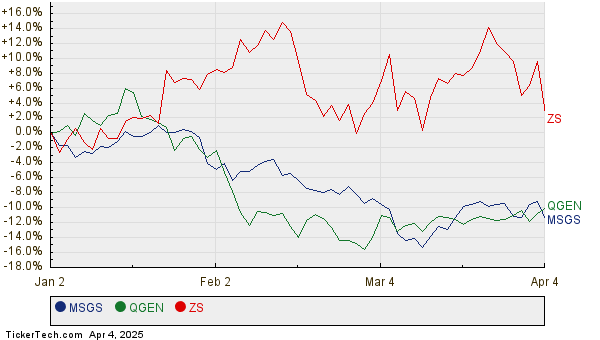

Currently trading at approximately $54.67, JQUA presents analysts with a forecasted upside of 21.58%. This estimate considers the average analyst targets of the ETF’s underlying holdings. Among these holdings, three stand out for their potential: Madison Square Garden Sports Corp (Symbol: MSGS), Qiagen NV (Symbol: QGEN), and Zscaler Inc (Symbol: ZS). MSGS, recently trading at $193.35 per share, has an average analyst target price of $248.75, indicating an upside of 28.65%. Meanwhile, QGEN’s recent price of $40.37 suggests a potential 23.84% gain to its target of $49.99. Lastly, ZS is projected to reach a target price of $235.11, which is 22.32% above its current trading price of $192.21. A chart below illustrates the twelve-month price performance of these stocks:

Here is a summary table of the current analyst target prices for the discussed holdings:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| JPMorgan US Quality Factor ETF | JQUA | $54.67 | $66.47 | 21.58% |

| Madison Square Garden Sports Corp | MSGS | $193.35 | $248.75 | 28.65% |

| Qiagen NV | QGEN | $40.37 | $49.99 | 23.84% |

| Zscaler Inc | ZS | $192.21 | $235.11 | 22.32% |

Given these projections, one may ask if analysts are justified in their target prices or if they hold overly optimistic views for these stocks over the next year. Are analysts accurately accounting for recent developments within the companies and their respective industries? A high target price compared to a stock’s trading price can suggest confidence in the future. However, it also raises the possibility of potential downgrades if those targets fail to reflect current market conditions. Investors should consider these inquiries before making decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

• Convertible Preferred Stocks

• Top Ten Hedge Funds Holding EONC

• Mettler-Toledo International MACD

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.