C3.ai Faces Challenges Amidst AI Hype and Investment Risks

C3.ai (NYSE: AI) has seen substantial interest from the market as it offers businesses across various sectors convenient AI solutions. This positions the company favorably for adopting next-generation technologies. However, despite its growth potential, C3.ai’s stock has struggled this year, reflecting significant investment risks.

Start Your Mornings Smarter! Receive Breakfast news in your inbox every market day. Sign Up For Free »

The company has recently released its fiscal third-quarter earnings. Here are three key figures from the report that warrant close examination before considering an investment in C3.ai’s stock.

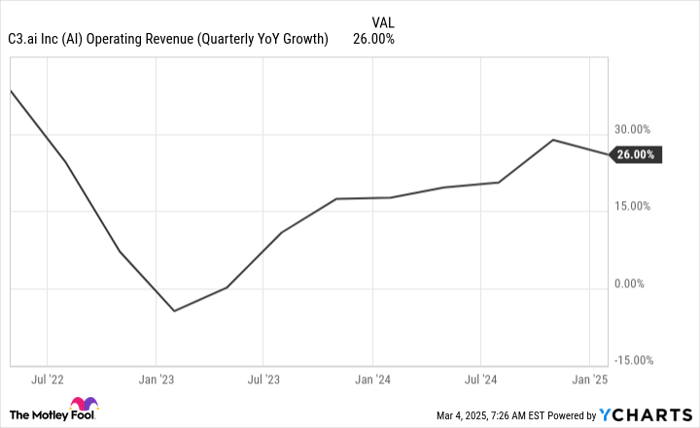

Sales Growth Rate Decreases to 26%

In the three months ending January 31, C3.ai’s sales increased by 26%, totaling $98.8 million. Although this growth is noteworthy, it indicates a slowdown compared to the previous period. Investors are particularly drawn to C3.ai due to its future growth potential in AI, and this slowdown raises concerns.

AI Operating Revenue (Quarterly YoY Growth) data by YCharts

While a 26% growth rate remains robust, worries persist regarding potential cutbacks in AI spending. Earlier this year, the introduction of a competitively priced AI chatbot by the Chinese firm DeepSeek raised fears of overspending, suggesting that companies might reassess their AI investments.

If expenditure on AI technologies declines, C3.ai could face a further slowdown in its growth trajectory, diminishing its attractiveness to investors.

Operating Loss Increases to $87.6 Million

C3.ai reported an operating loss of $87.6 million last quarter, compared to a loss of $82.5 million during the same period last year. The company is not yet profitable, and this raises the stakes concerning its growth rate. A solid growth trajectory is essential to justify ongoing high expenditures.

Previously, C3.ai’s CEO Tom Siebel emphasized that reaching profitability was a “mathematical certainty” with scale, but this outcome remains elusive. Investors should consider the implications: if C3.ai struggles to achieve profitability, doubts will linger about its business viability. A lack of a clear path to profit could deter potential investors.

Operating Activities Burned $52.7 Million Over Nine Months

A company that does not generate a positive cash flow typically needs to secure additional funding to expand its business. This situation usually leads to shares being issued, resulting in dilution for current shareholders, which can adversely affect stock prices.

In the past nine months, C3.ai’s operating activities resulted in a cash outflow of $52.7 million, compared to $83.7 million in the same period the previous year. Although this is an improvement, the company remains far from being cash flow-positive.

Despite this, C3.ai has also increased its expenditure on stock-based compensation—a strategy often employed by tech companies to manage cash flows by compensating employees with shares. Over the past nine months, total stock-based compensation reached $174.4 million, up from $159 million a year earlier. However, even with this approach, the company continues to experience significant losses from its daily operations.

C3.ai’s Stock Struggles Amid Ongoing Losses

Year-to-date, C3.ai’s shares have declined over 35%. Investor enthusiasm appears to be waning, and without demonstrable improvements in profitability and cash flow, further declines in the stock may be likely.

While impressive sales growth is beneficial, investors must also ensure that the company’s operations can be sustained over the long haul. C3.ai has yet to demonstrate that it can operate profitably, considering its persistent losses and cash outflows. Until there are substantial changes, it may be wiser for investors to avoid this volatile AI stock.

Don’t Miss This Second Chance at a Potential Opportunity

Ever feel like you’ve missed the chance to invest in winning stocks? You’ll want to pay attention now.

On rare occasions, our expert team of analysts identifies a “Double Down” Stock recommendation for companies poised for significant growth. If you’re concerned you’ve missed your investment opportunity, now may be the ideal time to act.

- Nvidia: A $1,000 investment made when we doubled down in 2009 would now be worth $286,710!*

- Apple: A $1,000 investment during our double down in 2008 would have grown to $44,617!*

- Netflix: Investing $1,000 when we gave our double down in 2004 could have resulted in $488,792!*

Currently, we are issuing “Double Down” alerts for three promising companies, and this opportunity may not arise again soon.

Continue »

*Stock Advisor returns as of March 3, 2025

David Jagielski has no positions in any of the stocks mentioned. The Motley Fool recommends C3.ai. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.