Monster Beverage Faces Earnings Challenge Amid Market Struggles

Monster Beverage Corporation (MNST), with a market cap of $48.1 billion, is a prominent energy drink company situated in Corona, California. The company is widely recognized for its Monster Energy line, which features a wide range of beverages tailored to various preferences. On Wednesday, Feb. 26, MNST is slated to release its fiscal Q4 earnings results.

Analyst Predictions and Recent Performance

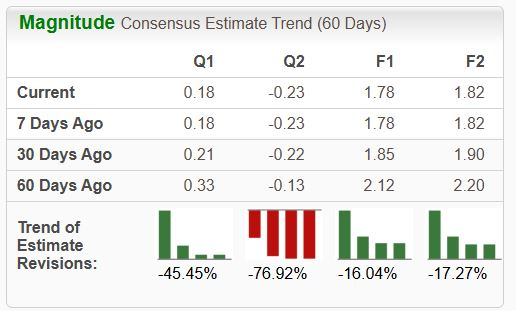

In anticipation of the earnings report, analysts forecast MNST will earn a profit of $0.40 per share. This figure represents a 5.3% increase from the $0.38 per share reported in the same quarter last year. Despite these optimistic expectations, MNST has not managed to meet Wall Street’s earnings estimates for the past four quarters.

Future Earnings Outlook

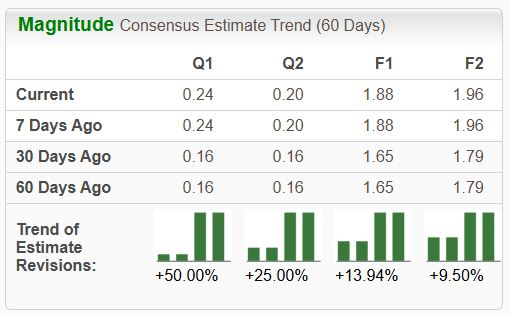

Looking ahead to fiscal year 2024, predictions indicate that the company will report an earnings per share (EPS) of $1.62, up 4.5% from $1.55 in fiscal 2023. Furthermore, for fiscal year 2025, EPS is expected to increase by 13.6% to $1.84.

Recent Stock Performance

Over the past year, MNST stock has fallen by 13.9%. This decline is notable compared to the S&P 500 Index’s ($SPX) 25% gain and the Consumer Staples Select Sector SPDR Fund’s (XLP) 7.7% return during the same period.

Challenges Impacting Growth

Monster Beverage’s recent struggles are attributed to slowing growth in the energy drink sector, especially in U.S. convenience stores, amid waning consumer spending. Additionally, the company has encountered inventory problems with its alcohol-infused Monster drinks, which indicate weaker-than-expected demand.

Q3 Results and Analyst Ratings

On Nov. 7, MNST published its Q3 results, leading to a slight increase in share price. However, the adjusted EPS of $0.40 fell short of Wall Street’s expectations of $0.42, and the revenue of $1.88 billion was below forecasts of $1.91 billion.

Despite these setbacks, the overall consensus on MNST stock is moderately positive, receiving a “Moderate Buy” rating. Among the 21 analysts monitoring the stock, 11 recommend a “Strong Buy,” one suggests a “Moderate Buy,” seven advise a “Hold,” and two propose a “Strong Sell.”

MNST’s average analyst price target stands at $55.09, suggesting an upside potential of 11.9% from current price levels.

On the date of publication, Kritika Sarmah did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.