Mondelez Set to Announce Q3 Earnings: Analysts Anticipate Growth

Mondelez International, Inc. (MDLZ), sporting a market cap of $94.5 billion, is a renowned global snacks company. Based in Chicago, Illinois, Mondelez produces and sells a variety of snack food and beverage products, ranging from chocolates and biscuits to gum, candy, and grocery items. The company is expected to reveal its fiscal Q3 earnings after market close on Tuesday, Oct. 29.

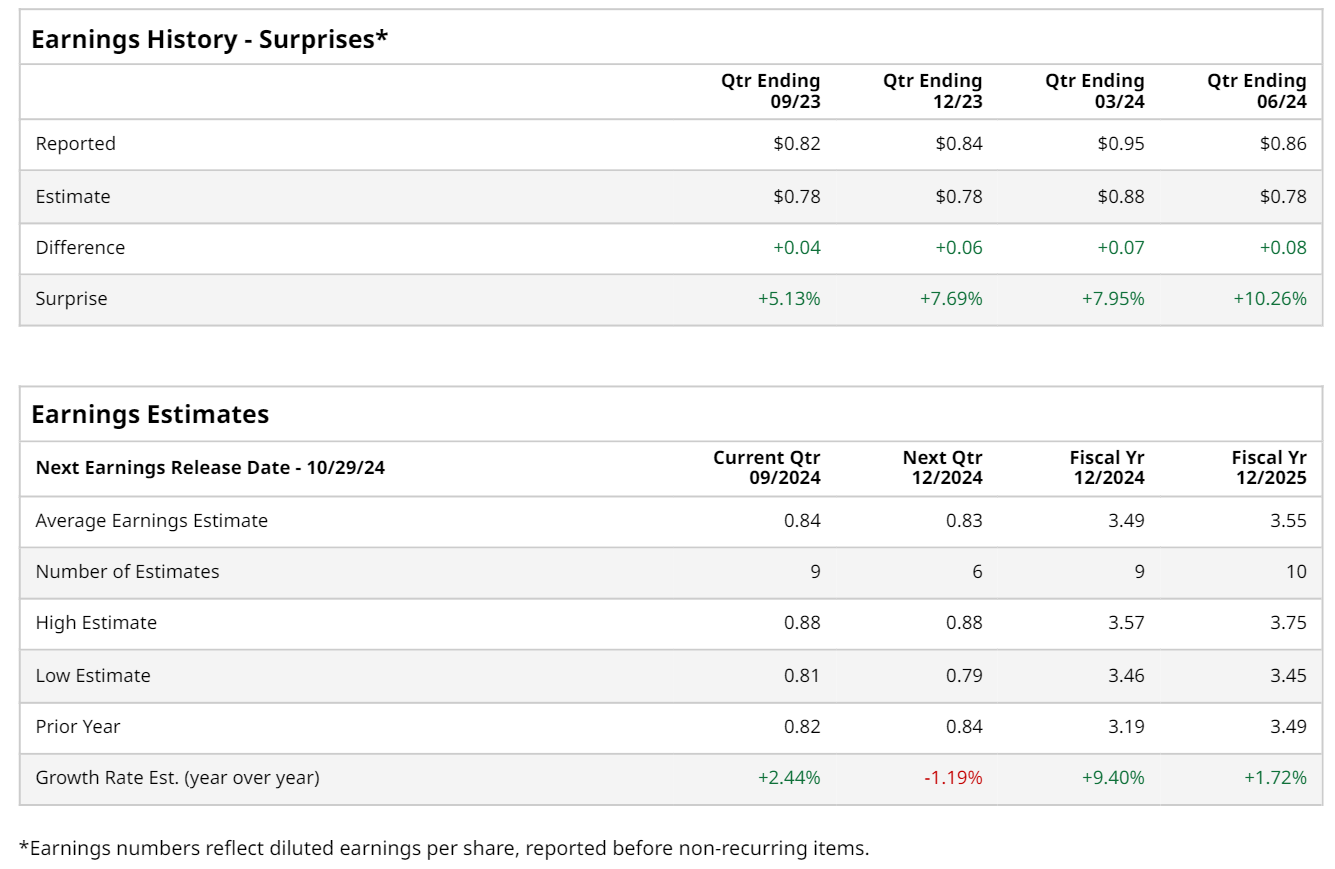

Profit Projections Point to Earnings Growth

Analysts anticipate Mondelez to report a profit of $0.84 per share for the upcoming quarter. This figure represents a 2.4% increase from the $0.82 per share reported in the same quarter last year. Notably, Mondelez has outperformed Wall Street’s earnings forecasts for the past four quarters. In the most recent quarter, the company reported adjusted earnings of $0.86 per share, exceeding consensus estimates by 10.3% and reflecting a 25% year-over-year growth on a constant currency basis. Contributing factors for this success include strong operating gains, reduced interest expenses, and a decrease in outstanding shares, despite facing higher tax obligations.

Future Earnings Predictions and Trends

Looking to fiscal 2024, analysts expect MDLZ to achieve an EPS of $3.49, which marks a 9.4% rise from the $3.19 recorded in fiscal 2023. The following year, fiscal 2025, is projected to see EPS further increase by 1.7% to $3.55.

Stock Performance Compared to Industry Peers

This year, MDLZ’s stock has seen a 2.8% decline, significantly trailing behind the S&P 500 Index’s ($SPX) impressive 22.7% gain and the Consumer Staples Select Sector SPDR Fund’s (XLP) 13.2% rise during the same period.

Stock Reaction Post Q2 Earnings

After the release of its Q2 earnings on July 30, shares of MDLZ climbed 1.9%. Revenue for the quarter stood at $8.34 billion, falling short of consensus estimates of $8.39 billion. However, the increase in stock price can largely be attributed to the company’s adjusted earnings beating expectations and the announcement of an 11% rise in quarterly cash dividends.

Analyst Ratings Show Optimism

The overall consensus among analysts remains positive for Mondelez International’s stock. Out of 21 analysts covering MDLZ, 19 recommend a “Strong Buy,” while one suggests a “Moderate Buy” and another advises “Hold.” The average analyst price target for MDLZ is $80.57, indicating a potential upside of 14.4% from current levels.

Disclaimer

On the publication date, Neharika Jain did not have (either directly or indirectly) positions in any securities mentioned in this article. All information and data in this article are for informational purposes only. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.