Options Trading Heats Up in the S&P 500: Notable Activity in NVIDIA, Vistra, and GE Vernova

Options trading in the S&P 500 is seeing significant action, especially with NVIDIA Corp (Symbol: NVDA) today.

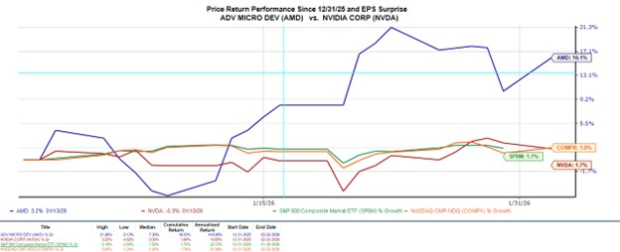

So far today, NVIDIA has recorded a total trading volume of 6.8 million options contracts. This figure translates to approximately 676.5 million underlying shares, given that each options contract represents 100 shares. Notably, this volume is 336.9% of NVDA’s average daily trading volume of 200.8 million shares over the past month. One highlight is the $130 strike call option expiring on January 31, 2025, which has seen particularly high activity today, with 158,228 contracts traded, representing around 15.8 million underlying shares. The chart below illustrates NVDA’s trading history with the $130 strike highlighted in orange:

In other news, Vistra Corp (Symbol: VST) has also witnessed robust options trading, with a volume of 144,248 contracts traded, which equals approximately 14.4 million underlying shares. This represents about 222.3% of VST’s average daily trading volume of 6.5 million shares. Particularly notable was the $150 strike put option expiring on June 20, 2025, where 9,063 contracts traded, corresponding to roughly 906,300 underlying shares of VST. The chart below shows VST’s trading history, highlighting the $150 strike:

Lastly, GE Vernova Inc (Symbol: GEV) has reported trading volumes of 44,929 contracts today, which accounts for about 4.5 million underlying shares. This is 162.9% of GEV’s average daily trading volume of 2.8 million shares over the last month. The $380 strike call option expiring on February 21, 2025, has seen significant volumes of 8,418 contracts, representing approximately 841,800 underlying shares. The chart below depicts GEV’s trading history, with the $380 strike highlighted:

For information on various expirations available for options on NVDA, VST, or GEV, visit StockOptionsChannel.com.

![]() Check out Today’s Most Active Call & Put Options of the S&P 500 »

Check out Today’s Most Active Call & Put Options of the S&P 500 »

Also see:

- Top Ten Hedge Funds Holding NIPG

- FGEN Price Target

- Funds Holding WFRD

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.