Understanding Wall Street’s Take on ASML: Insights and Recommendations

Investors frequently turn to Wall Street analysts for guidance on whether to buy, sell, or hold stocks. Changes in ratings from brokerage-firm-employed (or sell-side) analysts can significantly impact stock prices. But how much do these recommendations truly matter?

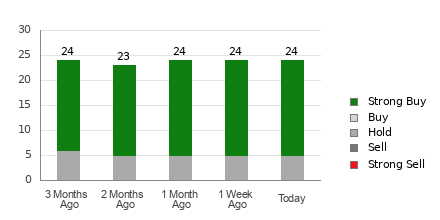

Current Consensus on ASML

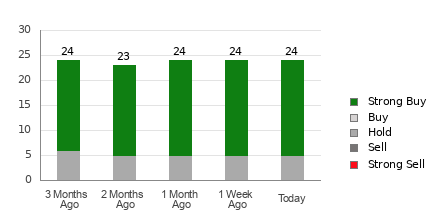

As it stands, ASML (ASML) has an average brokerage recommendation (ABR) of 1.42, where 1 represents Strong Buy and 5 signifies Strong Sell. This rating reflects the views of 24 brokerage firms, indicating that ASML is positioned between Strong Buy and Buy. Notably, 19 of these recommendations—approximately 79.2%—fall into the Strong Buy category.

Check price target & stock forecast for ASML here>>>

While the ABR suggests a buy for ASML, relying entirely on this measure may not be prudent. Studies indicate that brokerage recommendations often have minimal success in leading investors to stocks with the highest potential for price increase.

Evaluating the Effectiveness of Brokerage Recommendations

This inefficiency arises partly from the vested interests of brokerage firms. Typically, analysts display a strong positive bias when evaluating stocks they cover. Research shows that brokerage firms issue five Strong Buy recommendations for every Strong Sell, suggesting misalignment with retail investor interests.

Consequently, it might be more effective to use these recommendations to validate your own research or to complement another reliable indicator.

Comparing ABR and Zacks Rank

To further enhance your investment strategy, consider using the Zacks Rank. This proprietary stock rating tool scores stocks on a scale from #1 (Strong Buy) to #5 (Strong Sell), based on a strong track record in predicting short-term price movements. Validating the ABR with the Zacks Rank could improve decision-making.

It’s vital to recognize that while both Zacks Rank and ABR utilize a scale from 1 to 5, they are fundamentally different. The ABR reflects brokerage recommendations, often displayed in decimal format (e.g., 1.28), while Zacks Rank is a quantitative model based primarily on earnings estimate revisions, represented in whole numbers.

Brokerage analysts tend to be overly optimistic in their ratings. Because of this bias, their recommendations might mislead investors more than they guide them toward solid opportunities. In contrast, Zacks Rank is directly influenced by actual earnings estimate revisions, which have shown a consistent correlation with stock price movements.

Additionally, Zacks applies its rankings proportionally across all stocks analyzed, ensuring balance among the five ranks. This model also maintains a greater level of timeliness, as analysts frequently adjust their earnings estimates to reflect changing market conditions, leading to quicker Zacks Rank updates.

Is ASML a Good Investment?

Recent earnings estimate revisions for ASML show a 0.8% increase in the Zacks Consensus Estimate for the current year, now projected at $25.37. This upward trend in analysts’ earnings forecasts might signal positive momentum for the stock.

With a Zacks Rank of #2 (Buy) for ASML, bolstered by this consensus estimate change and supportive factors, the stock appears poised for growth. You can view the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here >>>>

Thus, the Buy-equivalent ABR for ASML can be a helpful indicator for investors evaluating potential investments in the stock.

Top Stock Recommendations for the Upcoming Month

Recently, experts have identified 7 elite stocks from a pool of 220 Zacks Rank #1 Strong Buys. They believe these stocks have the highest likelihood for early price spikes.

Since 1988, this selection has outperformed the market by more than double, averaging gains of +24.3% per year. Therefore, these meticulously curated 7 stocks deserve immediate attention.

ASML Holding N.V. (ASML) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.