Uber Technologies Set to Report Q1 Earnings Amid Positive Outlook

With a market capitalization of $135.2 billion, Uber Technologies, Inc. (UBER) operates proprietary technology applications both in the United States and globally. Founded in 2009, this San Francisco-based corporation has three main segments: Mobility, Delivery, and Freight. This Wednesday, May 7, the company is set to report its Q1 earnings before the market opens.

Analysts Anticipate Strong Earnings Growth

Ahead of the earnings report, analysts predict UBER will announce an earnings per share (EPS) of $0.51. This figure indicates a significant increase of 259.4% compared to the loss of $0.32 per share reported in the same quarter last year. In the past four quarters, UBER has outperformed earnings estimates in three occasions, falling short only once. In its most recent quarter, UBER achieved an EPS of $3.21, exceeding expectations by an impressive 542%, a result attributed to substantial growth in gross bookings and completed trips.

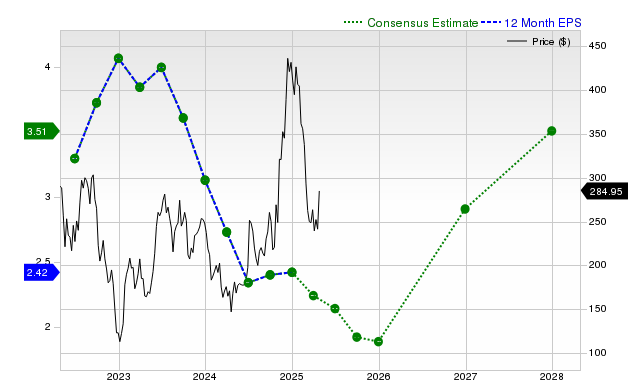

Yearly Forecast and Long-Term Expectations

For the current year, analysts expect UBER’s EPS to be $2.51, a decrease of 45% from the $4.56 reported in fiscal 2024. However, projections for the future appear more optimistic. Analysts forecast earnings to rise 37.5% year-over-year, reaching $3.45 per share in fiscal 2026.

Share Performance and Market Comparison

Over the past year, UBER shares have increased by 12.2%, outpacing the S&P 500 Index’s gain of 9.4% and the Technology Select Sector SPDR Fund’s (XLK) return of 5.5% during the same period.

Recent Earnings Release and Analyst Sentiment

Following its Q4 earnings release on February 5, UBER stock experienced a decline of 7.6%. In this quarter, the company reported a 20.4% year-over-year revenue growth, fueled by record demand for its mobility and delivery services, and exceeded Wall Street’s expectations. Furthermore, the company’s operational income rose by an impressive 18.1% year-over-year to $770 million.

Market Outlook

Analysts maintain a bullish outlook on UBER’s stock, offering a consensus “Strong Buy” rating. Out of 47 analysts covering the stock, 35 advocate for a “Strong Buy,” three recommend a “Moderate Buy,” and nine suggest a “Hold.” The consensus price target of $89.43 indicates a potential upside of 15% from its current trading level.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are intended for informational purposes only. For more information, please view the disclosure policy here.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.