Henry Schein Set to Report Q3 Earnings: Key Insights and Projections

What to Expect Before the Earnings Announcement

Henry Schein, Inc. (HSIC), based in Melville, New York, is a leader in providing healthcare products and services to various sectors including dental practices and surgery centers. With a market capitalization of $9.2 billion, the company supplies essential items and services designed to enhance operational efficiency and clinical outcomes. Investors are eagerly awaiting HSIC’s fiscal third-quarter earnings announcement for 2024, scheduled for Tuesday, Nov. 5, before the market opens.

Analysts’ Expectations for Q3 Earnings

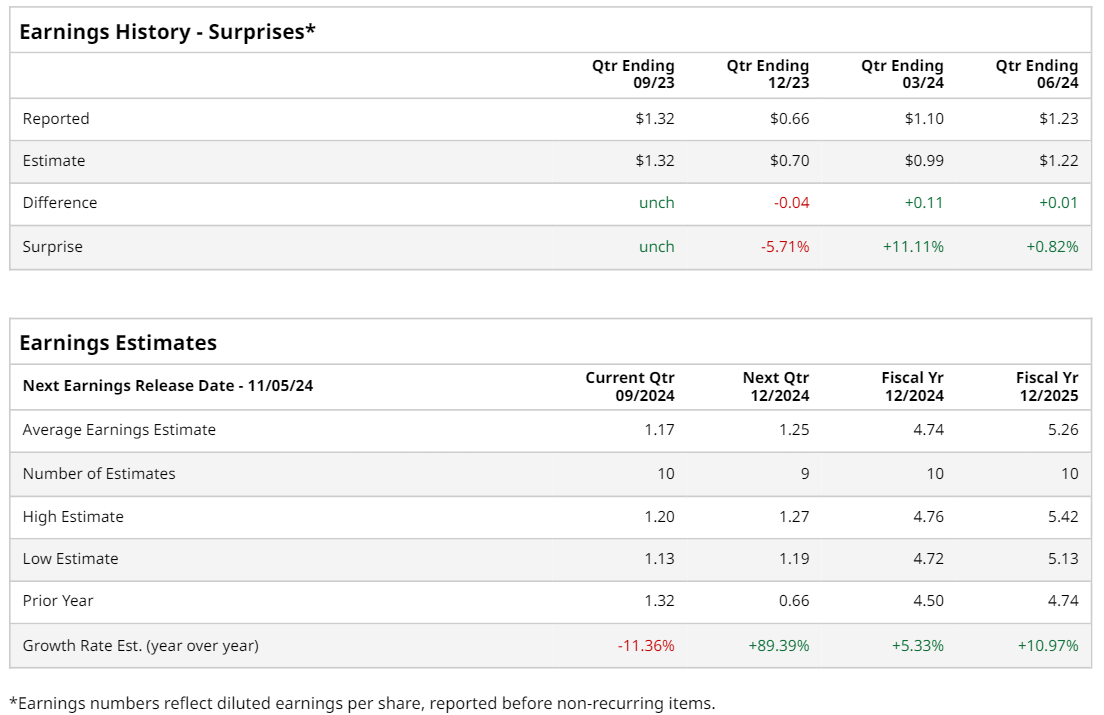

Analysts predict HSIC will report a profit of $1.17 per share on a diluted basis, marking an 11.4% decline from $1.32 per share reported in the same quarter last year. Historically, HSIC has either exceeded or met consensus estimates in three out of the last four quarters, with one quarter falling short.

Full-Year Projections Look Up

Looking ahead, the full-year forecast indicates an expected EPS of $4.74, reflecting a 5.3% increase from $4.50 in fiscal 2023. Furthermore, EPS is anticipated to climb to $5.26 in fiscal 2025, representing an 11% year-over-year growth.

Stock Performance Compared to Benchmarks

Despite the positive forecast, HSIC shares have lagged, showing only a 4.2% increase over the past 52 weeks, significantly underperforming the S&P 500’s ($SPX) remarkable 38.5% gains. The Health Care Select Sector SPDR Fund (XLV) has also outpaced HSIC, achieving 18% growth during the same period.

Factors Affecting Current Stock Performance

The company’s recent underperformance is attributed to challenging economic conditions in certain markets, along with a slower recovery from a cyberattack it faced. For context, on Aug. 6, HSIC saw its shares drop more than 8% following the release of its Q2 results, which reported an adjusted EPS of $1.23—slightly above analysts’ expectations of $1.22. However, revenue of $3.1 billion fell short of the anticipated $3.3 billion, leading HSIC to forecast a full-year adjusted EPS between $4.70 and $4.82.

Analyst Ratings and Price Target Insights

The analysts’ consensus on HSIC stock remains relatively positive, with a “Moderate Buy” rating overall. Out of 13 analysts covering the stock, five recommended a “Strong Buy,” six suggested a “Hold,” one proposed a “Moderate Sell,” and another a “Strong Sell.” The average analyst price target sits at $74.25, indicative of a potential upside of 4.3% based on current prices.

More Stock Market News from Barchart

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.