Rivian Automotive Faces Market Challenges Amid Earnings Estimates

Rivian Automotive (RIVN) has attracted significant attention from Zacks.com visitors recently. Therefore, it is prudent to assess factors that may influence the near-term performance of this stock.

Over the past month, shares of Rivian, a manufacturer of electric vehicles and passenger cars, have returned +6.6%, while the Zacks S&P 500 composite has declined by -6.9%. In contrast, the Zacks Automotive – Domestic industry to which Rivian belongs has seen a slight decrease of 0.3%. The crucial question now is: What direction is this stock likely to take in the near term?

Media reports or rumors about pivotal changes in a company’s business can impact its stock price quickly. However, fundamental aspects ultimately guide the buy-and-hold decision.

Earnings Estimate Revisions

At Zacks, we emphasize evaluating the changes in the projections of a company’s future earnings. We believe that the present value of expected future earnings is key to determining the fair value of a stock.

We analyze how sell-side analysts adjust their earnings estimates in light of the latest business trends. When estimates rise, the fair value of the stock also increases, which can attract investor interest and push the price higher. This is why research shows a strong connection between revisions in earnings estimates and near-term stock price changes.

For the current quarter, Rivian is projected to report a loss of $0.80 per share, representing a change of +32.8% relative to the same quarter last year. The Zacks Consensus Estimate has increased by 0.9% in the past 30 days.

The consensus earnings estimate for the current fiscal year stands at -$2.87, signifying a year-over-year change of +29%. This estimate has adjusted down slightly by 0.3% over the last month.

Looking to the next fiscal year, the consensus estimate is -$2.12, indicating a change of +26.2% compared to the expected results from the previous year. This figure has risen by 0.3% in the prior month.

With a solid externally audited track record, our proprietary stock rating tool, the Zacks Rank, provides a reliable predictor of a stock‘s near-term price movements by leveraging earnings estimate revisions. Rivian Automotive currently holds a Zacks Rank #4 (Sell), based on recent changes in the consensus estimate and other related factors.

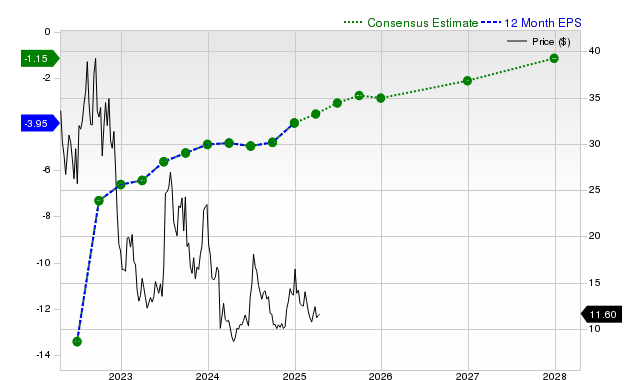

The following chart illustrates the progression of the company’s forward 12-month consensus EPS estimate:

12 Month EPS

Projected Revenue Growth

A company’s earnings growth is a crucial indicator of its financial health, but sustained revenue growth is equally important. Without revenue increases, long-term earnings growth is infeasible.

For Rivian, the consensus sales estimate for the current quarter is $1.03 billion, reflecting a year-over-year decline of 14.8%. The sales estimates for the current and next fiscal years are $5.46 billion and $7.93 billion, indicating anticipated changes of +9.9% and +45.2%, respectively.

Last Reported Results and Surprise History

Recently, Rivian Automotive posted revenues of $1.73 billion, marking a year-over-year increase of 31.9%. The EPS this period was -$0.52, compared to -$1.36 from a year prior.

When compared with the Zacks Consensus Estimate of $1.43 billion, the company’s reported revenues exceeded expectations by +21.5%. Furthermore, the EPS surprise amounted to +21.21%.

Over the last four reporting quarters, Rivian surpassed EPS estimates once and exceeded consensus revenue estimates on two occasions.

Valuation

A sound investment decision must consider a stock‘s valuation. Determining if its current market price accurately reflects the intrinsic value and growth prospects of the business is critical for future price performance.

Comparing the current valuation multiples, such as price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF), with historical figures helps assess whether a stock is fairly valued, overvalued, or undervalued. Additionally, relative comparisons to peers provide valuable insights into a stock‘s price reasonability.

The Zacks Value Style Score, which evaluates both traditional and unconventional valuation metrics, assigns grades from A to F. Rivian received an F grade, suggesting it is trading at a premium compared to its peers. For more information on the valuation metrics, click here.

Conclusion

The insights detailed here alongside other information from Zacks.com might help you decide whether the market buzz around Rivian Automotive warrants attention. However, its Zacks Rank #4 indicates potential underperformance against the broader market in the near term.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA, which has surged over +800% since our recommendation. While NVIDIA remains strong, our new top chip stock has greater growth potential.

This company, backed by robust earnings growth and an expanding customer base, is well-positioned to meet the soaring demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor market is set to grow dramatically from $452 billion in 2021 to $803 billion by 2028.

See this stock now for free >>

Are you seeking the latest recommendations from Zacks Investment Research? Download the 7 Best Stocks for the Next 30 Days for free. Click here to access this report.

Rivian Automotive, Inc. (RIVN): Free stock analysis report.

This article originally appeared on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.