Meta Platforms: A Closer Look at Future Stock Performance

Meta Platforms (META) has made headlines recently as one of the most searched stocks on Zacks.com. It’s important to evaluate the factors that might influence its stock performance moving forward.

Recent Stock Performance and Industry Context

Over the last month, shares of Meta have dropped by 2.6%, while the Zacks S&P 500 composite saw a decline of 2.2%. During this same time, the Zacks Internet – Software industry, which includes Meta Platforms, experienced a larger decrease of 5.3%. Analysts are now left wondering about the potential trajectory of the stock.

Earnings Estimates and Their Significance

At Zacks, we focus on changes in future earnings estimates since they are crucial to a company’s stock valuation. Analysts revise their earnings predictions based on current business trends, and when these estimates rise, it can signal higher fair value for the stock. A greater fair value than the market price often leads to increased buying interest, pushing the stock price higher. Consequently, there’s a well-established relationship between revisions in earnings estimates and short-term stock performance.

For the current quarter, Meta Platforms is projected to earn $6.76 per share, which represents a 26.8% increase from the same period last year. The Zacks Consensus Estimate has shifted up by 0.2% in the last month.

The full-year earnings estimate stands at $22.68, suggesting a 52.5% increase compared to last year. This estimate also rose by 0.1% over the past month.

For the upcoming fiscal year, analysts expect earnings of $25.21, indicating an 11.1% growth compared to expected results from a year ago, also with a slight increase of 0.1% in estimates recently.

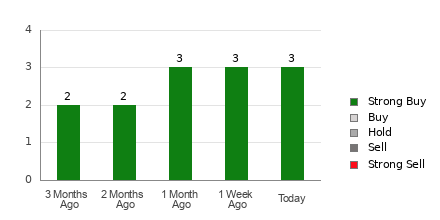

With a strong, externally verified track record, our proprietary Zacks Rank tool provides a reliable outlook for a stock’s near-term price behavior by analyzing earnings estimate revisions. Meta Platforms currently holds a Zacks Rank #2 (Buy), reflecting positive sentiment among analysts.

Projected Revenue Growth

While earnings growth serves as a solid indicator of financial health, revenue growth is equally crucial; a company requires increasing revenues to sustain long-term earnings growth. Thus, understanding revenue potential is essential.

For Meta Platforms, the consensus sales estimate is $46.98 billion for the current quarter, marking a year-over-year increase of 17.1%. For the current and next fiscal years, estimates stand at $163.08 billion and $187.11 billion, representing changes of 20.9% and 14.7%, respectively.

Recent Financial Performance and Surprises

Meta Platforms recently announced revenues of $40.59 billion for the last quarter, reflecting an 18.9% increase from the previous year. The earnings per share (EPS) were reported at $6.03, up from $4.39 a year earlier.

When compared to the Zacks Consensus Estimate of $40.21 billion, these results show a positive revenue surprise of 0.95%, with an EPS surprise of 16.18%.

Moreover, the company has consistently beaten consensus EPS and revenue estimates over the past four quarters.

Understanding Valuation

Assessing a stock’s valuation is critical when making investment choices. To understand future price movements, it is important to determine if a stock’s current price accurately reflects its intrinsic value and growth potential.

An effective method of evaluating stock valuation involves comparing current valuation multiples such as price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF) against historical values. Additionally, comparison with peer companies can provide insights into whether a stock is fairly valued, overvalued, or undervalued.

According to the Zacks Value Style Score, which grades stocks based on conventional and unconventional valuation metrics, Meta Platforms has a rating of C. This indicates that its stock value is in line with that of its peers. For more detailed valuation metrics, you can explore further.

Conclusion

The information discussed, along with additional resources from Zacks.com, can help decide whether to consider the market buzz around Meta Platforms. Given its Zacks Rank #2, there may be potential for the stock to outperform the market soon.

Discover Opportunities in Infrastructure Spending

Trillions in federal funds are dedicated to upgrading America’s infrastructure. This spending will not only enhance roads and bridges but also boost investments in AI data centers, renewable energy, and more.

In our latest report, uncover five surprising stocks that are set to gain significantly from this expanding infrastructure dollars.

Download the guide on how to profit from the trillion-dollar infrastructure boom for free today.

Interested in the latest stock insights from Zacks Investment Research? You can also access the 7 Best Stocks for the Next 30 Days by clicking here for your free report.

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com, click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.