Keybanc Upgrades Apple Outlook, Signals Growth Ahead

Fintel reports that on April 14, 2025, Keybanc upgraded its rating for Apple (NasdaqGS:AAPL) from Underweight to Sector Weight.

Analyst Price Forecast Indicates Strong Upside Potential

As of April 1, 2025, the average price target for Apple shares over the next year stands at $256.14, suggesting a potential upside of 29.27%. Predictions range from a low of $185.70 to a peak of $341.25, reflecting significant optimism about Apple’s future performance compared to its most recent closing price of $198.15 per share.

See our leaderboard of companies with the highest price target upside.

Projected Financial Performance

Apple’s projected annual revenue for the upcoming fiscal year is $456.34 billion, showing a substantial increase of 15.31%. Additionally, the expected annual non-GAAP EPS stands at 7.28.

Fund Sentiment Analysis

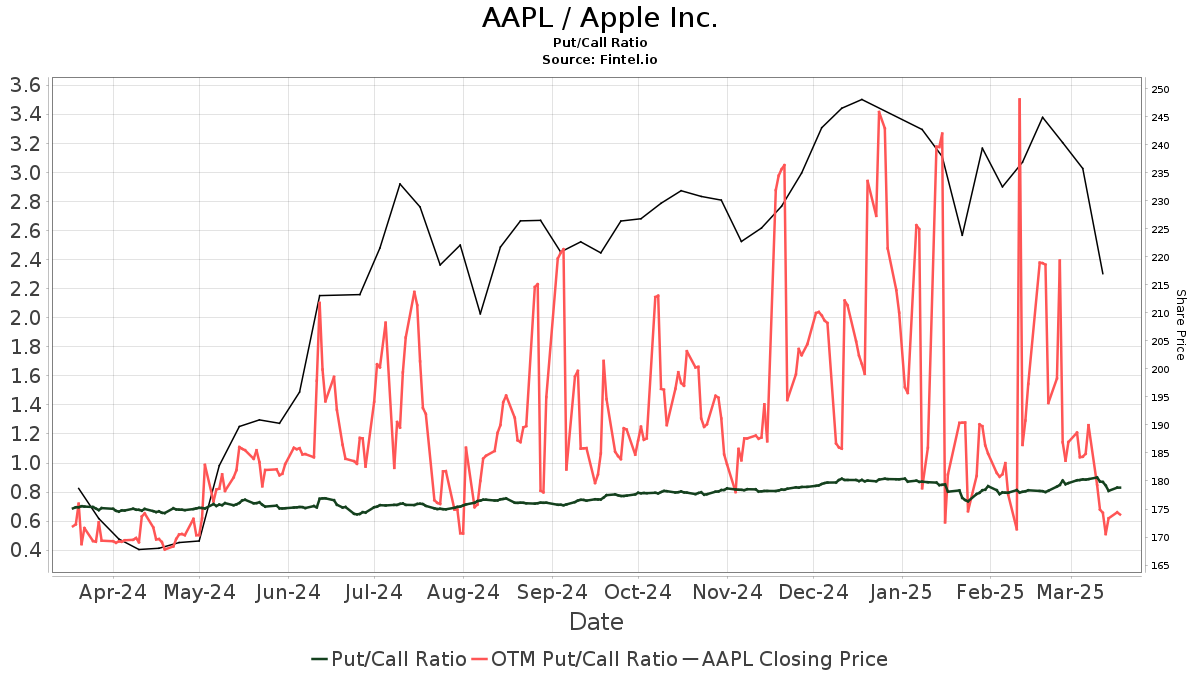

Currently, 7,664 funds or institutions hold positions in Apple. This number has risen by 571, or 8.05%, over the last quarter. The average portfolio weight of these funds in AAPL now sits at 3.82%, up by 12.59%. Institutional ownership has also surged, with total shares owned increasing by 3.85% to 10,702,150K shares. The put/call ratio for AAPL is at 0.81, indicating a bullish outlook among investors.

Institutional Shareholder Activity

The Vanguard Total Stock Market Index Fund (VTSMX) owns 473,592K shares, translating to a 3.15% ownership stake, which is an increase of 3.32% from 457,849K shares previously reported. The firm’s portfolio allocation in AAPL rose by 9.56% over the last quarter.

Meanwhile, the Vanguard 500 Index Fund Investor Shares (VFINX) holds 409,170K shares, representing 2.72% ownership. This reflects a 2.71% increase from its previous ownership of 398,082K shares, with a portfolio allocation boost of 4.51% in AAPL.

Geode Capital Management holds 340,165K shares for a 2.26% ownership, marking an increase of 1.85% from 333,858K shares. Their portfolio allocation in AAPL has increased by 4.89% over the last quarter.

Berkshire Hathaway maintains a steady position with 300,000K shares, accounting for 2.00% ownership, remaining unchanged from the last quarter.

Price T Rowe Associates reported holding 220,108K shares, representing 1.47% of the company. This is a decrease from their prior holding of 235,581K shares, reflecting a 7.03% drop. However, they have increased their allocation in AAPL by 0.54% over the last quarter.

Company Background on Apple

(This description is provided by the company.)

Founded in April 1976 by Steve Jobs, Steve Wozniak, and Ronald Wayne, Apple Inc. is a leading American technology company based in Cupertino, California. The company designs, develops, and sells a variety of consumer electronics, computer software, and online services. Apple is part of the Big Five in the U.S. tech industry, which includes Amazon, Google, Microsoft, and Facebook. Its product lineup features the iPhone, iPad, Mac, iPod, Apple Watch, and a range of audio devices like AirPods and HomePod smart speakers. Software offerings include iOS, macOS, and professional applications like Final Cut Pro X and Logic Pro. Additionally, Apple provides services such as Apple Music, iCloud, Apple Pay, and various app stores.

Fintel is a comprehensive investing research platform designed for individual investors, traders, financial advisors, and small hedge funds.

Our platform offers a wide array of data encompassing fundamentals, analyst insights, ownership stats, and market sentiment, as well as trading data and advanced stock picks focused on improved profitability.

Click to learn more.

This story initially appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.