Understanding Wall Street’s Take on Meta Platforms

Investors often turn to Wall Street analysts for guidance on whether to buy, sell, or hold stocks. Changes in ratings by these analysts, employed by brokerage firms, can significantly influence stock prices. But how much should investors really rely on these recommendations?

Meta Platforms: Current Analyst Recommendations

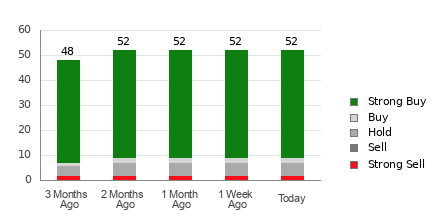

Meta Platforms (META) has an average brokerage recommendation (ABR) of 1.38 on a scale from 1 to 5, where 1 represents a Strong Buy and 5 a Strong Sell. This ABR is based on recommendations from 52 brokerage firms, positioning it close to a Strong Buy.

Of the 52 ratings contributing to this ABR, 43 are categorized as Strong Buy while two are rated as Buy. This highlights that Strong Buy and Buy recommendations make up 82.7% and 3.9% of the total, respectively.

Trends in Brokerage Recommendations for META

While an ABR indicating a buy suggests positive sentiment for Meta Platforms, making an investment decision based solely on this metric may not be the best approach. Research indicates that brokerage recommendations often fall short in helping investors choose stocks likely to experience significant price increases.

The Reason Behind Caution

The bias present in brokerage firms can mislead investors. For every “Strong Sell” from a firm, there tend to be five “Strong Buy” recommendations. This discrepancy suggests that analysts’ interests don’t always align with those of retail investors, making these ratings less reliable for predicting a stock’s future direction.

Instead, this information should ideally complement your own research or support indicators that have shown success in forecasting stock movements.

How Does Zacks Rank Differ?

Zacks Rank is another tool for stock evaluation. It categorizes stocks into five groups, from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This proprietary model, known for its solid track record, uses earnings estimate revisions as a backbone, thus serving as a more reliable predictor of near-term stock performance.

While both ABR and Zacks Rank utilize similar numerical scales, they differ in methodology. The ABR is derived from brokerage recommendations and often includes decimals. Conversely, Zacks Rank relies on earnings estimate trends and is displayed in whole numbers, making it more pragmatic for investors.

Current Estimates for Meta Platforms

Regarding Meta Platforms, the Zacks Consensus Estimate for this year climbed 0.1% over the past month to $22.68. This growing positivity among analysts may indicate a strong potential for price growth in the near future.

Meta Platforms currently holds a Zacks Rank #2 (Buy), bolstered by recent upward revisions in earnings estimates. This suggests a notable level of confidence in the company’s financial prospects.

What to Consider When Investing in META

For investors, the Buy-equivalent ABR for Meta Platforms can serve as an important consideration in their investment strategy.

Top Stock Picks for the Near Future

Experts have recently identified 7 top stocks from the Zacks Rank #1 Strong Buys list, suggesting they hold great potential for early price upsides.

Historically, this exclusive list has outperformed the market, achieving an average annual gain of +24.1% since 1988. It’s worth paying attention to these selected stocks.

To access the latest recommendations from Zacks Investment Research, you can download the report on the 7 Best Stocks for the Next 30 Days right now.

Meta Platforms, Inc. (META): Free Stock Analysis Report

For the complete article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.