Surging Options Volume Highlights S&P 500 Activity

Today, several notable stocks within the S&P 500 index have experienced exceptionally high options trading volume, signaling increased investor interest.

Synchrony Financial Sees Heavy Trading Activity

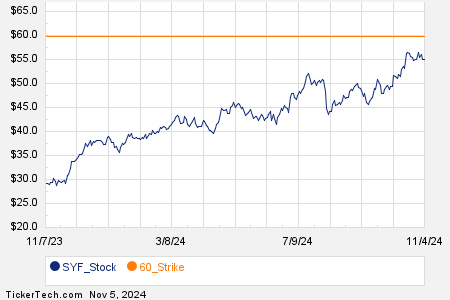

Synchrony Financial (Symbol: SYF) recorded a remarkable options trading volume of 44,618 contracts, which corresponds to around 4.5 million underlying shares. This figure represents approximately 134.1% of SYF’s average daily trading volume over the past month, which stands at 3.3 million shares. A significant focus is on the $60 strike call option set to expire on November 15, 2024; 25,165 contracts have traded, amounting to about 2.5 million underlying shares. Below is a chart illustrating SYF’s trading history over the past year, with the $60 strike highlighted in orange:

Celanese Corp Options Volume Indicates Market Activity

Celanese Corp (Symbol: CE) has also seen substantial options trading with a total of 6,369 contracts exchanged so far, equating to approximately 636,900 underlying shares. This trading volume represents around 92.1% of CE’s average daily volume of 691,670 shares over the past month. The $90 strike put option, expiring on November 15, 2024, has particularly drawn attention with 783 contracts traded today, reflecting about 78,300 underlying shares. Below is a chart showcasing CE’s trading history from the last twelve months, with the $90 strike highlighted:

NXP Semiconductors NV Experiences Active Options Trading

NXP Semiconductors NV (Symbol: NXPI) reported options trading volume of 15,817 contracts, which equates to approximately 1.6 million underlying shares. This activity represents around 75.5% of NXPI’s average daily trading volume over the past month of 2.1 million shares. Noteworthy is the $185 strike put option expiring on December 20, 2024, with 2,710 contracts trading today, or about 271,000 underlying shares. Below is a chart displaying NXPI’s twelve-month trading history, with the $185 strike emphasized:

For information on various expiration dates available for SYF, CE, or NXPI options, visit StockOptionsChannel.com.

![]() Today’s Most Active Call & Put Options of the S&P 500 »

Today’s Most Active Call & Put Options of the S&P 500 »

Also see:

- YTD Return on Dow

- NBL Options Chain

- INVZ Average Annual Return

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.