Seven-Day Trade Negotiation Window Sparks Market Volatility

We are currently navigating a pivotal seven-day negotiation period. By this Wednesday, the trade war could either show signs of resolution or escalate into more complex challenges.

To gain deeper insights, we turn to our hypergrowth expert, Luke Lango. Last week, in his Daily Notes for Innovation Investor, Luke discussed President Trump’s recent tariffs and the ongoing market turmoil affecting stocks.

Crucially, Luke believes this situation might not lead to an extensive trade war. Instead, he sees it as a significant opening in a negotiation strategy.

Immediately after [Trump’s] announcement, Treasury Secretary Scott Bessent reaffirmed a pivotal point:

“These tariffs are a cap—not a floor. Countries can negotiate down from them.”

This statement is significant. It suggests that these tariffs serve as leverage for negotiation rather than being rigid policies. Their purpose is to encourage other nations to engage in discussions, make concessions, and ultimately allow Trump to lessen the tariffs while claiming a victory.

Bessent’s choice of words was intentional, signaling the White House’s desire for deals, using the tariffs as a vehicle for this objective.

Understanding the Seven-Day Timeline

This situation hinges on the timing of the tariffs. While the blanket 10% tariff was implemented last Saturday, the higher, country-specific tariffs will take effect this Wednesday, a week after Trump’s announcement.

Luke highlights that:

“That’s a seven-day window—a deliberate buffer zone designed for one thing: negotiation.”

This approach aligns with Trump’s style of creating disruption, compelling global leaders to negotiate and facilitate concessions. The aim is for him to later proclaim, “We made a great deal. We’re rolling back the tariffs. Everyone wins.”

This is not about policy but rather strategic theater that the market must understand.

Last Friday, for instance, news emerged that Trump was in talks with a Vietnamese official regarding a potential tariff reduction agreement. Nike, which sources about 25% of its footwear from Vietnam, saw its stock rise dramatically, rebounding from an initial 5% loss to a gain of 6% within two hours.

This incident illustrates the potential for rapid gains in response to favorable tariff news. This morning, another example unfolded. A rumor that President Trump had paused tariffs caused the Nasdaq to surge from down 5% to up over 4% in minutes. However, as the White House refuted the rumor as “Fake news,” those gains disappeared. Despite this, bullish sentiment returned, causing a quick recovery before more volatility ensued.

Source: StockCharts.com

Luke maintains hope that “deals” will drive a resurgence in the stock market. His reasoning is straightforward: foreign countries cannot afford a prolonged trade war.

For example, Vietnam relies heavily on export-driven growth. A 46% tariff would severely disrupt their supply chains. Even developed economies would face significant challenges, as a 20% tariff on the European Union could trigger a recession in the region.

Luke emphasizes that:

“This is why we believe countries will play ball—because the cost of not doing so is simply too high.”

Rather than a global economic split, what we are witnessing may be a rapid series of trade negotiations, with various nations eager to de-escalate before the April 9th deadline arrives.

The next seven days will be crucial.

We’ll keep you posted, and you can find all the latest updates here in the Digest.

Investment Strategy Recommendations

Luke advises investors to proceed with caution. At the end of last week, he offered four strategic guidelines:

- Do not buy yet

- Trim lower conviction positions

- Focus on high conviction positions

- Identify preferred buying opportunities

In closing, Luke states:

“History has shown us that the market’s darkest moments often occur just before its brightest breakthroughs.”

While the journey may be tumultuous, it has the potential for a brighter future. Policy adjustments and negotiations will occur, ultimately restoring some level of normalcy. Those who maintain their positions through the uncertainty are likely to emerge stronger during the recovery.

Oil Prices Experience Severe Decline

Oil prices are facing a significant downturn. Last Friday, futures for U.S. West Texas Intermediate crude dropped 7%, reaching their lowest point since 2021. This decline continued into today, as oil slipped below $60 before rebounding above this threshold as of my writing.

This sell-off stems from a dual impact on both supply and demand. On the demand side, investors are anxious that Trump’s tariffs could induce a global recession.

As consumers cancel travel plans, demand for gasoline and jet fuel decreases, and corporate projections for product demand also wane—leading to a clear downward trajectory for oil demand.

On the supply side, last Thursday saw eight OPEC+ members agree to increase crude oil output by 411,000 barrels per day, exceeding market expectations.

Helima Croft, global head of commodity strategy at RBC Capital Markets, commented on this move:

“The countries that are driving this decision are saying, ‘Look, everyone thinks we need $90 oil.”

Oil Prices Face Decline: Impacts on Consumers and Investors

We emphasize that we do not require higher prices and are willing to tolerate lower prices for a time.

The Implications of Falling Oil Prices

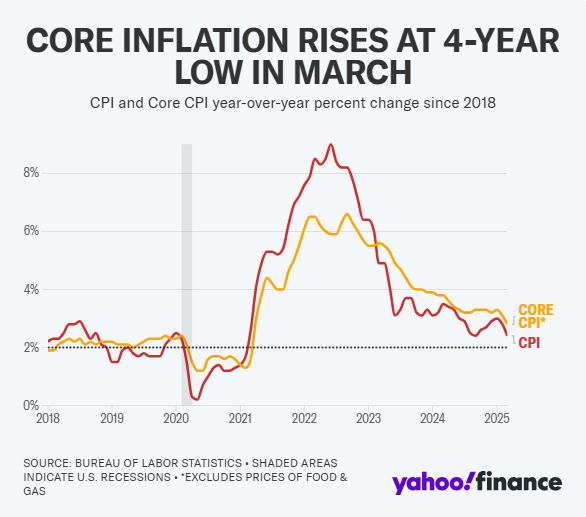

Lower oil prices can benefit consumers greatly. Filling up the gas tank becomes cheaper, and consumers may see lower prices on goods that require crude oil for production. This could also serve to counterbalance a potential resurgence in inflation.

However, these developments carry negative consequences for oil investors and hinder long-term oil infrastructure. The previous administration’s “Drill, baby, drill” slogan now feels outdated. No prudent oil executives will choose to increase drilling and flood the market with excess oil when prices drop.

Insights from the Federal Reserve Bank of Dallas underline these concerns. Recently, an anonymous executive from a major oil company stated:

“The threat of $50 oil prices by the administration has caused our firm to reduce its capital expenditures for 2025 and 2026.”

With $50 per barrel oil, the “Drill, baby, drill” mentality loses traction. The industry may see fewer rigs in operation, a decrease in oil sector jobs, and a drop in U.S. oil production, reminiscent of the downturn during COVID-19.

Despite these challenges, oil prices are expected to rise again. The global economy remains heavily reliant on oil, a fact unlikely to change quickly, even as a shift toward renewable energy grows. Prices may stay low or even decline further for an extended period. Investors should prepare for potential weaknesses in current oil holdings and ensure they have stop-loss strategies in place.

For those eyeing oil and gas stocks, be ready: bargain prices might soon be available.

For Those Ready to Take Risks…

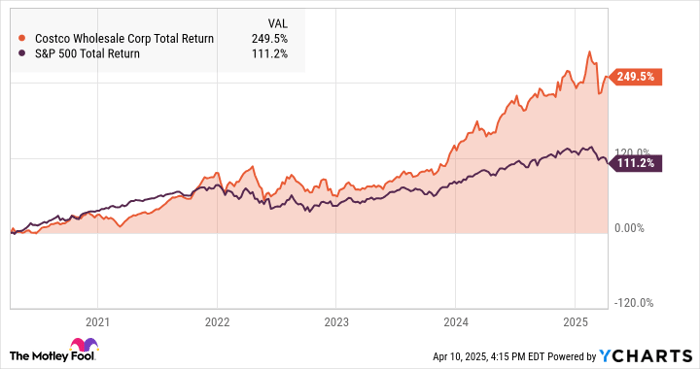

Last week, we explored two approaches for bold investors to engage with the current market turbulence. The first method comes from analysts Andy and Landon Swan, who analyze consumer data to detect spending trends before they reach Wall Street’s attention.

Leveraging these insights, they make targeted investments during earnings season, which kicks off this week as large banks prepare to report. Every Sunday during this season, Andy and Landon share a detailed list of all companies reporting earnings in the following week.

Each company receives an earnings Score ranging from -100 (bearish) to +100 (bullish), with near-zero scores indicating neutrality. They also recommend specific trades based on strategies that provide very brief “risk windows” of only five days.

Here is Landon outlining their goal:

Get in on Monday, exit by Friday, collect your profits, and enjoy your weekend.

Discover more about their approach here.

The Second Trading Approach from Louis Navellier

In his trading service Accelerated Profits, Louis focuses on high-growth stocks that are likely to see quick price increases. He employs his proprietary Stock-rating system to identify top-tier stocks with strong fundamentals and momentum.

The strategy emphasizes capitalizing on bullish trends and quickly exiting to lock in profits while minimizing exposure to possible market declines. Even amid current market volatility, Louis is confident in his system, asserting it can potentially yield at least $100,000 in payout opportunities over the next 12 months without requiring a significant initial investment.

For further details on this trading system and Louis’ pledge, just Click here.

Have a pleasant evening,

Jeff Remsburg

P.S. Don’t miss our latest market update video!

Earlier today, our Editor-in-Chief, Luis Hernandez, interviewed renowned investors Louis Navellier, Eric Fry, and Luke Lango. They discussed current market conditions, predicted where new opportunities will emerge, and offered strategies for investor portfolios.

This essential analysis caters to both cautious and opportunistic investors. Ensure you Click here to watch.