Tesla’s Stock Rating Upgraded: Analyst Forecasts Price Drop Ahead

On October 24, 2024, KGI Securities changed their stance on Tesla (XTRA:TL0), moving their rating from Neutral to Outperform.

Analyst Predictions Indicate a Significant Drop

As of October 22, 2024, the average one-year price expectation for Tesla sits at 198.25 €/share. Predictions vary widely, with estimates ranging from a low of 23.21 € to a high of 300.87 €. This average suggests a potential decrease of 17.24% from Tesla’s most recent closing price of 239.55 € / share.

Check out our leaderboard for companies showing the largest potential price increases.

Tesla Expected to See Revenue Growth

The projected annual revenue for Tesla is forecasted at 134,914 million, marking an increase of 38.87%. Additionally, non-GAAP earnings per share (EPS) is anticipated to reach 5.62.

What Are Investors Saying?

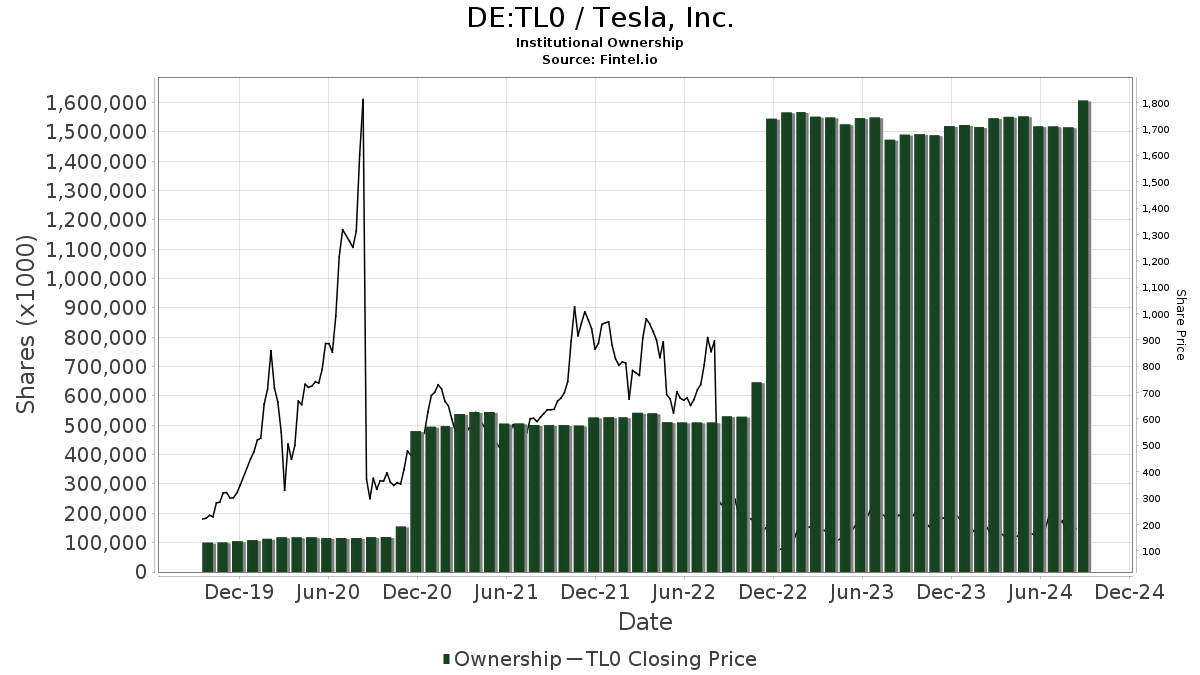

Currently, there are 4,291 funds or institutions reporting stakes in Tesla, a rise of 87 owners (2.07%) from the last quarter. The average portfolio allocation dedicated to TL0 across all funds is 0.89%, which is an increase of 8.31%. Institutions have increased their total shareholdings in the past three months by 7.12%, now totaling 1,621,996K shares.

Recent Investor Activity

The Vanguard Total Stock Market Index Fund (VTSMX) holds 85,652K shares, which is 2.68% of Tesla’s equity. Their last report indicated ownership of 85,113K shares, reflecting a 0.63% increase. Over the last quarter, VTSMX raised their allocation in TL0 by 10.16%.

The Vanguard 500 Index Fund (VFINX) owns 71,212K shares (2.23% of the company), up from 69,825K shares, accounting for a 1.95% increase. VFINX also increased its stake in TL0 by 8.68% in the previous quarter.

Geode Capital Management possesses 58,334K shares, representing 1.83% ownership, up from 56,909K shares, a 2.44% increase. They boosted their portfolio allocation in TL0 by 9.45% over the last three months.

Capital World Investors holds 42,709K shares (1.34% ownership), an increase from 39,096K shares, showing a 8.46% increase. They’ve raised their portfolio allocation in TL0 by 21.16% during the last quarter.

Invesco QQQ Trust, Series 1, has 35,997K shares, which equals 1.13% of the company. Previously, they had 34,985K shares, marking a 2.81% increase in ownership. Their allocation for TL0 went up by 4.26% over the last quarter.

Fintel is recognized as a leading investment research platform designed for individual investors, traders, financial advisors, and small hedge funds. Our extensive data encompasses fundamentals, analyst insights, ownership statistics, fund sentiment, insider trading, options flow, and much more, bolstered by advanced quantitative models aimed at maximizing profits.

Click to Learn More

This article first appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.