Rivian Automotive: Is the Next Tesla on the Horizon?

As Rivian Automotive (NASDAQ: RIVN) prepares for new mass market vehicle launches in 2026, many wonder if the company could follow in Tesla’s successful footsteps. Matching Tesla’s early sales growth could present significant opportunities for Rivian.

At the moment, one key financial figure is grabbing attention, and significant updates are expected in the coming months.

Start Your Mornings Smarter! Subscribe to receive Breakfast news every market day. Sign Up For Free »

Monitoring Rivian’s Critical Financial Milestone

For Rivian to achieve success similar to Tesla, it must meet several crucial objectives. This includes ramping up production, delivering new mass market vehicles on schedule, and maintaining high-quality standards. Achieving these goals could result in a sales trajectory reminiscent of Tesla’s early days.

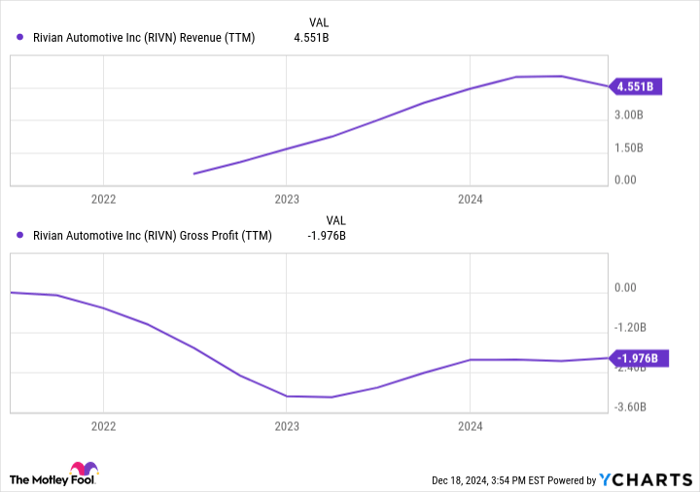

However, maintaining investor confidence is essential. Although Rivian reached $5 billion in sales earlier this year, it continues to post losses on every vehicle sold. Over the past year, the company reported a gross loss of nearly $2 billion. The financial history of electric vehicle makers shows that many have struggled to stay afloat. A misstep by Rivian could impact its ability to secure funding and follow through on its ambitious plans.

There’s hope for improvement, and more positive news may be forthcoming.

RIVN Revenue (TTM) data by YCharts.

Earlier in the year, Rivian’s management expressed optimism about reaching positive gross profits by the end of 2024. This would represent a significant turnaround, especially considering that the company lost nearly $40,000 on each vehicle sold last quarter. Closing this gap in just three months would be an impressive feat.

If Rivian can manage to achieve positive gross profits this quarter, it could dramatically shift market sentiment and clarify the company’s future prospects. More information will be available in a few months.

A Timely Opportunity for Investors

Have you ever felt like you missed out on investing in great stocks? Now could be your chance to reconsider.

Occasionally, experts issue a “Double Down” stock recommendation for companies poised for growth. If you think the window of opportunity has closed on investing, now might be the right moment to act before it’s too late. Consider these past performances:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $349,279!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $48,196!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $490,243!*

Currently, we are issuing “Double Down” alerts for three promising companies, and opportunities like this could be rare.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 16, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.