High Options Trading Volumes in Twilio, Wayfair, and Wells Fargo

Among the components of the Russell 3000 index, notable options trading activity occurred today in several companies.

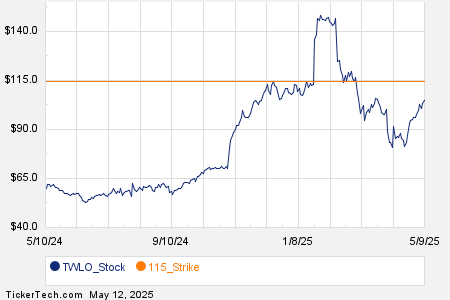

Twilio Inc (Symbol: TWLO) Options Activity

Twilio Inc (Symbol: TWLO) recorded significant options trading volume, with a total of 22,204 contracts traded so far. This volume corresponds to around 2.2 million underlying shares, representing approximately 78.3% of TWLO’s average daily trading volume of 2.8 million shares over the last month. Particularly high activity was noted for the $115 strike call option set to expire on July 18, 2025, which saw 5,978 contracts traded, equating to approximately 597,800 underlying shares of TWLO. Below is a chart illustrating TWLO’s trailing twelve-month trading history, with the $115 strike highlighted in orange:

Wayfair Inc (Symbol: W) Options Activity

Wayfair Inc (Symbol: W) exhibited a trading volume of 45,614 contracts, approximately 4.6 million underlying shares, which is about 73% of W’s average daily trading volume of 6.2 million shares over the past month. Notably, the $30 strike put option expiring on June 20, 2025, recorded high volume with 4,231 contracts traded, representing around 423,100 underlying shares. Below is a chart depicting W’s trailing twelve-month trading history, with the $30 strike highlighted in orange:

Wells Fargo & Co (Symbol: WFC) Options Activity

Wells Fargo & Co (Symbol: WFC) reported an options volume of 143,177 contracts today, translating to approximately 14.3 million underlying shares. This figure accounts for 72.6% of WFC’s average daily trading volume of 19.7 million shares over the past month. The $77.50 strike call option expiring on May 16, 2025, saw particularly high trading activity, with 33,286 contracts exchanged, representing roughly 3.3 million underlying shares of WFC. Below is a chart showcasing WFC’s trailing twelve-month trading history, with the $77.50 strike highlighted in orange:

For more information on the various available expirations for TWLO, W, or WFC options, visit StockOptionsChannel.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.