Keybanc Begins Coverage of Surgery Partners, Projects Significant Upside Potential

On October 11, 2024, Keybanc initiated coverage of Surgery Partners (NasdaqGS:SGRY) with a Sector Weight rating.

Analyst Predictions Indicate 31.69% Growth Potential

As of September 25, 2024, the consensus one-year price target for Surgery Partners stands at $40.11 per share. Projections vary, with estimates ranging from a low of $32.32 to a high of $52.50. This average target represents a potential increase of 31.69% from the latest closing price of $30.46 per share.

The projected annual revenue for Surgery Partners is $3.173 billion, reflecting a growth of 9.83%. Additionally, the anticipated annual non-GAAP EPS is $0.77.

Institutional Sentiment and Ownership Trends

A total of 464 funds and institutions have reported holdings in Surgery Partners. This number reflects a slight decline of 1 owner, or 0.22%, compared to the previous quarter. The average portfolio weight allocated to SGRY by all funds has risen by 12.49% to 0.22%. Over the last three months, institutional ownership increased by 3.40%, bringing the total number of shares held by institutions to 159.456 million.

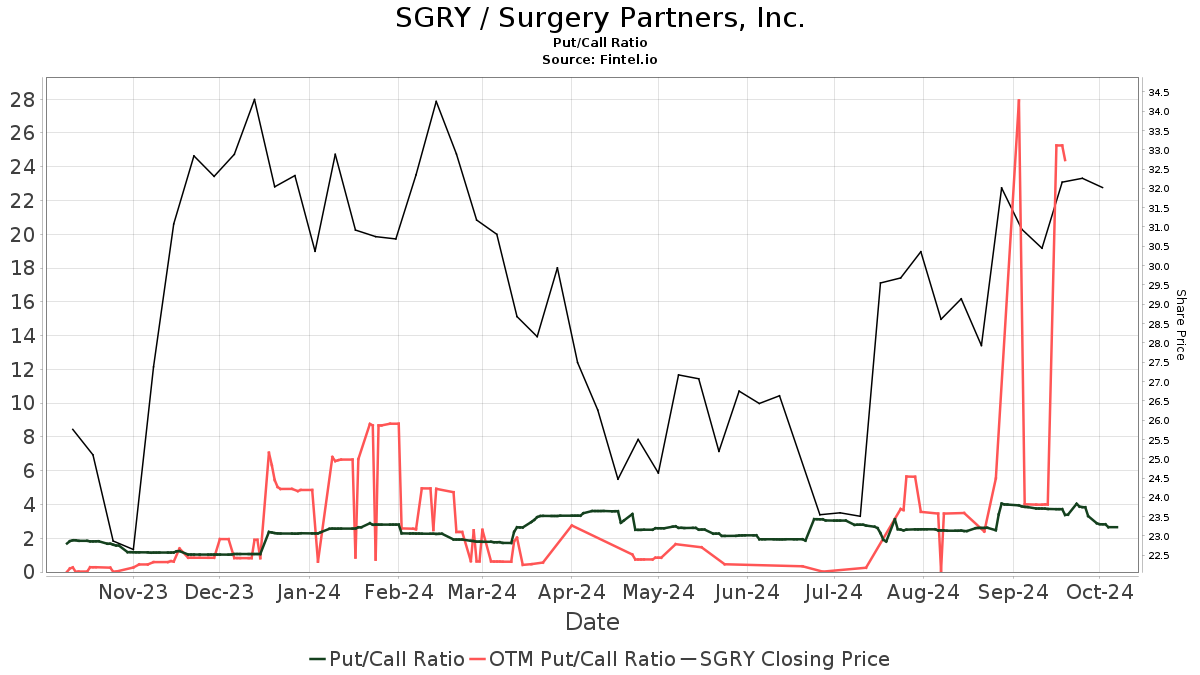

The put/call ratio for SGRY stands at 2.48, indicating a bearish sentiment among options traders.

Key Shareholders and Their Movements

Bain Capital Investors remains the largest stakeholder, holding 49.947 million shares, which equates to 39.52% ownership, showing no change this quarter.

Wellington Management Group, with 10.464 million shares (8.28% ownership), slightly increased its stake by 3.36%, although they decreased their overall portfolio allocation in SGRY by 16.85% over the same period.

Clearbridge Investments holds 5.586 million shares (4.42% ownership), up 1.31% from its last filing, yet it has reduced its portfolio allocation by 17.61% recently.

Deerfield Management Company raised its holdings to 4.707 million shares (3.72% ownership), a significant increase of 32.30%, with a portfolio allocation rise of 12.66% this quarter.

Meanwhile, Janus Henderson Group increased its shares held to 4.313 million (3.41% ownership), reflecting a notable rise of 41.94%. Their portfolio allocation in SGRY saw a substantial increase of 34.84% over the last quarter.

Overview of Surgery Partners

(Company description as provided.)

Founded in 2004 and based in Brentwood, Tennessee, Surgery Partners is recognized as a leading healthcare services provider. It focuses on outpatient care, delivering high-quality, affordable options for surgical and related ancillary services to both patients and physicians. Currently, Surgery Partners operates over 180 facilities across 30 states, including ambulatory surgery centers, surgical hospitals, multi-specialty physician practices, and urgent care centers.

Fintel offers a comprehensive investment research platform for individual investors, financial advisors, and small hedge funds.

Our extensive data encompasses fundamentals, analyst insights, ownership details, and fund sentiment, along with insider trading stats and unique stock picks based on advanced quantitative models.

This article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.