Ball Corporation Set to Reveal Third-Quarter Earnings Amid Modest Stock Performance

Headquartered in Westminster, Colorado, Ball Corporation (BALL) stands as a prominent player in the metal packaging industry, catering to sectors such as beverages, personal care, and household products. With a market capitalization of $20.5 billion, it provides packaging solutions for several leading multinational companies. Investors are keenly anticipating the company’s fiscal third-quarter earnings announcement, expected on Thursday, Oct. 31.

Analysts Project Earnings Growth

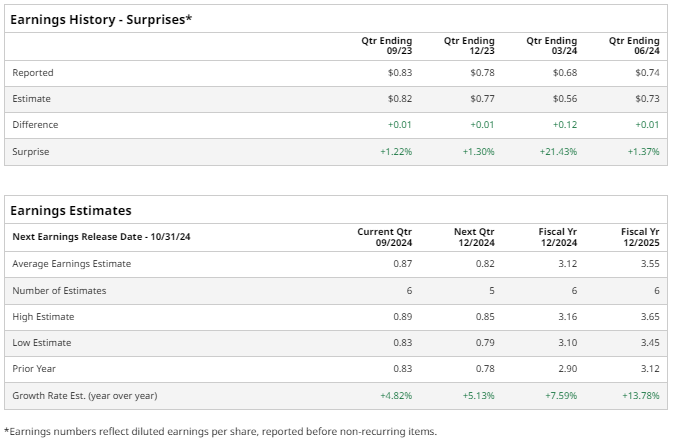

Before the earnings release, analysts forecast that BALL will report a profit of $0.87 per share on a diluted basis. This marks an increase of 4.8% compared to $0.83 per share from the same quarter last year. Remarkably, Ball Corporation has beaten Wall Street’s earnings per share (EPS) estimates in each of its last four quarterly reports.

Full-Year Projections Show Positive Trends

For the entire financial year, analysts predict that BALL will achieve an EPS of $3.12, which represents a 7.6% rise from $2.90 in fiscal 2023.

Stock Performance Compared to Major Indices

Over the past year, BALL stock has risen 13.8%, although it lags behind the S&P 500’s 22.7% increase. In contrast, it has outperformed the Consumer Discretionary Select Sector SPDR Fund (XLY), which recorded a 10.3% gain over the same period.

Recent Upgrades and Earnings Performance

On Sept. 4, shares of BALL gained over 1% following an upgrade by Morgan Stanley (MS), which increased its rating to “Overweight” from “Equal-Weight” with a price target of $78. Additionally, the stock rose 1.1% after the Q2 earnings report released on Aug. 1. Although the EPS exceeded market expectations, revenue figures fell short.

Analysts Favor a Positive Outlook

Market analysts hold a generally optimistic view on BALL stock, assigning it a “Moderate Buy” rating overall. Among the 14 analysts covering the company, five endorse a “Strong Buy,” two recommend “Moderate Buy,” six suggest a “Hold,” and one analyst advises a “Strong Sell.”

The average price target for BALL stands at $72.46, implying a potential upside of 12.4% from current levels.

More Stock Market News from Barchart

On the date of publication, Kritika Sarmah did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data are provided solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.