Keybanc Starts Coverage of Addus HomeCare with Positive Outlook

On October 11, 2024, Keybanc announced its initiation of coverage for Addus HomeCare (NasdaqGS:ADUS) with an Overweight rating.

Analysts Forecast Gains for Addus HomeCare

The current one-year price target for Addus HomeCare stands at $136.68 per share, as of September 25, 2024. Analysts predict a price range between $83.83 and $152.25. This average target suggests a potential upside of 4.63% from the last recorded closing price of $130.63 per share.

For a broader perspective, check out our leaderboard showcasing companies with the most significant price target upsides.

Revenue and Earnings Projections

Addus HomeCare is projected to generate annual revenue of $1,105 million, a slight decline of 0.87% from previous expectations. Additionally, the estimated non-GAAP EPS is 4.53.

Investors’ Sentiment Towards Addus HomeCare

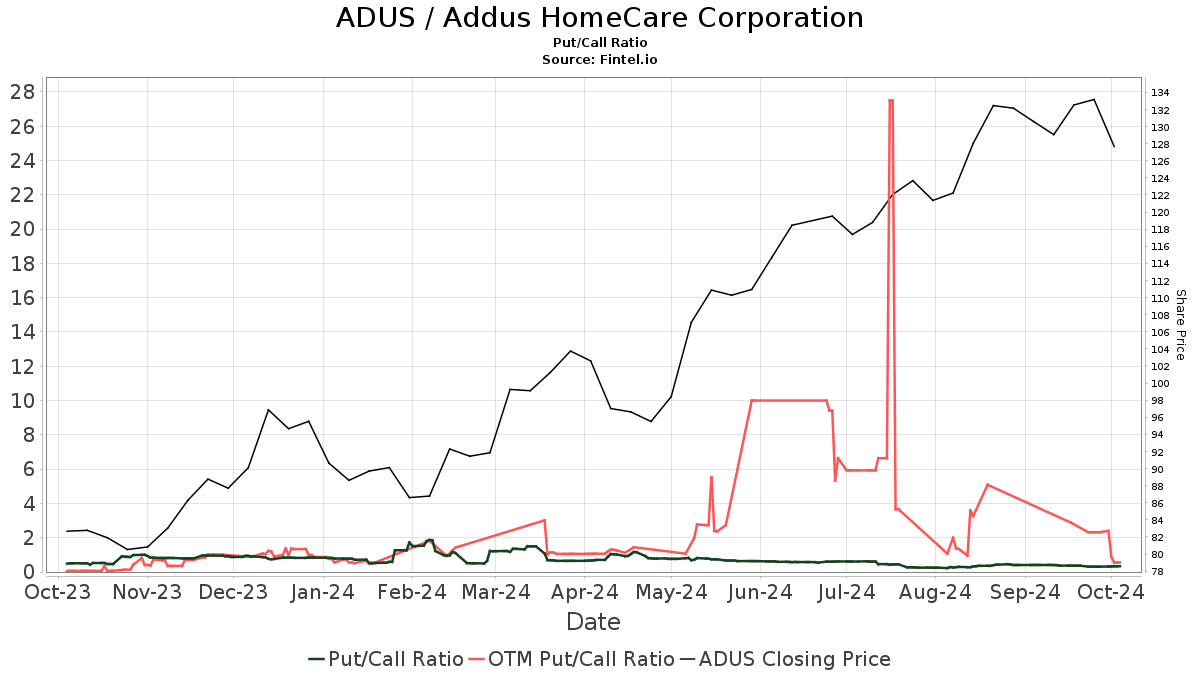

Currently, there are 643 funds or institutions holding positions in Addus HomeCare. This marks an increase of 39 funds, or 6.46%, in the last quarter. The average portfolio weight of all funds involved with ADUS has risen by 16.40% to 0.23%. Over the past three months, institutional shares owned saw an increase of 11.86%, totaling 21,202K shares.  Notably, the put/call ratio for ADUS is 0.32, indicating a bullish market sentiment.

Notably, the put/call ratio for ADUS is 0.32, indicating a bullish market sentiment.

Institutional Shareholder Activities

The iShares Core S&P Small-Cap ETF (IJR) currently holds 1,046K shares, accounting for 5.84% ownership. Previously, the ETF owned 1,085K shares, representing a decrease of 3.77%. However, its allocation to ADUS increased by 12.45% over the last quarter.

Wasatch Advisors has ramped up its stake as well, now holding 933K shares (5.21% ownership). This reflects an impressive increase of 67.14% from its last report which listed 307K shares. Their allocation in ADUS jumped by 249.69% over the last quarter.

Point72 Asset Management saw its holdings grow to 746K shares, representing 4.17% ownership, up 42.32% from 430K shares owned previously, marking an increase of 110.30% in portfolio allocation.

Silvercrest Asset Management Group increased its holdings to 709K shares (3.96% ownership) from 638K shares, a rise of 10.03%. They also modified their portfolio allocation in ADUS by 26.58% in the last quarter.

Wellington Management Group now holds 680K shares (3.80% ownership), slightly down from 702K shares, indicating a decrease of 3.16%. Notably, they still increased their portfolio allocation for ADUS by 9.74% last quarter.

About Addus HomeCare

Addus HomeCare Background Information

(This description is provided by the company.)

Addus HomeCare specializes in delivering home care services, primarily personal care that assists individuals with daily activities, and also offers hospice and home health services. Their services are crucial for the elderly, disabled, and chronically ill individuals who might otherwise face hospitalization. Addus partners with various payor clients, including governmental agencies and private insurers, and caters to around 44,000 consumers across 212 locations in 22 states.

Fintel provides an extensive investing research platform aimed at individual investors, financial advisors, and small hedge funds.

Our extensive data covers global markets, including fundamentals, analyst reports, ownership data, fund sentiment, options flow, and much more. Enhanced stock picks come from advanced, backtested quantitative models aimed at optimizing profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.