The **Beverages – Alcohol** industry faces significant challenges due to ongoing inflation impacting labor, transportation, and raw material costs. Key players like **Anheuser-Busch InBev (BUD)**, **Constellation Brands Inc. (STZ)**, **Brown-Forman Corporation (BF.B)**, and **The Boston Beer Company Inc. (SAM)** are grappling with rising ingredient prices and increased tariffs, affecting prices for imported brands and consequently straining profitability. The industry is currently ranked #218 out of over 250 groups, placing it in the bottom 11% of the Zacks Industry Rank, indicative of a negative earnings outlook for its constituents.

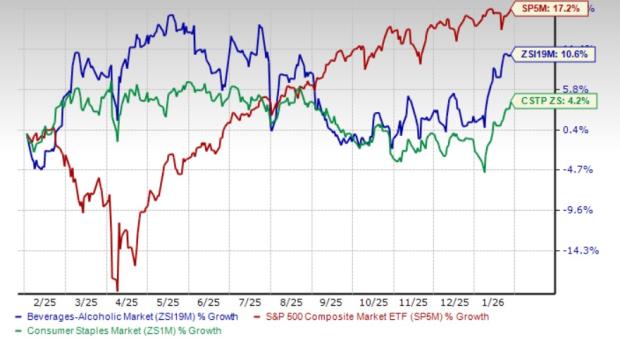

Despite these pressures, trends in premiumization are driving growth as consumers show a preference for high-quality offerings, including ready-to-drink spirits and flavored beverages. The industry recorded a collective return of **10.6% over the past year**, outperforming the Zacks Consumer Staples sector’s growth of **4.2%**, but underperforming compared to the S&P 500, which rose **17.2%**. As the industry adapts to consumer preferences, companies are intensifying investments in innovation and brand enhancement, while trying to navigate elevated operational costs and tariff impacts which continue to influence margins.