On October 24, global shipping giant United Parcel Service (NYSE: UPS) will unveil its Q3 earnings report, generating considerable interest. This follows FedEx (NYSE: FDX)‘s recent disappointing earnings announcement for the first quarter of 2025, where management cited declining business-to-business (B2B) demand and a shift to lower-cost alternatives.

This situation raises important implications for UPS and its shareholders.

What Should Investors Anticipate from UPS?

When a major competitor like FedEx shares disappointing news, it raises concerns for other players in the market. FedEx recently decreased its 2025 financial guidance just one quarter after it was first set, increasing caution among UPS investors ahead of its earnings report.

Given that UPS lowered its guidance during its July earnings call, the question remains: will it do so again, or is the negative outlook already reflected in its current guidance and stock price?

Key Metrics to Monitor for UPS

If UPS reaffirms its full-year guidance, it could boost investor confidence and the stock’s performance. One Wall Street analyst posits that UPS still has a viable path to achieving its earnings goals. Investors should focus closely on a critical metric: the average revenue per piece for domestic packages.

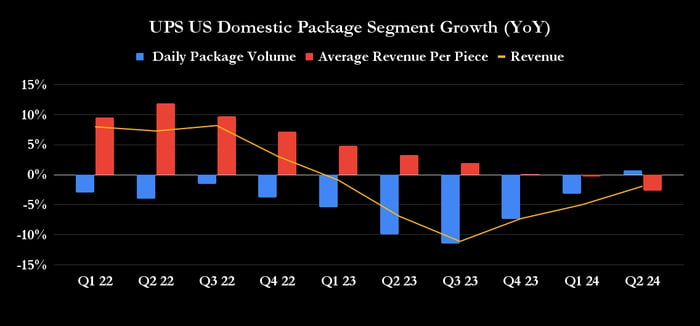

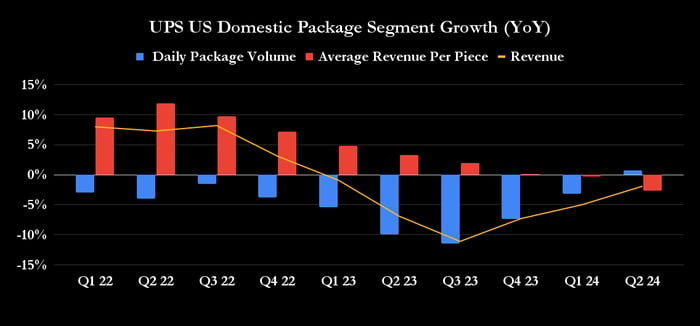

Data source: UPS presentation; chart by author.

FedEx noted a trend toward lower-yielding deliveries, a challenge also faced by UPS. However, UPS expects consistent growth in delivery volumes for Q3. The key question is: how does this impact their average revenue per package?

The Discussion Surrounding UPS Stock

During the July earnings call, CEO Carol Tomé noted the influx of new e-commerce companies in the U.S. that have significantly increased volume, albeit at lower profit margins, leading to pressure on revenue per piece during Q2.

Image source: Getty Images.

Critics could argue that the volume growth may have come at the cost of lower margins, making this a pivotal talking point in upcoming earnings discussions. The average revenue per piece figure from the forthcoming earnings report is likely to clarify the company’s situation.

Seize This Second Chance at Potential Gains

Have you ever felt you missed out on investing in top-performing stocks? Here’s your opportunity.

Our team of expert analysts occasionally highlights a “Double Down” stock—a recommendation for companies poised for significant growth. If you’re concerned you missed your chance to invest, now is the ideal time before prices climb. The figures tell the story:

- Amazon: If you invested $1,000 when we first recommended it in 2010, you’d have $21,285!

- Apple: If you invested $1,000 following our 2008 recommendation, you’d have $44,456!

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $411,959!

We are currently issuing “Double Down” alerts for three exceptional companies, and opportunities like this don’t come around often.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Lee Samaha has no positions in any of the stocks mentioned. The Motley Fool has positions in and recommends FedEx. The Motley Fool recommends United Parcel Service. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.