Kimco Realty, renowned for its strategic real estate investments, has made waves with the recent purchase of Waterford Lakes Town Center in Orlando, FL, for a staggering $322 million, which includes the absorption of a hefty $164 million mortgage. This move signifies Kimco’s bold stride to fortify its position in the Orlando market, expanding its portfolio to 18 centers encompassing over four million square feet of leasable space.

The jewel of this acquisition is the sprawling 976,000-square-foot property nestled across 79 sprawling acres, boasting an impressive 99% occupancy rate. The center boasts a seasoned blend of tenants, seamlessly integrating lifestyle and entertainment options with essential services and goods.

Situated in Orlando’s upscale West University submarket, Waterford Lakes Town Center caters to a vast trade area. With a local population exceeding 228,000 residents and an average household income of $111,000 within a five-mile radius, this shopping haven is strategically positioned in one of the nation’s fastest-growing metropolitan areas.

Fueled by robust demographics, the center sees a staggering 13.6 million annual visits, according to Placer.ai. Notably, several anchors and national tenants are cited as key footfall drivers in Florida.

Kimco’s president and chief investment officer, Ross Cooper, expressed enthusiasm about the acquisition, highlighting the company’s vision to maximize the center’s growth potential through strategic adjustments such as optimizing below-market leases and enriching its diverse mix of offerings.

Kimco’s Future Vision & 2024 Expectations

The acquisition of Waterford Lakes propels Kimco’s 2024 acquisition activity beyond the $560 million threshold, including structured investments. Significantly, the company now foresees a net acquisition stance in 2024, with total acquisition and structured investments ranging between $565 to $625 million, surpassing the initial estimate of $300 to $350 million.

Conversely, 2024 dispositions are anticipated to hover between $250 to $300 million, down from the earlier projected range of $300 to $350 million.

Riding the Wave of Growth

Kimco’s strategic focus on nurturing high-quality, open-air shopping centers predominantly anchored by grocery stores in prime drivable suburban areas across key metropolitan Sunbelt and coastal markets spells a promising trajectory for the company. By eyeing mixed-use asset development, Kimco sets the stage for sustained long-term growth.

The recent acquisition underscores Kimco’s dedication to expanding its premium shopping center portfolio, aligning with the evergreen demand for essential services and goods. Bolstered by a necessity-driven portfolio, Kimco stands resilient during economic downturns, ensuring a steady revenue stream. The addition of Waterford Lakes aligns seamlessly with this overarching strategy.

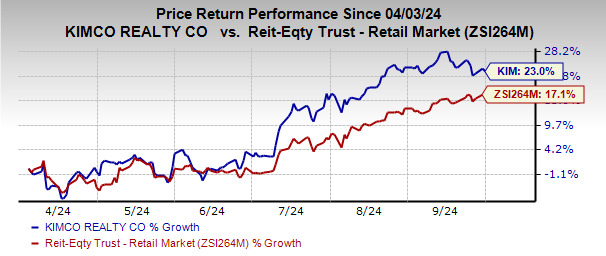

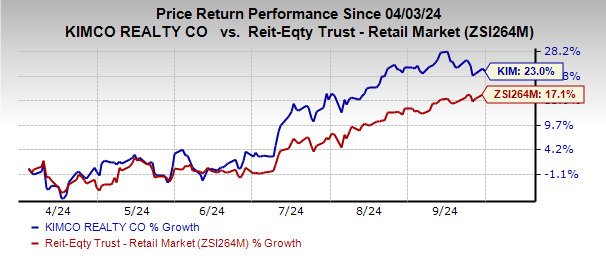

Kimco Realty Corporation (KIM) has seen its stock surge by 23% in the past six months, outperforming the industry’s growth rate of 17.1%, signifying positive investor sentiment and robust market confidence in the company’s strategic direction.

Image Source: Zacks Investment Research

Winning Stocks in the Retail REIT Sector

Noteworthy mentions in the retail REIT sector include the likes of Brixmor Property Group (BRX) and Tanger, Inc. (SKT), each boasting a Zacks Rank #2 (Buy). These stocks are well-positioned for growth, with Brixmor anticipated to see a 4.4% year-over-year surge in its 2024 FFO per share, while Tanger is geared up for a 6.6% uptick from the previous year’s reported figure.

It’s imperative to note that earnings-related data in this narrative encapsulates funds from operations (FFO), a pivotal metric for evaluating REIT performance.

Final Words

Are you ready to dive into the stock market pool and grab some winning opportunities? If so, seven elite stocks have been meticulously handpicked by experts from the list of 220 Zacks Rank #1 Strong Buys. Positioned as “Most Likely for Early Price Pops,” these stocks have consistently outperformed the market by over 2X since 1988, boasting an average annual gain of +23.7%. Don’t snooze on these picks – seize the moment now!

Curious for more insights from Zacks Investment Research? Dive into their latest report, “5 Stocks Set to Double,” for free.

To access the original article on Zacks.com, click here.

The sentiments and viewpoints conveyed herein are of the author’s own and do not necessarily mirror those of Nasdaq, Inc.