Surge in Option Trading for Floor & Decor, Sana Biotechnology, and IonQ

Today’s options trading reflected significant activity in the Russell 3000 index, particularly in three companies: Floor & Decor Holdings Inc (Symbol: FND), Sana Biotechnology Inc (Symbol: SANA), and IonQ Inc (Symbol: IONQ).

Floor & Decor Holdings Inc (FND) Sees Exceptionally High Volume

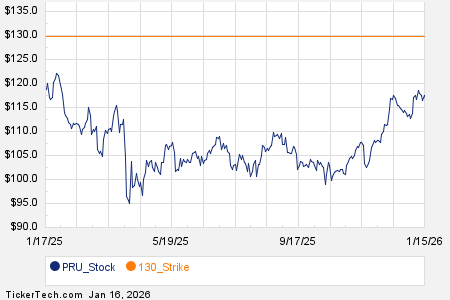

Floor & Decor Holdings Inc (Symbol: FND) experienced remarkable trading volume, with 22,579 contracts exchanged, equating to about 2.3 million underlying shares. This figure represents approximately 176.1% of the company’s average daily trading volume of 1.3 million shares over the past month. A notable spike was observed in the $90 strike put option, which had 10,405 contracts trading today, translating to around 1.0 million underlying shares. Below is a chart illustrating FND’s trading history for the past twelve months, with the $90 strike clearly marked in orange:

Sana Biotechnology Inc (SANA) Records Strong Options Activity

Sana Biotechnology Inc (Symbol: SANA) witnessed a robust trading volume today, with 52,458 contracts traded, representing about 5.2 million underlying shares. This volume is approximately 165.4% of SANA’s average daily trading volume of 3.2 million shares over the past month. A significant amount of activity was noted for the $7.50 strike call option, which had 13,455 contracts trading, amounting to around 1.3 million underlying shares. The chart below shows SANA’s trading history for the last twelve months, highlighting the $7.50 strike in orange:

IonQ Inc (IONQ) Sees Massive Options Trading Volume

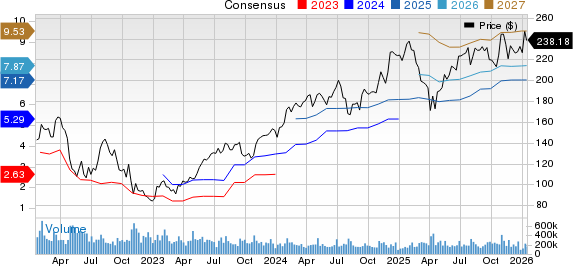

IonQ Inc (Symbol: IONQ) achieved substantial options trading volume, with a staggering 372,573 contracts traded, which corresponds to about 37.3 million underlying shares. This figure accounts for approximately 137.1% of IONQ’s average daily trading volume of 27.2 million shares over the previous month. Notably, the $20 strike put option had a considerable 15,215 contracts trading today, representing around 1.5 million underlying shares. Below is a chart of IONQ’s twelve-month trading history, with the $20 strike highlighted in orange:

For more information about available expirations for options related to FND, SANA, or IONQ, visit StockOptionsChannel.com.

![]() Today’s Most Active Call & Put Options of the S&P 500 »

Today’s Most Active Call & Put Options of the S&P 500 »

Also see:

- TSN Split History

- Church and Dwight MACD

- CINF Insider Buying

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.