Wall Street Analysts Weigh In on Celsius Holdings: A Financial Overview

Investors often turn to Wall Street analysts for guidance on whether to buy, sell, or hold stocks. Changes in ratings by brokerage-firm analysts can significantly impact stock prices, leading many to wonder about their true influence. Let’s explore the insights from analysts regarding Celsius Holdings Inc. (CELH) and evaluate the reliability of these brokerage recommendations.

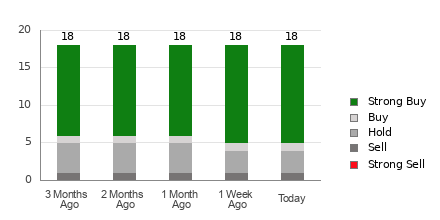

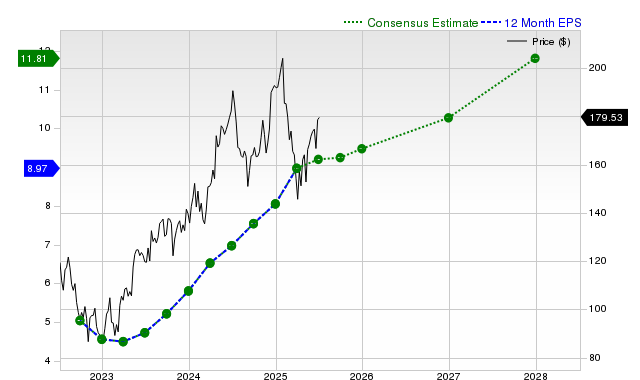

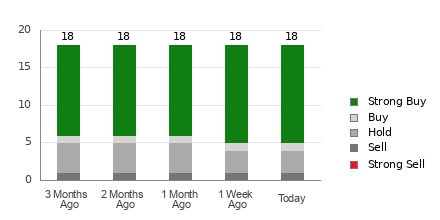

Currently, Celsius holds an average brokerage recommendation (ABR) of 1.56 on a scale from 1 to 5, with 1 representing Strong Buy and 5 representing Strong Sell. This figure is derived from the actual recommendations provided by 18 different brokerage firms. An ABR of 1.56 suggests a leaning towards Strong Buy.

Among the 18 reports that contribute to this ABR, 13 are classified as Strong Buy and one as Buy. As a result, Strong Buy ratings make up approximately 72.2% of recommendations, while the Buy ratings account for around 5.6%.

Celsius Recommendations: Analyzing the Trends

View Celsius price target and stock forecast here>>>

While the ABR suggests purchasing Celsius, relying solely on this metric for investment decisions may not be prudent. Research indicates that brokerage recommendations often offer little to no success in helping investors identify stocks with strong price appreciation potential.

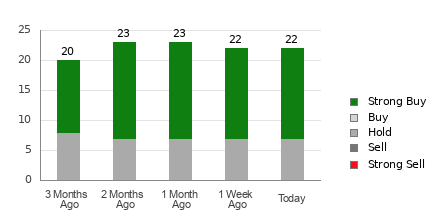

But why is that? Brokerage firms often have vested interests in the stocks they cover, leading to a bias in the recommendations they provide. Studies reveal that analysts assign approximately five “Strong Buy” ratings for every “Strong Sell” recommendation.

This discrepancy can misalign the interests of brokerage firms with retail investors, which results in less accurate predictions regarding future stock price movements. Therefore, brokerage ratings should ideally be used to supplement your own analysis or be combined with other effective tools for stock price predictions.

One such tool is the Zacks Rank, a proprietary stock rating system backed by an externally audited track record. The Zacks Rank classifies stocks into five categories from #1 (Strong Buy) to #5 (Strong Sell) and serves as a reliable predictor of near-term price performance. Using Zacks Rank alongside the ABR can enhance your investment decisions.

Understanding the Difference: Zacks Rank vs. Average Brokerage Recommendation

Although Zacks Rank and ABR both use a numerical scale from 1 to 5, they are fundamentally different metrics. The ABR is purely based on brokerage recommendations and is often displayed in decimal form (e.g., 1.28), while the Zacks Rank is a quantitative model based on earnings estimate revisions.

Analysts from brokerage firms tend to exhibit biases toward more favorable ratings due to their employers’ interests. Consequently, these analysts may provide recommendations that are not fully supported by the underlying research, often leading investors astray.

Conversely, the Zacks Rank is driven by revisions in earnings estimates, which are closely tied to stock price movements. This model ensures a more balanced outlook across all stocks with current-year earnings estimates, making it a reliable assessment tool.

Furthermore, there is a significant difference in responsiveness between ABR and Zacks Rank. The ABR may not reflect the most current information, whereas the Zacks Rank is continually updated to account for changes in earnings estimates made by analysts, providing timely predictions of stock prices.

Is Investing in Celsius a Good Decision?

Looking at earnings estimate revisions for Celsius, the Zacks Consensus Estimate for this year has risen by 9.6% in the last month to $1.05. The favorable sentiment among analysts regarding the company’s earnings growth, shown through the upward adjustment in EPS estimates, suggests that CELH could see increased value in the near future.

The magnitude of this estimate change, coupled with three other relevant factors, has led to a Zacks Rank of #1 (Strong Buy) for Celsius. You can view the complete list of current Zacks Rank #1 stocks here>>>>

Consequently, while the ABR suggests a Buy rating for Celsius, it should merely guide investors rather than serve as the sole basis for investment decisions.

Zacks Names #1 Semiconductor Stock

With an impressive growth trajectory, this company is just 1/9,000th the size of NVIDIA, the stock which soared over +800% since Zacks recommended it. Although NVIDIA’s performance remains strong, this new semiconductor stock offers significant room for growth.

With robust earnings growth and a growing customer base, it is set to capture the rising demand in industries like Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor market is anticipated to expand from $452 billion in 2021 to $803 billion by 2028.

Discover this stock for free>>

Access your free stock analysis report on Celsius Holdings Inc. (CELH).

This article was originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.