MicroStrategy Coverage Initiated by Keefe, Bruyette & Woods

On February 7, 2025, Keefe, Bruyette & Woods began coverage of MicroStrategy (BIT:1MSTR) with an Outperform rating.

Analyst Forecast Indicates Significant Price Surge

As of January 28, 2025, MicroStrategy’s average one-year price target stands at €405.15 per share. Forecasts vary, with estimates ranging from €177.01 to €588.86. This average target indicates a potential 27.29% increase from the company’s most recent closing price of €318.30 per share.

Investment Sentiment Among Funds

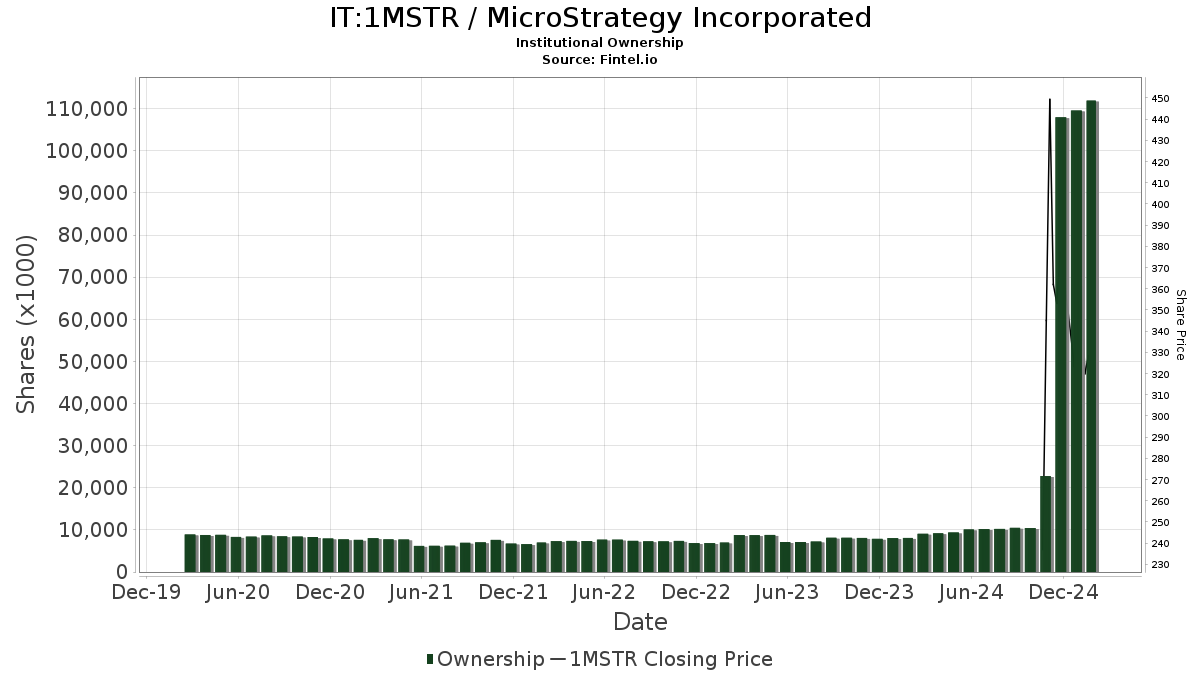

A total of 1,234 funds or institutions have reported holdings in MicroStrategy, marking a notable rise of 196 owners, or 18.88%, in the last quarter. The average portfolio weight of all funds invested in 1MSTR is now 0.52%, which reflects an increase of 33.94%. Over the past three months, institutional ownership surged by 349.65%, leading to a total of 111,938K shares owned by these institutions.

Institutional Shareholders’ Movements

Capital International Investors has increased its holdings to 17,528K shares, now owning 7.54% of MicroStrategy, a significant leap from the 1,726K shares reported earlier, equating to a 90.16% growth in ownership. The firm raised its portfolio allocation by 15.92% in the last quarter.

In contrast, AGTHX – Growth Fund of America has seen a decrease in shares, holding 6,777K shares (2.91% ownership) down from 8,241K shares, which constitutes a drop of 21.60%. However, the firm raised its overall allocation to 1MSTR by 123.71% in the same timeframe.

Furthermore, ANCFX – American Funds Fundamental Investors now owns 6,279K shares (2.70% ownership), up from 611K shares, marking a 90.26% increase. Portfolio allocation in 1MSTR has risen by 20.52% for this fund.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares reported holding 5,539K shares, reflecting a substantial increase of 91.00% from the previous 499K shares. The firm also boosted its investment in 1MSTR by 27.73% over the last quarter.

Geode Capital Management has ramped up its holdings to 2,766K shares (1.19% ownership) from 254K shares, an increase of 90.83% in this period. Their allocation in 1MSTR grew by 23.18% in the most recent quarter.

Fintel offers a comprehensive investment research platform for individuals, traders, financial advisors, and small hedge funds. Our platform supplies extensive data, including fundamentals, analyst reports, ownership data, fund sentiment, and more, to aid in informed investment decisions. We also offer exclusive stock picks supported by advanced quantitative models to enhance profitability.

This article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.