Major Earnings Reports: Key Players Shape Market Trends

In the S&P 500, only a select few companies truly influence market movements through their earnings reports or product announcements.

The Current Earnings Season

As we dive into earnings season, 180 S&P 500 companies are set to report this week. However, four companies stand out: Apple Inc. (AAPL), Amazon.com Inc. (AMZN), Meta Platforms, Inc. (META), and Microsoft Corporation (MSFT).

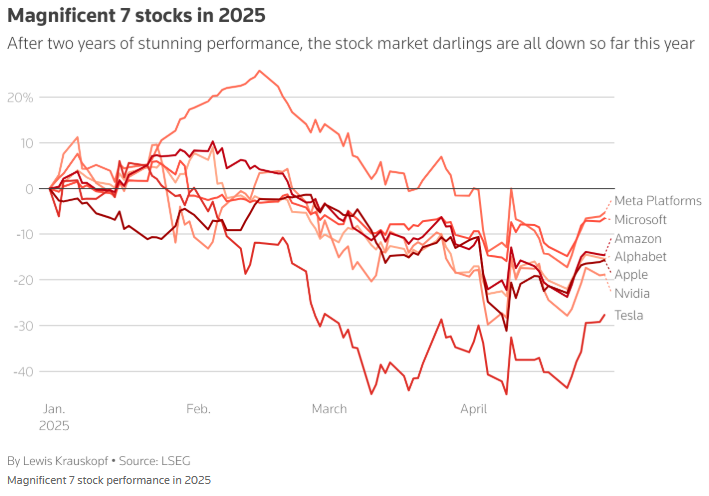

These four are part of the “Magnificent Seven,” which also includes Alphabet Inc. (GOOGL), NVIDIA Corporation (NVDA), and Tesla, Inc. (TSLA). Alphabet’s and Tesla’s earnings were covered in a recent Market 360, with NVIDIA set to announce earnings on May 28.

Currently, these stocks represent around 30% of the S&P 500 and nearly half of the NASDAQ 100’s market cap, highlighting their significant role in market performance. Despite their past dominance, the first quarter of 2025 has been challenging for these companies.

With all seven companies recording losses in the early part of 2025, this week’s earnings announcements are vital for uncovering potential recovery signs. In today’s Market 360, we analyze the anticipated earnings announcements and examine the market’s predicted reactions. We’ll also utilize my Stock grading system to evaluate each company and aid in identifying top stocks for this earnings season and beyond.

Meta Platforms, Inc.

Meta Platforms showcased a robust first quarter after market closure on Wednesday.

Earnings soared nearly 37% to $6.43 per share, up from $4.71 a year earlier. Revenue also surged, increasing almost 16% to reach $42.31 billion. Analysts had anticipated earnings of $5.21 per share on $41.36 billion in revenue, meaning profits exceeded expectations by over 23%, with sales outpacing projections by about 2%.

A significant contributor to this growth was the rise in advertisements. Meta’s ad impressions across platforms like Facebook and Instagram rose 5%, while the average ad price increased by 10%. Additionally, user engagement improved, with daily active users climbing 6% to 3.43 billion.

CEO Mark Zuckerberg addressed economic uncertainties during the earnings call, asserting the company’s preparedness for potential economic challenges.

Looking ahead to the second quarter, Meta forecasts revenue between $42.5 billion and $45.5 billion. The company is also ramping up its investment in artificial intelligence, planning expenditures of $64 billion to $72 billion in 2025, up from prior estimates of $60 to $65 billion. Much of this investment will support the development of new data centers for its expanding AI initiatives.

Microsoft Corporation

Microsoft released strong results on Wednesday, reporting revenue of $70.1 billion, an increase of 13% from the previous year, surpassing analyst expectations of $68.44 billion. Earnings reached $3.46 per share, exceeding the projected $3.22 and reflecting an 18% year-over-year increase.

The cloud segment drove these results, with Intelligent Cloud revenue hitting $26.8 billion. Specifically, server products and cloud services revenue grew by 22%, while Azure, Microsoft’s cloud platform, saw a remarkable 33% increase.

Despite some concerns in the industry regarding tariffs, Microsoft remained optimistic about its AI investments. AI services contributed significantly to Azure’s growth, adding 7 points to the overall 33% increase last quarter.

Microsoft is committed to AI, with CEO Satya Nadella recently announcing an $80 billion investment in data centers during fiscal 2025. This past quarter, capital expenditures rose to $16.75 billion, marking a nearly 53% increase.

The company has projected revenue for the next quarter between $73.2 billion and $74.3 billion, above the consensus estimate of $72.3 billion.

Amazon.com, Inc.

On Thursday, after the bell, Amazon reported results that fell short of expectations.

Amazon and Apple Report Mixed Earnings Amid Trade Challenges

Amazon’s earnings surged 62% year-over-year to $1.59 per share, surpassing analyst expectations of $1.36 per share. Revenue also increased by 9% to $155.67 billion, exceeding estimates of $155.12 billion.

However, the company’s cloud computing division, Amazon Web Services (AWS), fell short of expectations. AWS reported revenue of $29.27 billion, growing by 17%, yet it did not meet the forecast of $29.42 billion.

Amazon also announced the launch of a new AI group aimed at developing software for AI-powered tools known as “agents.” These innovative programs are designed to autonomously perform tasks, such as reading emails, summarizing content, scheduling meetings, and sending invitations without requiring detailed instructions for each step.

The company projects revenue between $159 billion and $164 billion, along with operating income ranging from $13 billion to $17.5 billion. Both figures slightly miss market analyst forecasts. CEO Andy Jassy highlighted ongoing efforts to address tariff challenges while maintaining competitive pricing.

Apple, Inc.

Apple reported earnings of $1.65 per share for the second quarter of fiscal year 2025, up 8% from the previous year and slightly above analyst estimates of $1.63. Revenue hit $95.36 billion, a 5% increase, again exceeding expectations of $94.75 billion.

iPhone sales experienced a modest rise of 2% year-over-year, generating $46.8 billion and exceeding forecasts. Sales of Mac and iPad also performed well, contributing $7.9 billion and $6.4 billion, respectively.

The Services division continues to thrive, with revenue reaching $26.6 billion, up 12%, although it narrowly missed expectations of $26.7 billion.

In terms of tariffs, CEO Tim Cook remained vague about potential impacts. Apple did not provide specific revenue or earnings guidance for the June quarter, but Cook revealed an expected $900 million loss due to tariffs, indicating that trade tensions are beginning to affect the company’s financials. To mitigate these impacts, Apple plans to increase iPhone production in India, aiming for most units sold in the U.S. to be manufactured there by 2026.

Market Reaction and Key Takeaways

Following these earnings reports, Meta and Microsoft shares rose by 7.8% and 9.1%, respectively, on Thursday. Conversely, Amazon’s stock remained flat and Apple saw a decline of about 3.75% on Friday after their respective earnings results.

The overall performance of these Tech giants reflects a mixed outcome. Two important points arise from this: first, the intricate and compounded effects of tariffs are impacting these firms. Reports cover a time before trade tensions escalated, signalling that ongoing monitoring is essential. Second, the AI Boom remains robust and continues its upward trajectory.

Regarding investment potential, Apple and Meta received a B-rating, categorizing them as buys. In contrast, Amazon and Microsoft received a C-rating, indicating a hold position. Both companies display weak ratings regarding their Quantitative Grades, suggesting reduced institutional buying interest.

What to Watch For

Each of these companies has been pivotal in driving innovation over the recent years, creating significant wealth opportunities for investors. My analysis system previously identified these firms before they became giants in the market.

Currently, my system indicates a major economic transition that is reshaping America’s financial landscape. On one hand, this shift is generating remarkable wealth opportunities; on the other hand, it is leading to the elimination of traditionally secure careers.

This transformation is not limited to a single industry but is fundamentally altering the economy. It’s crucial to stay informed about these developments to make strategic decisions moving forward.

# Financial Insights: Louis Navellier Discusses NVIDIA and Market Trends

Louis Navellier

Editor, Market 360

Disclosure Statement: As of the date of this email, the Editor, directly or indirectly, holds securities that are discussed in the commentary, analysis, and recommendations below, including:

NVIDIA Corporation (NVDA)