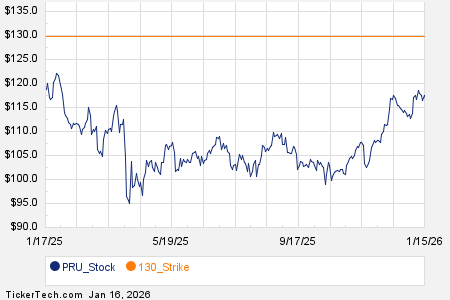

Among the Russell 3000 index components, notable options trading was observed in several companies on October 9, 2023. Prudential Financial Inc (PRU) saw 6,575 contracts traded, representing approximately 657,500 underlying shares, or 44.7% of its average daily trading volume of 1.5 million shares. A significant focus was on the $130 strike call option expiring February 20, 2026, with 877 contracts traded.

Horton Inc (DHI) experienced options trading of 14,228 contracts, totaling about 1.4 million underlying shares, or 43.6% of its average daily trading volume of 3.3 million shares. Notably, the $150 strike put option expiring January 23, 2026, accounted for 4,023 contracts traded.

The Trade Desk Inc (TTD) registered the highest activity with 56,355 contracts traded, equal to approximately 5.6 million underlying shares, or 43.4% of its monthly average of 13 million shares. The $40 strike call option expiring January 23, 2026, was particularly active with 5,762 contracts traded.