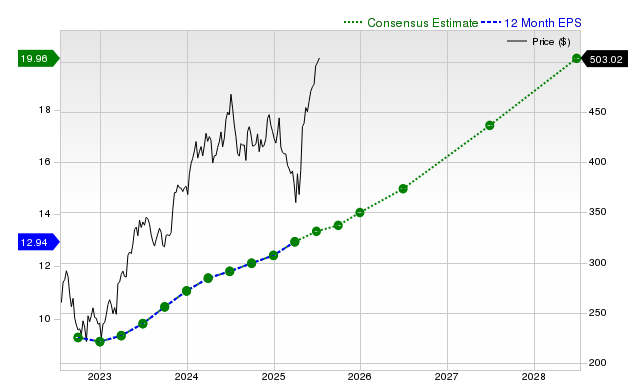

Microsoft Corporation (MSFT) has seen a +5.3% increase in shares over the past month, outperforming the Zacks S&P 500 composite’s +3.7% and the Zacks Computer – Software industry’s +4.8%. Analysts project earnings of $2.90 per share for the current quarter, reflecting a 7.8% year-over-year growth, with a full fiscal year estimate of $11.77 indicating a 20% increase from the previous year.

The consensus sales estimate for the current quarter stands at $64.16 billion, correlating to a 14.2% yearly growth. Microsoft achieved $61.86 billion in revenue in its last quarter, a 17% increase from the prior year, surpassing the Zacks Consensus Estimate by 2.02%.

Despite the positive earnings and revenue forecasts, Microsoft’s Zacks Rank is #3 (Hold), suggesting a performance in line with the broader market in the near term. The company’s valuation score is graded D, indicating it may be trading at a premium compared to its peers.