Kingsway Financial Reports Wider Loss in Q3 FY2024 Despite Revenue Growth

Kingsway Financial Services Inc. (KFS) reported a loss per share of 10 cents for the third quarter of fiscal 2024, which is greater than the loss of 4 cents per share in the same quarter last year.

Revenue Growth Across Segments

Kingsway Financial achieved revenues of $27.1 million in the fiscal third quarter, marking a 9.5% increase compared to the previous year.

Both business segments contributed to this upward trend in revenues.

However, shares of KFS fell by nearly 2.3% as of the last trading session.

Breakdown of Kingsway Financial’s Segments

The company’s revenue comes from two main segments: Extended Warranty and Kingsway Search Xcelerator.

For the quarter in question, revenues from the Extended Warranty service fees and commissions were $17.8 million, a 3.4% increase year over year.

KFS’s Kingsway Search Xcelerator segment saw more significant growth, with revenues of $9.3 million, up 23.3% from last year.

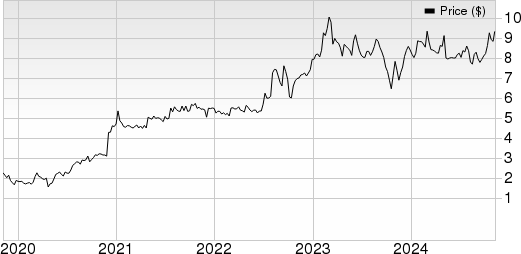

Price Trends for Kingsway Financial Services, Inc.

View Kingsway Financial Services, Inc. price, consensus, and EPS surprise data

Analysis of Operating Expenses

In the third quarter of fiscal 2024, general and administrative expenses rose by 15% year over year, amounting to $11.9 million. The cost of services sold also grew by 9.5%, reaching $6.8 million.

At the end of the third quarter, claims authorized on vehicle service agreements increased by 7.5% to $6.3 million, while commissions rose by 8.9% to $2.8 million.

Profitability Overview of Kingsway Financial

The operating loss for the third quarter of fiscal 2024 was $0.7 million, compared to an operating loss of $0.2 million in the same quarter last year.

Net loss for Kingsway Financial was $2.3 million for the quarter, an increase from the $0.7 million loss reported a year earlier. Nevertheless, adjusted EBITDA grew by 27.8% year over year, reaching $2.9 million.

Liquidity and Debt Management

At the end of the third quarter of fiscal 2024, Kingsway Financial had cash and cash equivalents, along with short-term investments of $6.7 million, down from $9.8 million at the end of the previous quarter.

Cumulative net cash from operating activities was $1.2 million, a considerable improvement from the $25.3 million used in operating activities last year.

Conclusion

Kingsway Financial ended the third quarter of fiscal 2024 with impressive top-line results, showing strong revenues from both segments. During this quarter, the company acquired Image Solutions LLC, an information technology managed services provider, and sold its VA Lafayette subsidiary, which adds to a positive outlook for the stock.

On the downside, the disappointing bottom-line results this quarter raise concerns.

Research Chief Identifies “Top Pick to Double”

Among thousands of stocks, five Zacks experts have each selected their favorite to potentially increase by +100% or more in the upcoming months. One of these selections has been highlighted by the Director of Research, Sheraz Mian, as having the most explosive upside.

This chosen company targets millennial and Gen Z consumers, generating nearly $1 billion in revenue last quarter alone. Recent stock declines might present an ideal entry opportunity. While not every pick will shine, this particular stock could exceed previous Zacks recommendations like Nano-X Imaging, which surged +129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

Kingsway Financial Services, Inc. (KFS): Free Stock Analysis Report

Click here to read this article on Zacks.com.

The views expressed in this article are those of the author and do not necessarily reflect those of Nasdaq, Inc.