The Kroger Co. Poised for Revenue Growth as Third-Quarter Results Approach

The Kroger Co. KR is likely to see an increase in revenue when it reports third-quarter fiscal 2024 results on Dec. 5. The Zacks Consensus Estimate for revenues stands at $34,295 million, which indicates a 1% increase from the previous year.

Earnings are also expected to rise compared to last year. Over the past 30 days, the Zacks Consensus Estimate for third-quarter earnings per share has remained steady at 98 cents. This consensus estimate reflects a 3.2% increase from the same quarter last year.

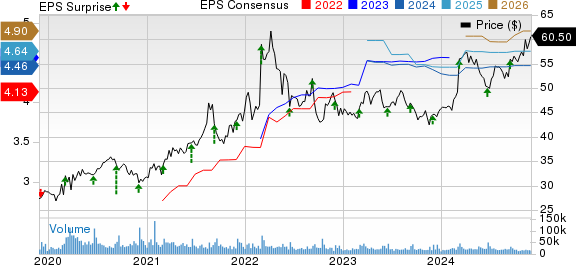

Kroger has maintained a trailing four-quarter earnings surprise average of 8.2%. In the last reported quarter, earnings exceeded the Zacks Consensus Estimate by 1.1%.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Kroger’s Price, Consensus, and Earnings Surprises

The Kroger Co. price-consensus-eps-surprise-chart | The Kroger Co. Quote

Factors Influencing Kroger’s Upcoming Earnings

Kroger is leveraging its strengths by offering a wide range of fresh products, expanding its ‘Our Brands’ portfolio, creating personalized shopping experiences, and ensuring a seamless digital environment. These strategies are likely bolstering customer satisfaction and reinforcing Kroger’s competitive edge in the retail sector, contributing to strong performance during the third quarter despite challenges in the retail environment.

As the year progresses, Kroger is cautiously optimistic about its sales. The company anticipates that customers will focus on food and essential products, which aligns well with its business strategy.

The Zacks Consensus Estimate for total sales to retail customers, excluding fuel, is estimated at $30,080 million, representing a 1.7% year-over-year increase. Likewise, the estimate for identical sales without fuel is projected to grow by 1.8%. Conversely, fuel sales through supermarkets are expected to decline by 8.4% from the prior year, amounting to $3,760 million, while other sales are forecasted to rise to $284 million from $272 million last year.

Kroger’s digital initiatives, such as the Delivery Now program, Boost membership program, and expanded customer fulfillment centers, are proving to be significant growth factors. Moreover, its alternative profit ventures, including Kroger Precision Marketing, are likely adding to revenue growth.

However, margin concerns persist due to potential risks linked to rising operating, general, and administrative expenses. Keeping tabs on these challenges is essential for assessing Kroger’s performance this quarter.

Forecast Predictions for Kroger

Our model does not strongly indicate an earnings beat for Kroger this quarter. Typically, a combination of a positive Earnings ESP and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) enhances the likelihood of an earnings beat. Currently, Kroger holds a Zacks Rank of #3, but the Earnings ESP is 0.00%. For insights on the best stocks to buy or sell prior to earnings announcements, utilize our Earnings ESP Filter.

Stocks to Watch for Potential Earnings Beat

Here are some stocks worth considering, showing favorable conditions for a potential earnings beat this reporting season.

US Foods Holding Corp. USFD has an Earnings ESP of +0.15% and a Zacks Rank of 2. It is expected to show year-over-year earnings growth when it reports fourth-quarter fiscal 2024 results, with the Zacks Consensus Estimate set at 80 cents per share.

Revenues for US Foods are projected to rise, with a consensus estimate of $9.5 billion representing a 6% increase year-over-year. The company achieved an earnings surprise of 3.7% in the last quarter.

Casey’s General Stores CASY shows an Earnings ESP of +1.50% and a Zacks Rank of 3. The company expects a decline in year-over-year revenues for second-quarter fiscal 2025 results, with estimates at $4 billion, reflecting a 1.4% decrease from last year. Despite this, the consensus estimate for Casey’s second-quarter earnings per share has risen by a cent in the last month, now positioned at $4.24, unchanged from a year earlier. CASY has delivered an average trailing four-quarter earnings surprise of 15.8%.

The Simply Good Foods Company SMPL has an Earnings ESP of +3.87% and a Zacks Rank of 3. The consensus estimate for first-quarter fiscal 2025 earnings per share is 45 cents, indicating a 4.7% increase year-over-year, while revenues are expected to reach $347.3 million, up 12.5% from last year. SMPL also maintains a trailing four-quarter earnings surprise average of 5.3%.

Exploring Future Energy Opportunities

The demand for electricity is on the rise, leading to a shift away from fossil fuels like oil and natural gas. Nuclear energy presents an ideal solution.

Recently, leaders from the U.S. and 21 other countries committed to tripling the world’s nuclear energy capacity. This urgent transition could result in significant profits for nuclear-related stocks. Investing early may yield considerable rewards.

Our compelling report, Atomic Opportunity: Nuclear Energy’s Comeback, details the key players and technologies behind this shift, highlighting three standout stocks positioned for success.

Download Atomic Opportunity: Nuclear Energy’s Comeback free today.

The Kroger Co. (KR): Free Stock Analysis Report

Casey’s General Stores, Inc. (CASY): Free Stock Analysis Report

The Simply Good Foods Company (SMPL): Free Stock Analysis Report

US Foods Holding Corp. (USFD): Free Stock Analysis Report

To read the original article on Zacks.com click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.