U.S.-China Tariff Deal Sparks Stock Market Surge

Stocks surged on Monday, buoyed by news of a deal between the U.S. and China to temporarily reduce their mutual tariffs. This development has fostered optimism that a global economic recession might be averted.

As part of easing the ongoing trade war, the U.S. will lower tariffs on China from 145% to 30%, while China will reduce tariffs on U.S. goods from 125% to 10%. This agreement is set to last for 90 days, during which both nations aim to establish a sustainable, long-term trade relationship.

The S&P 500 climbed by 3% during today’s trading session, while the Nasdaq experienced a notable spike of over 4%. Investors particularly flocked to big tech stocks that had previously taken a hit due to escalating trade tensions.

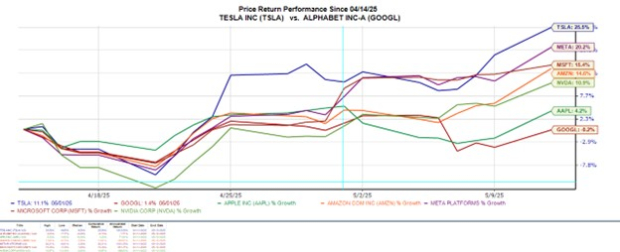

The Mag 7

A significant factor in this market rebound has been the performance of mega-cap tech stocks, such as Apple AAPL, Amazon AMZN, Meta Platforms META, and Tesla TSLA, each recording gains of over 6% on Monday.

Given that a majority of Apple’s production is sourced from China, analysts are likely to adopt a more bullish perspective on the company’s short-term outlook.

While Apple, Amazon, and Meta’s stocks appear poised for continued growth, Tesla has received a Zacks Rank of #5 (Strong Sell) due to a pattern of declining earnings estimate revisions. This may suggest that it’s wise to reconsider a bullish position on Tesla, which has spiked by 25% in the past month. Furthermore, Tesla has the highest price-to-earnings (P/E) ratio among the Mag 7 at an elevated 161.4X forward earnings, compared to Alphabet’s GOOGL more moderate 16.2X.

Nvidia NVDA and Microsoft MSFT have also shown positive momentum, although Microsoft’s gain was limited to 2% today. Notably, Microsoft is the only Mag 7 stock with a buy rating, earning a Zacks Rank of #2 (Buy), while others are rated as #3 (Hold) or lower. Over the last 60 days, fiscal 2025 EPS estimates for Microsoft have increased by 2%, while FY26 estimates have grown by 1%.

Image Source: Zacks Investment Research

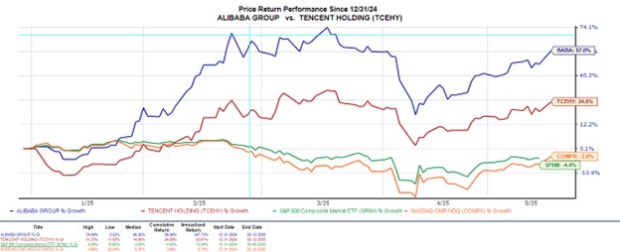

Alibaba & Tencent

Chinese tech stocks have been benefiting from improved investor sentiment even before the U.S. tariff truce. Chinese President Xi Jinping’s recent supportive stance has bolstered confidence in their independent growth. Notably, Alibaba BABA and Tencent TCEHY currently hold a Zacks Rank of #2 (Buy).

Their ADRs (American Depositary Receipts) have performed exceptionally well on U.S. stock exchanges this year, with BABA surging nearly 60% year-to-date and TCEHY rising over 20%. The strong performance is attributed to their ventures into artificial intelligence, aimed at lowering costs and enhancing customer experience, leading to higher e-commerce sales for Alibaba and growth in gaming and cloud services for Tencent.

Image Source: Zacks Investment Research

Retail Stocks

Beyond Amazon and Apple, retailers such as Nike NKE, Starbucks SBUX, Walmart WMT, and Target TGT significantly rely on supply chain operations from China. Both Nike and Starbucks generate a large portion of their revenue from Chinese operations, making improved U.S.-China trade relations advantageous for their growth outlook.

Nike and Walmart Stock are rated #3 (Hold), while Starbucks and Target are rated #4 (Sell). In 2024, China accounted for 14% of Nike’s revenue, representing $5.5 billion solely from footwear sales, as illustrated in the chart below.

Trade Agreement May Boost Energy and Transportation Stocks

Image Source: Statista

Impact of the U.S.-China Trade Agreement on Energy and Transportation

Energy and transportation stocks are expected to see increased activity following the recent U.S.-China trade agreement. Investors hope this may lead to enhanced market conditions, boosting demand for travel and energy production. Crude oil prices rose over 2% to exceed $62 per barrel, although they remain down 20% compared to 2025 projections.

Image Source: trading Economics

Bottom Line

The trade agreement between the U.S. and China has provided reassurance to the market, suggesting that the global economy will face less disruption from increased tariffs. As the world’s two largest economies, it’s crucial to monitor the progress over the next 90 days to gauge its full impact.

###

Zacks Highlights Semiconductor Stock Potential

A recently identified semiconductor stock, though modest in size compared to giants like NVIDIA, shows significant growth potential. NVIDIA has appreciated by over 800% since being recommended. Zacks notes this emerging stock’s strong earnings growth and expanding customer base, positioning it well to meet the rising demand in sectors like Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor market is expected to grow from $452 billion in 2021 to $803 billion by 2028.

For financial insights and further analysis, readers are encouraged to explore various stock reports available through Zacks Investment Research.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.