Amazon Stock Performance Faces Challenges Amid Market Fluctuations

Amazon (AMZN) has recently garnered attention on Zacks.com as one of the most searched stocks. It’s important to consider key factors that may affect the stock’s performance in the near future.

In the past month, shares of the online retail giant have declined by 6.5%, while the Zacks S&P 500 composite fell by 6.1%. The Zacks Internet – Commerce industry, encompassing Amazon, also experienced a downturn of 8.6%. The pressing question remains: What is the likely direction for the stock?

Factors Influencing Stock Performance

Media reports and rumors regarding business prospects can significantly impact a company’s stock price. However, fundamental factors consistently guide the buy-and-hold strategy for investors.

Revisions to Earnings Estimates

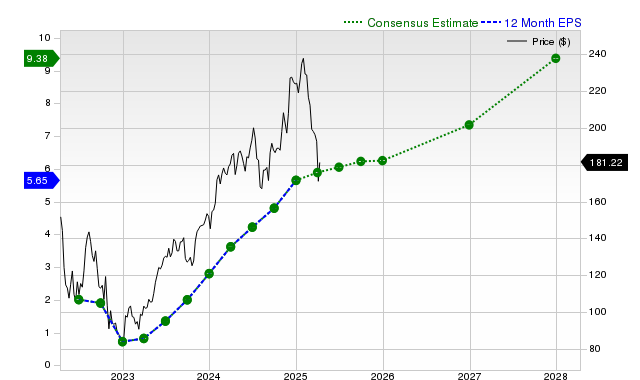

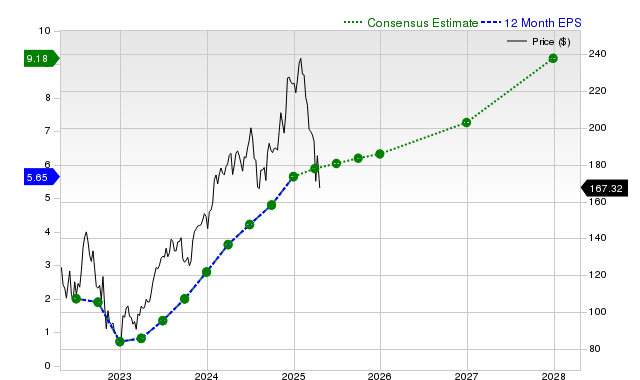

At Zacks, we prioritize changes in a company’s future earnings projections as fundamental to assessing stock value. Understanding how sell-side analysts adjust their earnings estimates based on the latest trends is crucial. A rise in estimated earnings can raise the stock’s fair value, prompting investor interest and pushing prices higher. Research consistently indicates a strong correlation between earnings estimate revisions and stock price movements.

For the current quarter, Amazon’s expected earnings stand at $1.37 per share, signifying a year-over-year increase of 21.2%. However, the Zacks Consensus Estimate has decreased by 0.8% in the past 30 days.

The consensus estimate for the current fiscal year is $6.25, reflecting a 13% increase compared to the previous year. This estimate has fallen by 1.1% within the last month.

Looking to the next fiscal year, the estimate of $7.34 indicates a 17.5% increase from prior expectations. This figure has seen a reduction of 1.3% over the last month.

Utilizing our proprietary stock rating tool, the Zacks Rank evaluates a stock‘s near-term performance potential. Currently, Amazon holds a Zacks Rank of #3 (Hold), based on various factors related to earnings estimate changes.

12 Month EPS

Projected Revenue Growth

While earnings growth is a vital indicator of a company’s health, sustained growth is contingent upon rising revenues. Thus, understanding Amazon’s revenue potential is essential.

The consensus sales estimate for the current quarter is $154.64 billion, indicating a year-over-year increase of 7.9%. For the current and next fiscal years, estimates of $694.54 billion and $763.21 billion suggest growth rates of 8.9% and 9.9%, respectively.

Last Reported Results and Surprise History

In its latest quarterly report, Amazon generated revenues of $187.79 billion, a year-over-year increase of 10.5%. The EPS of $1.86 represented a substantial improvement from $1.01 the previous year.

Relative to the Zacks Consensus Estimate of $187.28 billion, Amazon’s reported revenues exceeded expectations, resulting in a surprise of 0.28%. The EPS surprise registered at 22.37%.

In fact, Amazon has consistently surpassed consensus EPS estimates over the last four quarters, achieving revenue estimates above consensus three times in that same period.

Valuation Insights

Evaluating a stock’s valuation is crucial in making informed investment decisions. It’s vital to determine if a stock’s current price accurately reflects the business’s intrinsic value and growth prospects.

By comparing valuation multiples such as price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF) with historical values, investors can assess whether a stock is fairly valued or not. Comparative analysis with peers further aids in determining the stock’s price reasonableness.

Amazon receives a D rating on the Zacks Value Style Score, indicating that it trades at a premium compared to its peers. Click here to view the valuation metrics contributing to this grade.

Bottom Line

The analysis discussed here, along with further information on Zacks.com, may help investors decide whether to engage with the current market sentiment surrounding Amazon. Its Zacks Rank of #3 suggests a likelihood of performance in line with the broader market in the near term.

Zacks Identifies Top Semiconductor Stock

This company, a fraction of NVIDIA’s size, which has surged over 800% since our recommendation, shows great potential. Although NVIDIA remains strong, our new top chip stock has ample room for growth.

Through robust earnings growth and an expanding customer base, this company is poised to meet the soaring demand for Artificial Intelligence, Machine Learning, and the Internet of Things. Projections predict global semiconductor manufacturing could grow from $452 billion in 2021 to $803 billion by 2028.

See this stock now for free >>

Interested in the latest recommendations from Zacks Investment Research? Download the report on the 7 Best Stocks for the Next 30 Days. Click for your free copy.

Amazon.com, Inc. (AMZN): Free stock analysis report.

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.