Keybanc Initiates Coverage of Astrana Health with Positive Outlook

On October 11, 2024, Keybanc initiated coverage of Astrana Health (NasdaqCM:ASTH), recommending a Sector Weight rating.

Analysts Forecast Modest Price Increase

As of September 25, 2024, the average one-year price target for Astrana Health is $59.46 per share. Predictions vary with a low of $33.71 and a high of $73.50. This average represents a potential increase of 5.75% from the last recorded closing price of $56.23 per share.

Check our leaderboard for companies with the most promising price targets.

Projected Growth in Revenue and Earnings

Astrana Health is expected to generate annual revenue of $1,789 million, reflecting a growth of 12.39%. Additionally, the projected annual non-GAAP EPS stands at 1.44 for the upcoming year.

Institutional Investor Interest on the Rise

Currently, 389 funds or institutions report positions in Astrana Health, which marks an increase of 24 owners (6.58%) compared to the previous quarter. The average portfolio weight for all funds invested in ASTH is 0.12%, up by 1.90%. In total, institutional ownership rose by 3.27% over the last three months, totaling 25,335,000 shares.

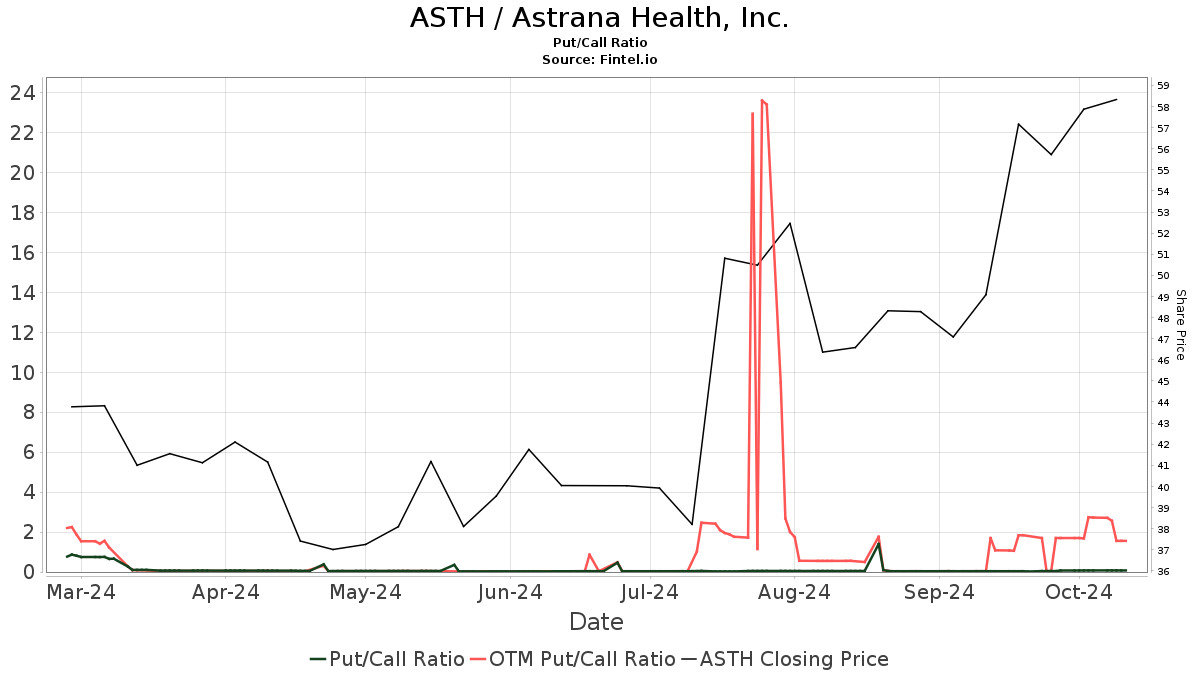

The put/call ratio for ASTH is 0.08, signaling a generally bullish outlook among investors.

Trends Among Other Shareholders

IJR – iShares Core S&P Small-Cap ETF currently holds 2,737,000 shares, representing 5.58% ownership of Astrana Health. This is a decrease from 2,857,000 shares previously, marking a reduction of 4.39%.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares retains 1,347,000 shares, which is 2.74% of the company, down from 1,468,000 shares, reflecting a 9.02% decrease.

NAESX – Vanguard Small-Cap Index Fund Investor Shares owns 1,057,000 shares (2.15% ownership), also down from 1,190,000 shares—a reduction of 12.56%.

Geode Capital Management has increased its stake to 1,016,000 shares (2.07%), up from 990,000 shares, a gain of 2.47%. Meanwhile, IWM – iShares Russell 2000 ETF owns 1,014,000 shares and has seen a slight increase of 0.90% despite a drop from 1,059,000 shares previously.

A Brief Look at Astrana Health

(Company-provided description)

Astrana Health, also known as Apollo Medical Holdings, Inc., is a technology-driven healthcare management firm. Founded in 1994 and headquartered in Alhambra, California, the company specializes in physician-centric medical care. They leverage a proprietary platform to support a value-based healthcare model that aids providers in delivering high-quality care. Their services target patients with public and private insurance, including Medicare and Medicaid, as well as the uninsured in California.

Fintel serves as a comprehensive research platform for individual investors, financial advisors, and small hedge funds, providing data on fundamentals, analyst reports, ownership details, options sentiment, and more.

This article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.