Jack Henry & Associates: Preparing for Earnings Reports with Strong Growth Predictions

Company Overview and Upcoming Earnings

With a market cap of $13.6 billion, Jack Henry & Associates, Inc. (JKHY) is a financial technology firm that links consumers and financial institutions through innovative technology solutions and payment processing services. Headquartered in Monett, Missouri, Jack Henry offers transaction processing, business process automation, and information management services, and is set to announce its fiscal Q1 earnings results on Tuesday, Nov. 5.

Projected Earnings and Historical Performance

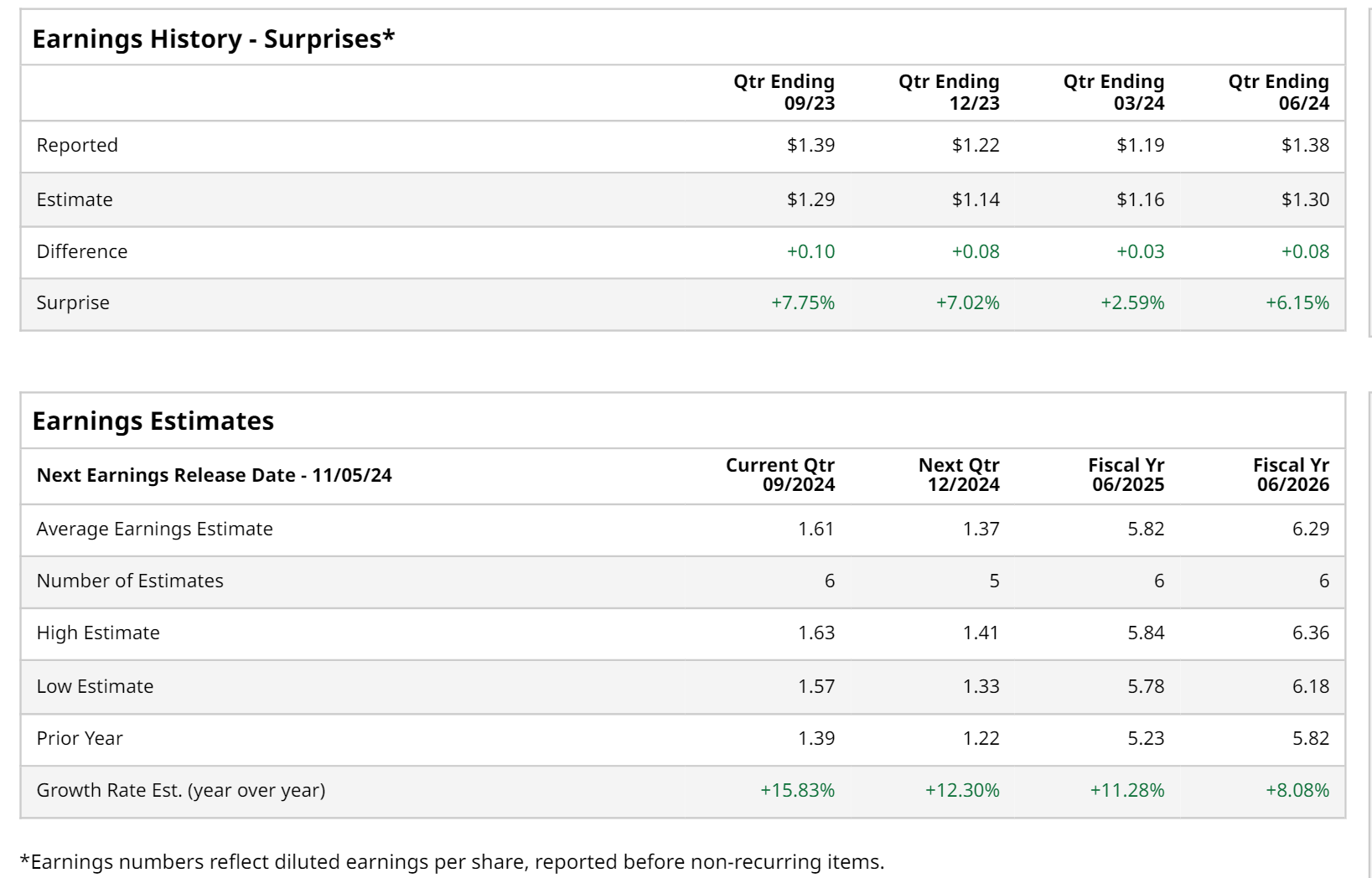

As the earnings report approaches, analysts predict a profit of $1.61 per share for the fintech company, marking a 15.8% increase from $1.39 per share in the same quarter last year. Over the past four quarters, Jack Henry has consistently exceeded Wall Street’s earnings estimates. In Q4 2024, the company reported earnings per share (EPS) of $1.38, which was 6.2% above expectations and an increase of 3% year-over-year. This success is linked to JKHY’s strong performance across its segments, particularly with a 9.2% rise in processing revenues. This growth was fueled by a 14% increase in digital and transaction revenues, alongside an 8.3% growth in card revenues.

Future Earnings Forecast

Looking ahead to fiscal 2025, analysts anticipate JKHY will report an EPS of $5.82, up 11.3% from $5.23 in fiscal 2024. Then, for fiscal 2026, the EPS is expected to rise by 8.1% year-over-year to $6.29.

Market Performance Comparison

Year-to-date, shares of JKHY have increased by 13.9%. However, this growth falls behind the S&P 500 Index’s nearly 23% rise and the Technology Select Sector SPDR Fund’s (XLK) return of 20% during the same timeframe.

Investor Sentiment and Analyst Ratings

Despite surpassing earnings forecasts, shares of JKHY fell slightly following its Q4 and full-year 2024 earnings release on August 20. The decline was largely attributed to a Q4 revenue of $559.9 million, which fell short of the consensus estimate of $563.4 million. Additionally, the company’s operating margin decreased to 22.4%, down 80 basis points from the previous year, leading to diminished investor confidence.

Analysts maintain a moderately optimistic view of Jack Henry & Associates, reflected in an overall “Moderate Buy” rating. Out of 17 analysts covering the stock, five recommend a “Strong Buy,” 11 advocate for a “Hold,” and one suggests a “Strong Sell.” This outlook demonstrates an increased bullish sentiment compared to three months ago, when only four analysts indicated a “Strong Buy.” Currently, the stock is trading above its average price target of $185.07.

More Stock Market News from Barchart

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the author’s and do not necessarily reflect those of Nasdaq, Inc.