Nvidia’s Blackwell Launch: A New Era in AI Technology

Nvidia (NASDAQ: NVDA) is on the brink of a significant milestone: the launch of its Blackwell architecture and chip. This event is crucial for several reasons. Firstly, Blackwell showcases Nvidia’s latest advancements, reinforcing its dominance in the growing artificial intelligence (AI) sector. Secondly, this platform could redefine how customers approach their AI projects, potentially driving substantial revenue growth for Nvidia.

The tech giant has firmly established itself at the center of the AI boom. Nvidia’s influence in the AI chip market has expanded exponentially, supporting a wide range of products and services that contribute to its AI ecosystem. With the Blackwell launch imminent, here’s what we can expect.

Image source: Getty Images.

Transitioning from Gaming to AI: Nvidia’s Evolution

Nvidia’s journey is noteworthy. Initially, the company’s graphics processing units (GPUs) catered mainly to the gaming industry, generating modest revenue by today’s standards. However, as the capabilities of GPUs became evident, particularly in multitasking, Nvidia began to pivot towards AI. This strategic move proved fruitful.

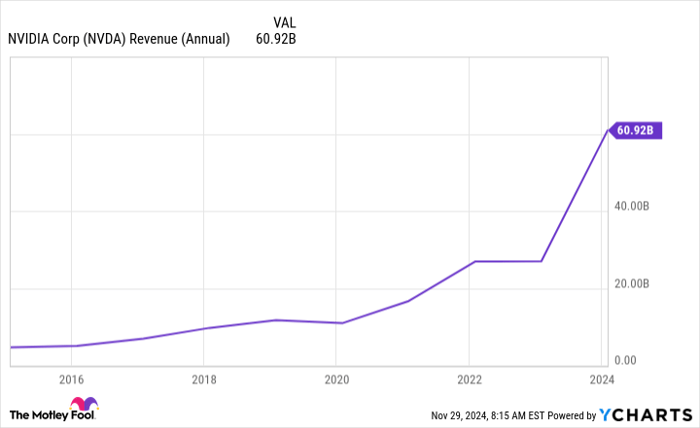

NVDA Revenue (Annual) data by YCharts

Nvidia’s expansion into AI-related markets has led to remarkable growth, with recent earnings soaring into the triple-digit percentages and the company’s stock climbing nearly 2,300% over the past five years.

The impending Blackwell release signals potential for further gains in earnings and stock performance.

Looking ahead, Nvidia has already begun introducing this new platform to customers. In the third quarter, the company distributed 13,000 sample GPUs. Firms like Microsoft and Oracle have already announced they are receiving Blackwell chips.

First Cloud Deployment of Blackwell

On October 8, Microsoft Azure proudly declared, “Microsoft Azure is the 1st cloud running Nvidia’s Blackwell system with GB200-powered AI servers,” on X (formerly Twitter).

During Nvidia’s Nov. 20 earnings call for its fiscal third quarter of 2025, the company shared, “Blackwell is now in the hands of all of our major partners, and they are working to bring up their data centers. We are integrating Blackwell systems into our customers’ diverse data center configurations.”

With demand for Blackwell exceeding supply, it may take some time for Nvidia to fully meet customer needs. Nonetheless, the company remains optimistic, predicting that Blackwell revenue in the current fourth quarter may exceed its initial guess of several billion dollars.

Future developments regarding Nvidia’s customers will reveal how effectively they implement Blackwell. Awareness of new Blackwell-powered products or services from these partners should be a priority for investors.

Nvidia’s Pivotal Moment

Nvidia is ramping up Blackwell production in the fourth quarter, marking a crucial time for the company. Observations regarding comments on the launch pace and demand trends will provide insight into the near-term outlook.

Blackwell also presents an opportunity that will carry on beyond the initial release period. While Nvidia anticipates a decline in gross margin to the low 70% range due to launch-related logistics, margins are expected to improve to the mid-70% range as processes stabilize.

For Nvidia shareholders and potential investors, this launch is a pivotal moment that could influence the company’s trajectory for several quarters.

Considering an Investment in Nvidia?

Before making an investment in Nvidia, here’s something to ponder:

The Motley Fool Stock Advisor analyst team has identified what they consider to be the 10 best stocks to buy now, and Nvidia didn’t make the cut. These stocks could deliver impressive returns in the years ahead.

To illustrate, if you had invested $1,000 in Nvidia when it made the list on April 15, 2005, your investment would now be worth $847,211!*

Stock Advisor equips investors with a straightforward strategy for success, featuring portfolio-building advice, analyst updates, and new stock recommendations twice a month. Over the years, Stock Advisor has substantially outperformed the S&P 500 since 2002, yielding returns more than four times that index.*

See the 10 stocks »

*Stock Advisor returns as of November 25, 2024

Adria Cimino has positions in Oracle. The Motley Fool has positions in and recommends Microsoft, Nvidia, and Oracle. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.