Keybanc Begins Coverage of UnitedHealth Group with Positive Outlook

On October 11, 2024, Keybanc initiated coverage of UnitedHealth Group (SNSE:UNH) with an Overweight rating.

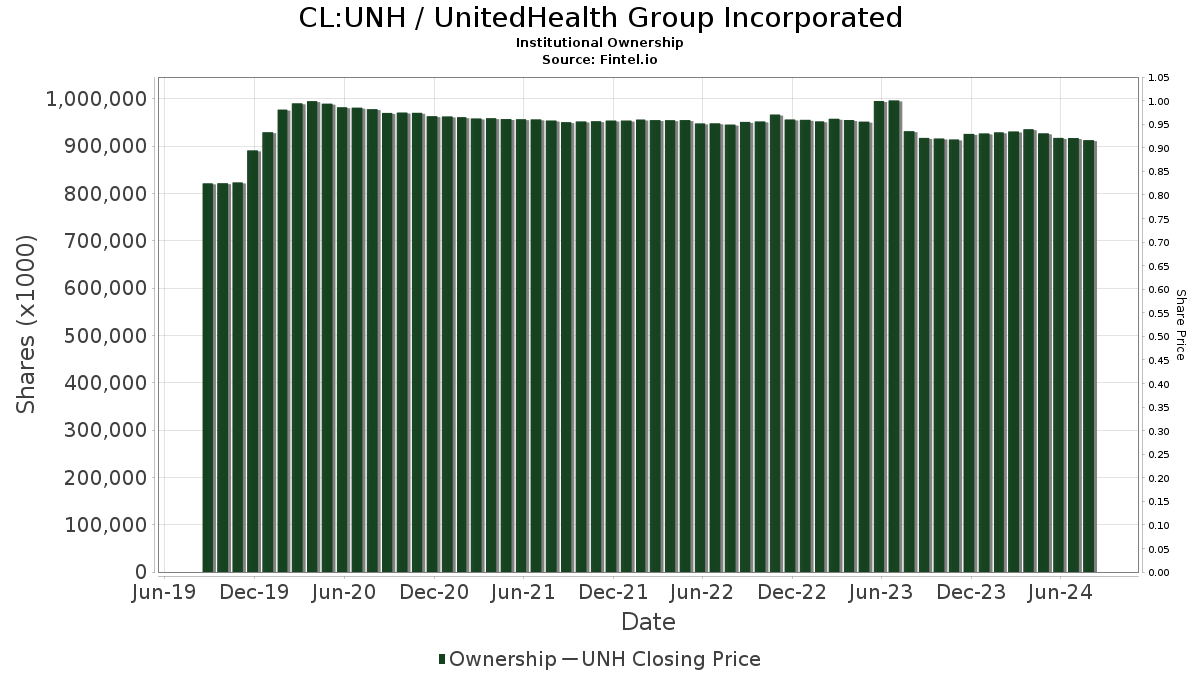

Growing Institutional Interest

According to Fintel, 5,234 funds or institutions hold positions in UnitedHealth Group, marking an increase of 27 (or 0.52%) from the previous quarter. The average portfolio weight of all funds dedicated to UNH stands at 0.99%, showing an improvement of 1.88%. Institutions collectively upped their holdings by 5.17% over the last three months, reaching a total of 939,681K shares.

Activity from Major Shareholders

The Vanguard Total Stock Market Index Fund (VTSMX) currently holds 29,080K shares, which is 3.15% of the company. This represents a slight increase of 0.02% from their previous holding of 29,075K shares. VTSMX has raised its allocation to UNH by 0.12% in the last quarter.

Capital World Investors owns 28,023K shares, equating to 3.03% ownership, a decrease of 1.07% from 28,322K shares in the prior filing. However, their overall portfolio allocation in UNH rose by 0.35% recently.

Price T Rowe Associates holds 26,021K shares, which constitutes 2.82% ownership, slightly down from 26,063K shares, reflecting a 0.16% drop. They have increased their UNH portfolio allocation by 0.34% in the last quarter.

Wellington Management Group LLP possesses 25,884K shares, or 2.80% ownership. They reported an increase from 24,283K shares, showing a 6.18% rise, although they significantly decreased their UNH portfolio allocation by 84.42% recently.

Lastly, J.P. Morgan Chase holds 24,349K shares, amounting to 2.64% ownership, which is up from 23,841K shares for an increase of 2.09%. This firm has also drastically lowered its UNH portfolio allocation by 84.01% during the last quarter.

Fintel is a robust investing research platform catering to individual investors, traders, financial advisors, and small hedge funds.

The platform offers extensive data, including fundamentals, analyst reports, ownership data, and fund sentiment, as well as insights on options trading and insider activities. It supports investors with advanced, backtested quantitative models for enhanced decision-making.

This information originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.