U.S. Steel Sector Rises as Tariffs Take Effect

U.S. stocks in the industrial products and basic materials sectors surged today, overshadowing international markets. This increase follows President Trump’s announcement of a 25% tariff on imported steel and aluminum, potentially raising commodity prices.

American manufacturers are likely to see higher demand for domestic metals, as the tariffs make foreign options more expensive.

Nucor: Leading the Way

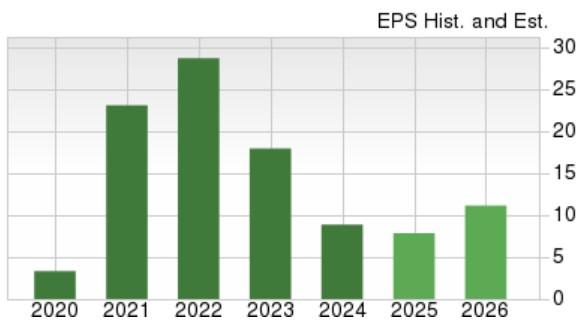

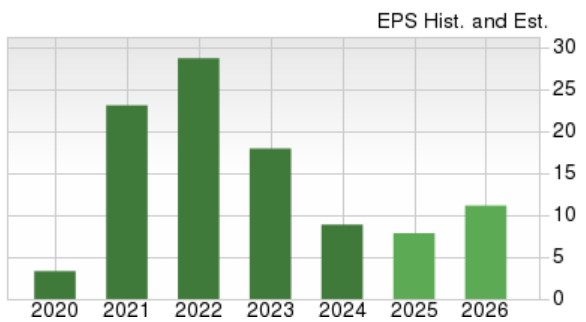

Nucor NUE stands out as the largest steel producer in the United States. Often a favorite on Wall Street, Nucor’s broad production abilities have attracted interest from hedge funds and institutional investors. Despite a projected 11% dip in annual earnings this year, forecasts predict a substantial recovery, with earnings expected to jump 42% to $11.18 per share by fiscal 2026.

Image Source: Zacks Investment Research

U.S. Steel Developments

In his recent address, President Trump declared that Japanese company Nippon Steel will not be allowed to acquire U.S. Steel X, but they can invest in it. Trump emphasized his commitment to safeguarding the U.S. steel industry while asserting that U.S. Steel stands to gain from the newly imposed tariffs as the nation’s second-largest steel producer.

Cleveland-Cliffs: Potential for Growth

Cleveland-Cliffs CLF, the largest iron ore producer in North America, has tried to acquire U.S. Steel and proposed a partnership with Nucor. Although their offers were seen as inadequate and were rejected, a favorable market could enhance Cleveland-Cliffs’ capacity for expanding steel production.

Alcoa: On the Upswing

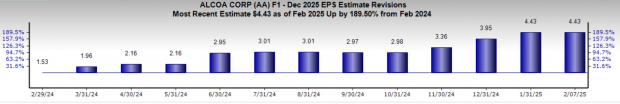

The rise in aluminum prices has significantly improved Alcoa’s AA operational efficiency. Analysts have noted a positive trend in earnings estimates for Alcoa’s fiscal year 2025, mirroring the stock’s 30% increase in value over the past year.

Image Source: Zacks Investment Research

Stocks to Keep an Eye On

Two additional stocks to monitor include Steel Dynamics STLD and Kaiser Aluminum KALU. Steel Dynamics is a leading steel producer and metal recycler in the U.S., while Kaiser Aluminum specializes in semi-fabricated specialty aluminum for various industrial sectors including aerospace and automotive.

Just Released: Zacks Top 10 Stocks for 2025

Don’t miss out on our handpicked list of 10 top stocks for 2025. Chosen by Zacks Director of Research Sheraz Mian, this portfolio has shown a remarkable performance, gaining +2,112.6% since its inception in 2012, significantly outperforming the S&P 500’s +475.6%. Discover the latest recommendations that could reshape your investment strategy.

Alcoa (AA): Free Stock Analysis Report

United States Steel Corporation (X): Free Stock Analysis Report

Nucor Corporation (NUE): Free Stock Analysis Report

Cleveland-Cliffs Inc. (CLF): Free Stock Analysis Report

Steel Dynamics, Inc. (STLD): Free Stock Analysis Report

Kaiser Aluminum Corporation (KALU): Free Stock Analysis Report

For more details, visit Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.