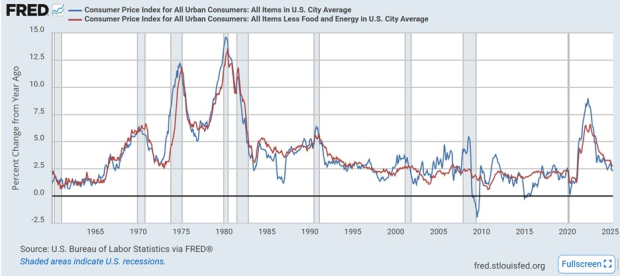

The Consumer Price Index (CPI) for May rose by 0.1% from the previous month, which was below economists’ expectations of 0.2% and less than April’s increase of 0.2%. Year-over-year, CPI increased by 2.4%, slightly missing the forecast of 2.5% but up from 2.3% in April, marking the lowest yearly increase since February 2021. Core CPI, excluding food and energy costs, also rose by 0.1% month-over-month versus expectations of 0.3% and matched the annual rise of 2.8%, below the predicted 2.9%.

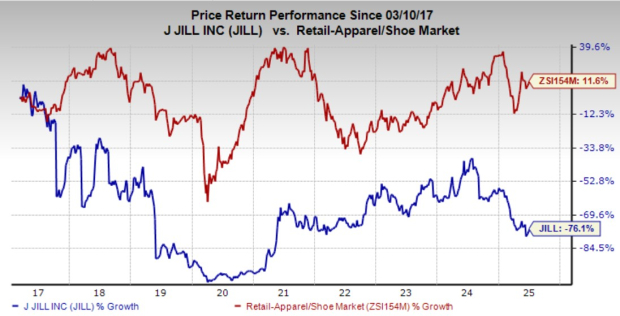

Following the CPI report, notable retail stocks, including Carvana (CVNA) with a nearly 3,000% stock surge since its IPO in 2017, Sprouts Farmers Market (SFM), and Urban Outfitters (URBN), have shown strong growth. URBN reported Q1 sales of $1.3 billion and saw a 60% growth in its Nuuly business, while estimates for SFM and URBN’s fiscal years 2025 and 2026 EPS have seen increases of 9% and 7%, respectively.

In the consumer lending sector, stocks like LendingTree (TREE) and OneMain Holdings (OMF) experienced over a 2% rise in trading, maintaining Zacks Rank #3 (Hold) ratings, while OneMain has an appealing 7% annual dividend yield.