Humana’s Stock Gets Attention with Keybanc’s New Recommendation

Fintel reports that on October 11, 2024, Keybanc initiated coverage of Humana (NYSE:HUM) with a Sector Weight recommendation.

Analysts Predict Significant Growth for Humana

As of September 25, 2024, analysts set the average one-year price target for Humana at $399.85 per share. Estimates range from a low of $352.49 to a high of $460.95. Notably, this average price target indicates a potential increase of 54.94% from its latest closing price of $258.07 per share.

Check out our leaderboard showcasing companies with the largest price target upside.

Revenue and Earnings Outlook

The projected annual revenue for Humana is $112,600 million, reflecting a modest increase of 0.50%. Additionally, the annual non-GAAP earnings per share (EPS) is forecasted to be $32.33.

Institutional Interest in Humana

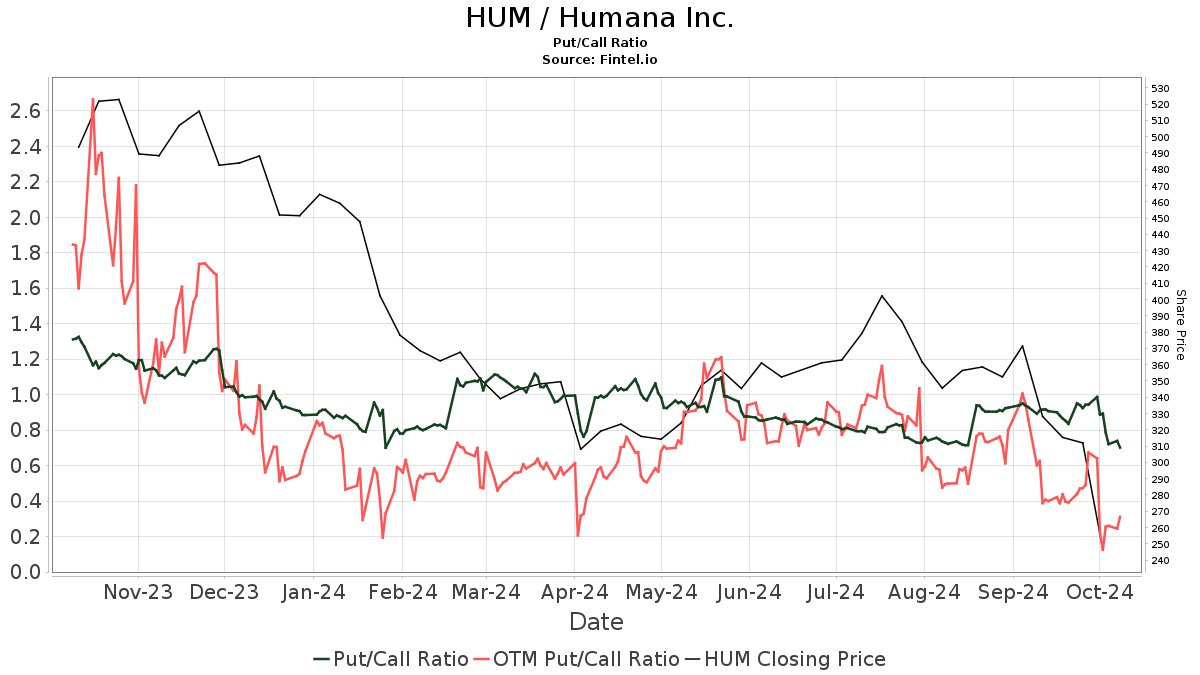

Currently, 2,049 funds or institutions hold positions in Humana, a decrease of 181 owners or 8.12% from the previous quarter. On average, these funds allocate 0.36% of their portfolios to HUM, up by 3.60%. Over the last three months, total shares owned by institutions rose by 4.80% to 132,335K shares.  Interestingly, Humana’s put/call ratio stands at 0.69, suggesting a bullish outlook among investors.

Interestingly, Humana’s put/call ratio stands at 0.69, suggesting a bullish outlook among investors.

Shareholder Movements

Wellington Management Group LLP currently holds 4,600K shares, representing 3.82% ownership. This is a decrease from its previous holding of 5,495K shares, marking a decline of 19.46%. The firm also lowered its portfolio allocation in HUM by 9.10% last quarter.

Dodge & Cox owns 4,309K shares, representing 3.58% ownership of Humana.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) now holds 3,806K shares, up by 0.17% from 3,800K shares previously. Their portfolio allocation in HUM increased by 4.97% over the last quarter. On the other hand, Eagle Capital Management significantly boosted its position, now owning 3,227K shares, a sharp increase from 687K shares, representing a whopping 385.33% rise in allocation.

The Vanguard 500 Index Fund Investor Shares (VFINX) holds 3,093K shares, a slight increase of 0.44% from its previous 3,079K shares, reflecting a 2.46% increase in its portfolio allocation.

Overview of Humana Inc.

Humana Inc. is dedicated to assisting its millions of medical and specialty members in achieving their best health. The company’s history in care delivery and health plan management has enabled it to develop a new integrated care model that aims to improve health outcomes and reduce costs. This commitment benefits a diverse group including Medicare recipients, families, individuals, military personnel, and the communities they serve.

Fintel is a comprehensive investing research platform for individual investors, traders, financial advisors, and small hedge funds.

Our extensive data includes fundamentals, analyst reports, ownership data, fund sentiment, options market insights, insider trading, and more. Additionally, our exclusive stock picks leverage advanced, backtested quantitative models for enhanced profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the author’s and do not necessarily reflect those of Nasdaq, Inc.