Key Earnings Reports to Watch for NVIDIA and Walmart in 2025

Imagine having to release your financial details every few months for the public to see. You’d need to reveal where you’ve spent money, how much you’ve earned, and your savings. This scenario reflects what earnings season entails.

This period provokes a flurry of activity among market participants. Companies disclose their financial performance, revealing insights from behind closed doors. As we approach the upcoming 2025 Q1 earnings cycle, let’s examine two critical players: NVIDIA (NVDA) and Walmart (WMT).

NVIDIA’s Potential for Recovery

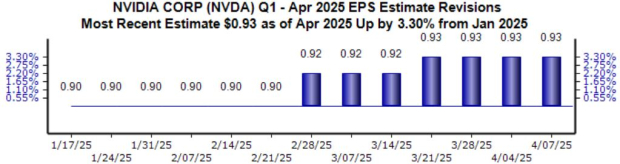

NVIDIA’s forthcoming earnings report is expected to draw significant attention, particularly following recent underperformance in the broader AI market. Current consensus estimates indicate a robust 52% surge in EPS and an impressive 65% increase in sales, both of which have seen positive revisions recently.

Image Source: Zacks Investment Research

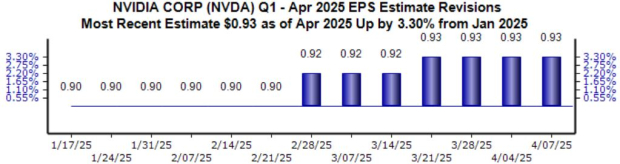

This anticipated growth highlights strong demand, a trend that has persisted in recent periods. However, the real focus will be on the Data Center division’s performance, which has experienced explosive growth, largely spurred by the AI surge.

Below is a quarterly chart showing NVIDIA’s Data Center sales.

Image Source: Zacks Investment Research

NVIDIA typically reports earnings later in the cycle, with the upcoming results set for May 28th.

Walmart’s Insight into Consumer Health

Walmart’s earnings release will also be closely scrutinized, offering insights into consumer behavior. The retail giant has seen its stock soar nearly 40% over the last year, outperforming many tech companies.

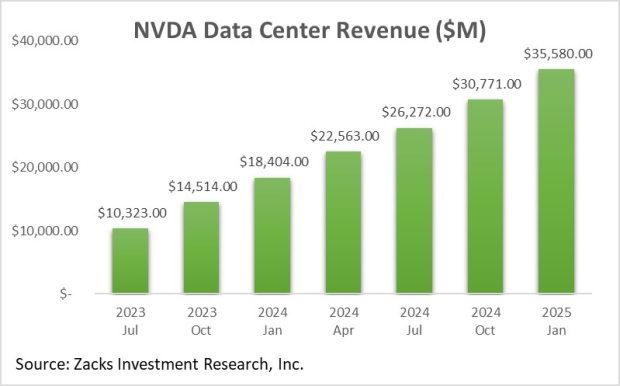

Image Source: Zacks Investment Research

Despite its strong stock performance, analysts have expressed some bearish sentiments ahead of the release. The current Zacks Consensus EPS estimate stands at $0.59, which is down over 9% since mid-January. While sales forecasts remain relatively stable, Walmart is expected to experience a 1.6% dip in EPS, offset by a 2.8% rise in sales.

Image Source: Zacks Investment Research

As the reporting date approaches on May 15th, it will be crucial to monitor any revisions, particularly in light of recent tariff discussions. Walmart’s margins have shown signs of recovery, but shifts in the political and economic landscape could pose risks.

Image Source: Zacks Investment Research

Conclusion

This week, the major banks will ramp up the 2025 Q1 earnings season, traditionally viewed as a kickoff. Even though NVIDIA and Walmart’s reports are scheduled for later, they will provide critical insights into market trends and economic health.

5 Stocks Set to Double

Each stock from this report has been carefully selected by a Zacks expert as the top pick anticipated to gain +100% or more in 2024. While not all investments succeed, past recommendations have delivered gains of +143.0%, +175.9%, +498.3%, and +673.0%.

Most stocks highlighted here remain below Wall Street’s radar, offering an excellent opportunity to enter early. Explore these 5 Potential Home Runs >>

To receive the latest recommendations from Zacks Investment Research, download the 7 Best Stocks for the Next 30 Days. Click for your free report.

Walmart Inc. (WMT): Free Stock Analysis report.

NVIDIA Corporation (NVDA): Free Stock Analysis report.

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.