Dividend Declaration and Historical Performance

On February 14, 2024, Koppers Holdings announced that its board of directors has confirmed a regular quarterly dividend of $0.07 per share ($0.28 annualized), up from the previous $0.06 per share. The ex-dividend date for eligibility is March 7, 2024, with payment distribution scheduled for March 25, 2024, to shareholders of record as of March 8, 2024.

At the present share price of $51.07 per share, the stock’s dividend yield stands at 0.55%. Over five years and across a sample of 234 data points, the average dividend yield has been 0.85%, with the lowest at 0.47% and the highest at 2.57%, and a standard deviation of yields at 0.29 (n=234). Notably, the current dividend yield resides 1.02 standard deviations below the historical average.

Furthermore, the company’s dividend payout ratio is 0.07, shedding light on the proportion of the company’s income disbursed in dividends. The 3-Year dividend growth rate stands at -0.17%.

Fund Sentiment and Analyst Price Forecast

Reportedly, 428 funds or institutions disclose holdings in Koppers Holdings, marking an increase of 10 owners or 2.39% in the last quarter. The average portfolio weight of all funds dedicated to KOP is 0.12%, reflecting an 11.42% uptick. Meanwhile, total shares owned by institutions increased by 1.62% in the last three months to 23,239K shares.

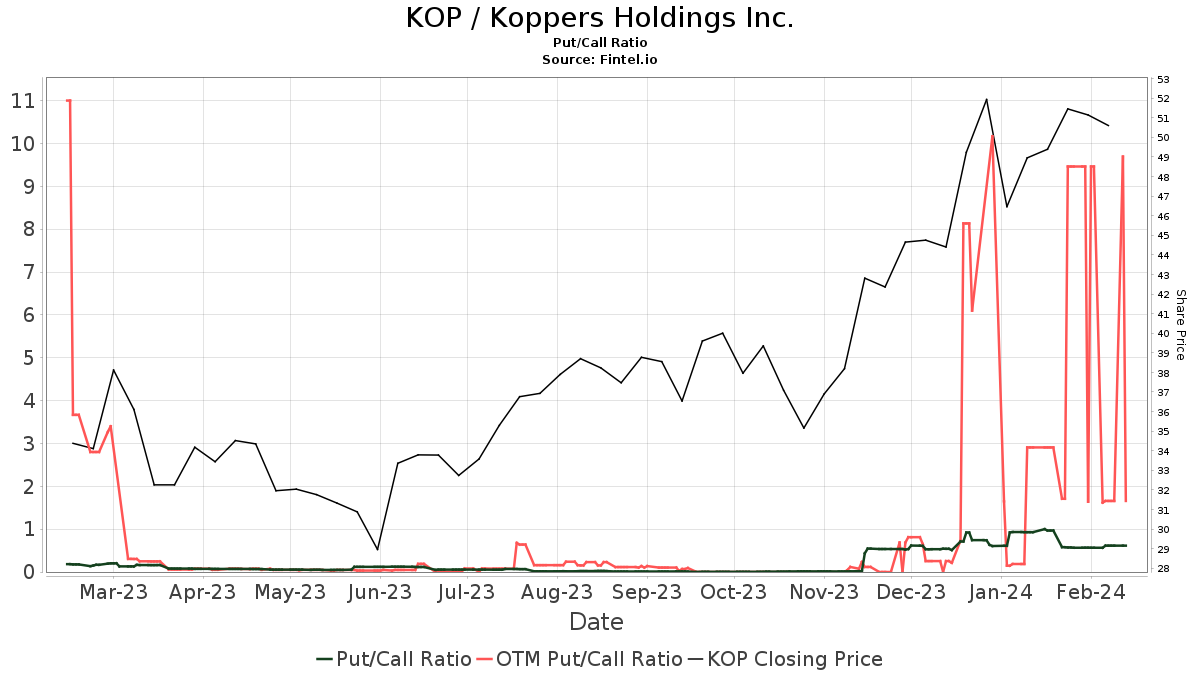

The put/call ratio of KOP is 0.62, indicating a bullish outlook. Additionally, the average one-year price target for Koppers Holdings as of January 20, 2024, is $58.14, pointing towards a potential 13.84% upside from its latest reported closing price of $51.07.

The projected annual revenue for Koppers Holdings is 2,028MM, displaying a 4.50% decrease. Correspondingly, the projected annual non-GAAP EPS is 4.34.

Insights into Shareholder Activities

Fuller & Thaler Asset Management holds 2,091K shares representing 10.04% ownership of the company. Notably, the firm decreased its portfolio allocation in KOP by 4.05% but then increased it by 9.65% over the last quarter. A similar trend of adjustments is evident with other major shareholders including UBVLX, IJR, Rubric Capital Management, and Lsv Asset Management.

Understanding Koppers Holdings

Koppers, with its headquarters situated in Pittsburgh, Pennsylvania, operates as an integrated global provider of treated wood products, wood treatment chemicals, and carbon compounds. Its products and services span across various niche applications in a broad spectrum of end-markets, including the railroad, specialty chemical, utility, residential lumber, agriculture, aluminum, steel, rubber, and construction industries. The company caters to its customers through a comprehensive global manufacturing and distribution network, with facilities located in North America, South America, Australasia, and Europe.

Additional reading: Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds. The provided data includes fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and more. Additionally, Fintel offers exclusive stock picks driven by advanced, backtested quantitative models for improved profitability.

Click to Learn More. This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.