Key U.S. Companies Positioned to Benefit from Trade Policies

While the outcome of the current trade conflict remains uncertain, several trends are becoming clear. The U.S. administration is focused on improving trading conditions for American companies and workers, which includes both exporters and domestic competitors. Encouraging self-sufficiency in energy, minerals, and metals is a priority. This situation presents potential advantages for companies such as Freeport-McMoRan (NYSE: FCX), Whirlpool (NYSE: WHR), and Cheniere Energy (NYSE: LNG).

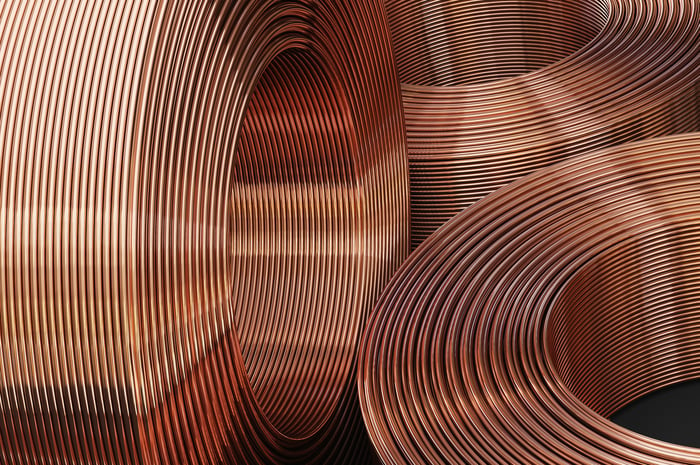

Freeport-McMoran: Securing Essential Copper Supplies

Freeport-McMoran is a leader in the domestic copper market, supplying 70% of the copper needed for U.S. refined production. However, the U.S. still imports 45% of its refined copper consumption. To decrease this dependency, Freeport-McMoran will be vital in boosting domestic production.

Support for this initiative is growing; the U.S. Chamber of Commerce is advocating for copper to be classified as a critical metal and included for tax credits under section 45X. Immediate action is urged to bolster U.S. production of essential minerals.

Freeport-McMoran is well-positioned to fulfill domestic demand, with potential projects in Bagdad and Lone Star, Arizona, alongside an innovative leaching initiative to extract copper from U.S. stockpiles. Additionally, President Trump has called for an investigation into copper imports, which could result in tariffs. The anticipation of these tariffs has led to a 13% premium on U.S. copper. Freeport’s management estimates that maintaining this premium could yield an $800 million financial benefit. Should a tariff of 25% be imposed, the benefit would increase further.

Image source: Getty Images.

While these outcomes are not guaranteed, the current administration’s support for copper investment is likely to boost Freeport-McMoran’s profitability.

Whirlpool: Navigating Competitive Challenges

Whirlpool, known for its substantial dividend yield, faces sustainability issues with its $380 million dividend amidst pressing market challenges. High interest rates are impacting the housing market, subsequently affecting discretionary spending on appliances.

Asian competitors had already started to dominate the U.S. market with increased imports in anticipation of potential tariffs. Recent pauses on tariffs with China may further encourage short-term imports. With long-term debt of $4.8 billion and doubts about generating $500 million to $600 million in free cash flow, Whirlpool’s dividend payout is at risk.

However, management believes the company could benefit from tariffs if the administration takes steps to close loopholes that allow Asian producers to avoid tariffs on the steel used in their products, resulting in a significant cost disadvantage for Whirlpool on major appliances.

In a recent earnings call, CEO Marc Bitzer expressed confidence that the new administration would address these loopholes, which could mean significant gains for Whirlpool. If the company adjusts its dividend policy, it could potentially emerge as a strong investment option.

Image source: Getty Images.

Cheniere Energy: A Leader in LNG Exports

The Biden administration had paused approvals for LNG export applications in 2024, but the Trump administration reinstated them immediately after taking office. This shift is favorable for Cheniere Energy, the leading LNG producer in the U.S.

Cheniere controls a 48.6% stake in Cheniere Energy Partners, which owns a major LNG terminal in Sabine Pass, Louisiana. The company also continues to invest in expanding the Corpus Christi LNG Terminal in Texas.

Cheniere’s business model focuses on purchasing natural gas domestically and converting it into LNG for global export. The Trump administration’s commitment to promoting LNG exports aligns with Cheniere’s interests.

Identifying Potential Investment Opportunities

Tariffs aim to enhance the competitive positioning of U.S. firms, both at home and abroad. However, the administration can also bolster companies by encouraging investments in copper, closing competitive loopholes affecting Whirlpool, and supporting LNG export initiatives. If these strategies succeed, the stocks discussed are likely to emerge as significant long-term assets.

Should You Invest in Freeport-McMoran?

Before making a decision to invest in Freeport-McMoRan, consider the following:

The analyst team has identified what they consider the top 10 stocks for investors currently, and Freeport-McMoran is not among them. These selections have the potential to yield substantial returns over the coming years.

For example, if you had invested $1,000 in Netflix after it made the list on December 17, 2004, your investment would now be worth $642,582!

Or, an investment in Nvidia from April 15, 2005, would have turned $1,000 into $829,879!

It’s important to note that Stock Advisor has achieved an average return of 975%, significantly outperforming the S&P 500 at 172%.

Lee Samaha has no positions in any of the stocks mentioned. The Motley Fool has positions in and recommends Cheniere Energy and Whirlpool. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.