Wall Street on Edge: Inflation Reports Could Signal Stock Market Direction

In the world of finance, the connection between inflation and stock performance is clear. When inflation is low, stocks tend to rise. Conversely, when inflation becomes a threat, stocks face challenges.

This week, often regarded as a “make-or-break” moment for the stock market, will be crucial in determining whether stocks will climb or plummet in the coming month.

Optimistically, analysts expect a positive boost for stocks, potentially igniting a strong market rally. This could mean excellent buying opportunities lie ahead.

To fully grasp these potential opportunities, it’s essential to understand the significance of the week for Wall Street.

It all revolves around one key issue: inflation.

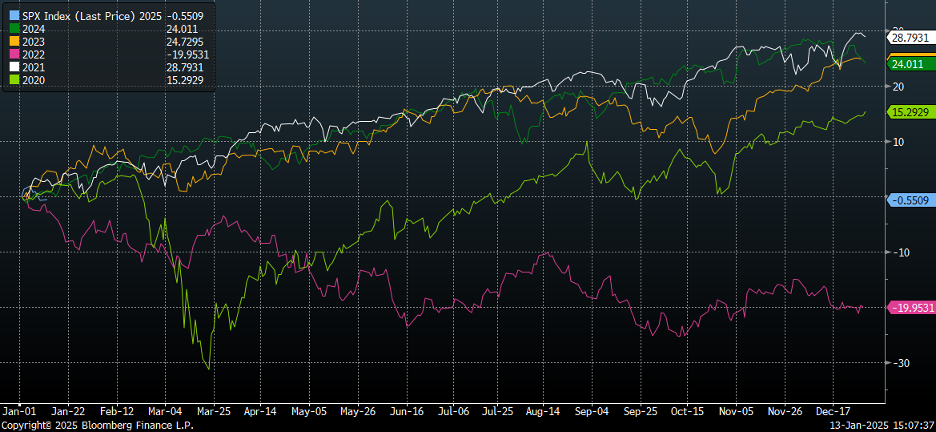

Since the COVID pandemic began nearly five years ago, inflation has been a persistent challenge for markets. In years when inflation was controlled—such as 2020, 2021, 2023, and 2024—the markets thrived, with the S&P 500 climbing over 20% in 2021, 2023, and 2024. However, 2022 told a different story, as inflation surged and the S&P plummeted nearly 20%. See the chart below:

Clearly, inflation has significantly influenced stock market trends over the years. As the market keeps watchful eyes on inflation, concerns have emerged about a potential upswing in inflation rates in 2025.

Concerns Over Inflation and Key Economic Reports

Following a consistent decline from summer 2022 to late 2024, the U.S. inflation rate has shown signs of increase in recent months. The core inflation rate, which excludes fluctuating food and energy prices, has also leveled off. Additionally, consumer inflation expectations have been climbing recently.

With possible inflationary policies such as tariffs and deregulation on the horizon, market experts fear that inflation could surge again this year.

This is a serious concern. A new spike in inflation would likely prevent the Federal Reserve from reducing interest rates and might even force rate hikes to combat inflation. The implications are significant: higher mortgage rates, increased auto financing costs, elevated lending rates, and higher credit card interest rates—all contributing to a more expensive lifestyle for Americans.

Should inflation rise significantly, the risk of a recession looms large.

This week, Wall Street will receive vital inflation reports, shedding light on the current economic climate.

On Tuesday, the Producer Price Index will be released, followed by the Consumer Price Index on Wednesday, and the Import/Export price report on Thursday.

In short, we will discover if the inflation-induced recession fears currently circulating on Wall Street are justified.

Interestingly, we don’t believe they are.

Recent data indicates that although inflation rates have moved upward in late 2024, they appear to be stabilizing. The headline consumer inflation rate did rise in October and November but is expected to increase less dramatically in December. Projections suggest a decrease of seven basis points in January.

In simpler terms, inflation seems to be easing again. The latest trends indicate a shift from rising inflation back towards more stable levels.

Core inflation trends also reveal improvement. It rose slightly in October but showed a decline in November and is projected to continue falling into January.

As inflation trends rebound from late 2024’s setback, we expect this week’s inflation reports might outperform market expectations.

If they do, we could see a positive rebound in stocks over the upcoming weeks.

Final Insights on Inflation’s Impact

The S&P 500 has retraced to critical support levels at the base of its 2024 trading channel as well as its 100-day moving average. Historically, it has bounced back off these levels twice since late 2023—once in October 2023 and again in August 2024. Similarly, it has found support at the 100-day moving average in April 2024 and September 2024.

In all instances, these points have presented solid buying opportunities.

Currently, support from the bottom of the trading channel and the moving average creates a potential for market recovery. If the market reacts positively to this week’s inflation reports, it could signal the beginning of a significant rally towards new highs.

For 2025, we are keen on identifying promising stock investments, particularly coming from innovative leaders like Elon Musk and his AI endeavor, xAI.

Click here to learn more about xAI now.

On the date of publication, Luke Lango held no positions related to the securities discussed in this article.

P.S. Stay informed with Luke’s latest market insights by following our Daily Notes! Check out the latest issue on your Innovation Investor or Early Stage Investor subscriber site.