OUTFRONT Media‘s OUT rich and varied collection of advertising sites alongside its extensive reach are positive signs. The company’s strategic investments and ongoing efforts to expand its digital billboard portfolio lay the groundwork for tapping into long-term growth prospects.

The Zacks Consensus Estimate for 2024 funds from operations (FFO) per share is predicted to be $1.68, signaling a 2.4% increase compared to the previous year.

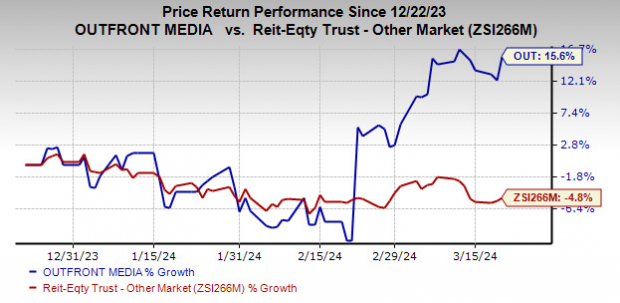

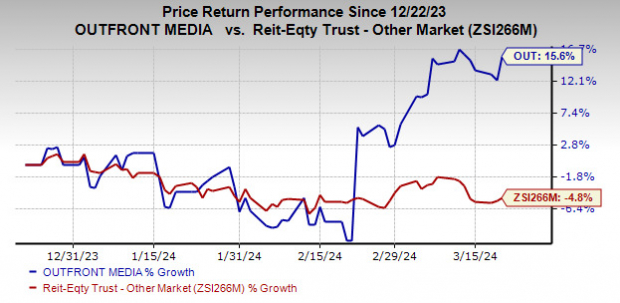

Over the last three months, this Zacks Rank #2 (Buy) entity has witnessed a significant upswing of 15.6%, contrasting with the industry’s 4.8% decline. With its robust fundamentals, there appears to be ample room for further growth in this stock.

Image Source: Zacks Investment Research

What Makes OUTFRONT Media Shine

A Versatile Portfolio: OUT boasts a geographically diverse array of advertising sites, spanning across the United States and Canada. This diversity allows its clients to engage a national audience and tailor campaigns to specific regions or markets.

Specializing in out-of-home (“OOH”) advertising, the company not only serves the transit sector but also caters to various industries such as professional services, healthcare/pharmaceuticals, and retail.

This diversified revenue stream shields the company from volatile market shifts. Revenue is estimated to grow by 1.5% year-over-year in 2024.

Emphasis on Digital Billboards: OUTFRONT Media has been consistently investing in its digital billboard portfolio. In 2023 alone, the company established or converted 84 and 45 new digital billboards in the United States and Canada, respectively. The total digital displays numbered 2,191 by the end of 2023, up from 1,970 in 2022.

These initiatives highlight the company’s shift from traditional static billboard advertising to digital displays. This transition has not only expanded the scope of new advertising partnerships but also enhanced digital revenues. Projections indicate a 1.5% and 2% year-over-year increase in billboard revenues for 2024 and 2025, respectively.

Industry Momentum: The cost-effective nature of OOH advertising has led to its ascending popularity, capturing a larger market share compared to other media forms. Future advancements in technology are anticipated to further boost OOH advertising.

Benefitting from this trend, OUTFRONT Media is extending its footprint and offering innovative tech platforms to marketers to harness growth prospects.

Recently, the company announced the expansion of programmatic transit advertising within New York City’s Metropolitan Transportation Authority (MTA) system, encompassing nearly all subway stations in New York City, Long Island, and Metro-North Railroad Systems. This move will create the largest programmatically available full-motion transit network in America.

Strategic Acquisitions: OUTFRONT Media has leveraged acquisitions to enrich its portfolio. The company executed asset acquisitions totaling $33.7 million in 2023, $353.9 million in 2022, and $136.5 million in 2021. With such strategic expansions, the company is primed for long-term growth.

Favorable Valuation: OUT stock boasts a Value Score of B. Research indicates that stocks with a Value Score of A or B, combined with a Zacks Rank #1 (Strong Buy) or 2, offer substantial upside potential.

Exploring Other Investment Options

Within the broader REIT sector, some other highly-ranked stocks include SL Green Realty (SLG) and Lamar Advertising (LAMR), both currently holding a Zacks Rank #2. To view the full list of today’s Zacks #1 Rank (Strong Buy) stocks, click here.

The Zacks Consensus Estimate for SLG’s 2024 FFO per share is $5.88, signifying a 19% year-over-year growth.

LAMR’s 2024 FFO per share is estimated at $7.74, showing a 3.6% increase from the previous quarter.

Note: The financial figures discussed in this article pertain to funds from operations (FFO), a widely adopted metric for evaluating the performance of REITs.

5 Stocks Poised for Outstanding Growth

Handpicked by a Zacks expert as the top stock choices anticipated to witness +100% growth or more in 2024. Previous recommendations have surged by +143.0%, +175.9%, +498.3%, and +673.0%.

Many of the stocks in this report are under the radar of Wall Street analysts, presenting a compelling opportunity to engage early.

Discover These Potential Market Winners Today >>

The opinions and viewpoints expressed herein represent those of the author and not necessarily those of Nasdaq, Inc.