KLA Corporation KLAC reported second-quarter fiscal 2024 non-GAAP earnings of $6.16 per share. This figure beat the Zacks Consensus Estimate by 4.76% but marked a decline of 16.5% year over year.

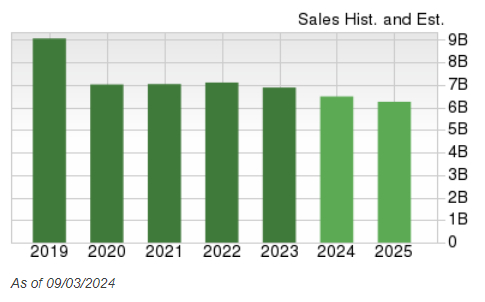

The revenues decreased 16.7% year over year to $2.49 billion, surpassing the Zacks Consensus Estimate by 1.25%. The year-over-year decline in the top line was attributed to softness in the Semiconductor Process Control, Specialty Semiconductor Process, and PCB, Display and Component Inspection segments.

Segment Performance

In terms of reportable segments, Semiconductor Process Control revenues (88.2% of total revenues) decreased 17.4% year over year to $2.19 billion but increased 3% sequentially. Foundry & Logic accounted for about 56%, while Memory constituted about 44% of Semiconductor Process Control revenues.

Specialty Semiconductor Process revenues (6% of total revenues) were $150.1 million, down 5.1% year over year, but jumped 18% on a sequential basis. PCB, Display and Component Inspection revenues (5.8% of total revenues) plunged 15.8% year over year to $143 million but increased 5% sequentially. Limited capacity investments in consumer electronics end markets hurt top-line growth.

Stock Performance and Market Comparisons

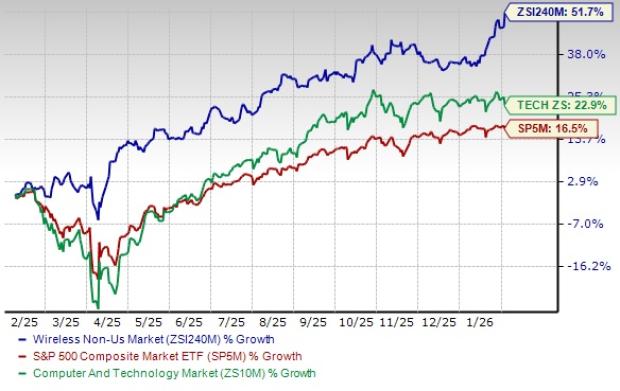

KLA shares were down 6% in after-hours trading. The company’s shares have outperformed the Zacks Computer & Technology sector in the past six-month period. While KLAC shares have gained 33%, the Computer & Technology sector has increased 14.3%.

Revenue Breakdown and Regional Performance

Product revenues (accounted for 77.3% of total revenues) decreased 22% year over year to $1.92 billion. Service revenues (22.7% of total revenues) increased 8.5% year over year to $564.9 million.

In terms of regional breakdown of revenues, China, Taiwan, Japan and Korea accounted for 41%, 15%, 12% and 12% of the total revenues for the fiscal second quarter, respectively.

Operational and Financial Highlights

In second-quarter fiscal 2024, the non-GAAP gross margin was 62.6%, 10 basis points (bps) above the guidance range. KLA reported research and development (R&D) expenses decreased 3.7% year over year to $320.4 million, while non-GAAP operating margin was 40.7%, up 50 bps sequentially.

As of Dec 31, 2023, cash, cash equivalents and marketable securities totaled $3.34 billion, and long-term debt at the end of the fiscal second quarter was $5.14 billion.

Guidance and Market Analysis

For third-quarter fiscal 2024, revenues are expected to be $2.34 billion, plus/minus $125 million, and non-GAAP earnings of $5.26 per share, plus/minus 60 cents. KLA carries a Zacks Rank #2 (Buy).

Other Opportunities and Recommendations

Shopify SHOP, Pinterest PINS and AvidXchange AVDX are some other top-ranked stocks that investors can consider in the broader sector, each sporting a Zacks Rank #1 (Strong Buy) at present.

While Shopify shares have gained 25.8% in the past six-month period, Pinterest shares have gained 37.7%, and AvidXchange shares have declined 9.5% in the same time frame.

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2023. Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.