Witness the stampede as the price target for Krosaki Harima (TSE:5352) races to a new high of 14,137.20 / share with an exhilarating 8.62% surge. This remarkable rise from the previous estimation of 13,015.20 dated January 16, 2024, sends a strong signal to investors – confidence is soaring!

Market analysts have pooled their insights in this cacophony of bulls, with the latest targets indicating a vast landscape from a low of 12,544.20 to an impressive summit of 16,065.00 / share. The average price target stands at 14,137.20 / share, representing a bullish 2.74% leap from the latest reported closing price of 13,760.00 / share.

The Steady Dividend Journey of Krosaki Harima

Amidst this bullish frenzy, Krosaki Harima maintains a resilient 2.91% dividend yield – a port in the storm for many investors. The company’s dividend payout ratio of 0.27 reveals the balance: maintaining dividends without imperiling corporate health. Like a seasoned traveler, the company’s 3-Year dividend growth rate of 2.08% attests to its steady journey of increasing shareholder returns.

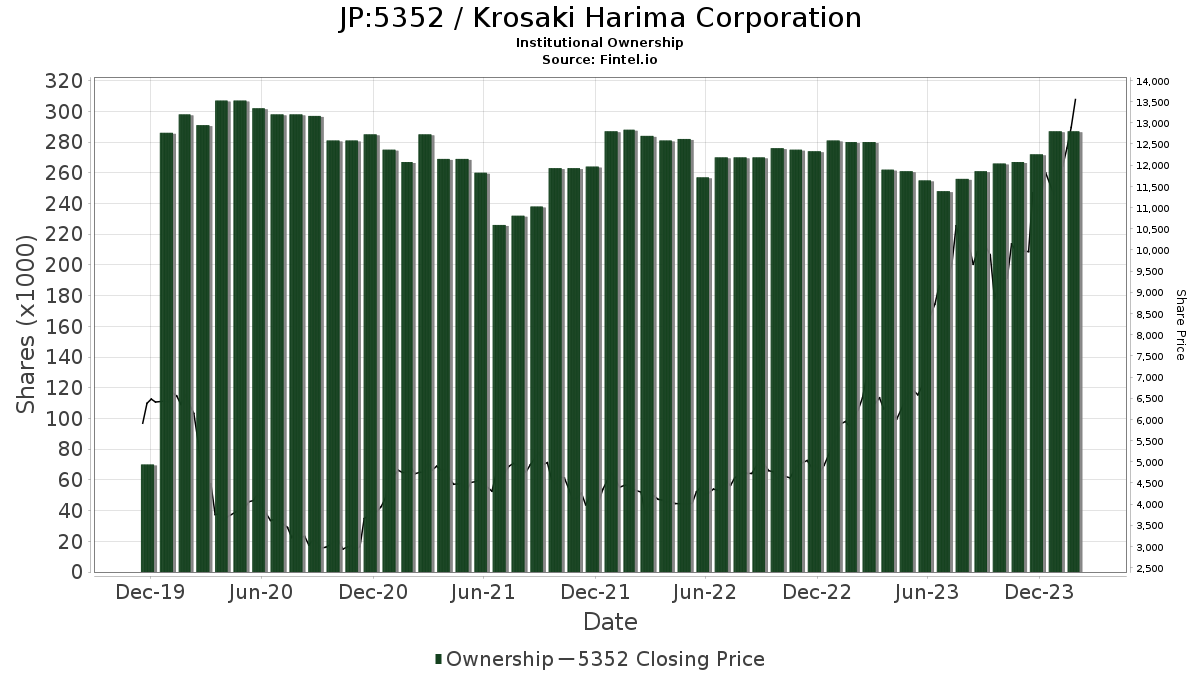

A Symphony of Fund Sentiment

Peering behind the curtain reveals a diverse orchestra of 41 funds or institutions, showcasing their positions in Krosaki Harima. A crescendo of 7 owner(s) join the tune – an impressive 20.59% increase in the last quarter. Meanwhile, the average portfolio weight dedicated to 5352 experiences a modest decrease of 27.77%, yet the total share ownership by institutions has soared by 7.27% to 287K shares in the last three months.

Insights from Other Shareholders

VGTSX – Vanguard Total International Stock Index Fund Investor Shares proudly holds 54K shares, capturing 0.64% ownership of the company in its symphonic embrace with no change in the last quarter.

Enter DISVX – Dfa International Small Cap Value Portfolio – Institutional Class, who skillfully plays with 50K shares, securing 0.60% ownership of the company. Like a wistful tune, the firm reported a decrease of 13.32% in the last filing and dimmed its portfolio allocation by 18.52% over the quarter, painting a shifting allegro in their investment strategy.

The performance continues with VTMGX – Vanguard Developed Markets Index Fund Admiral Shares harmonizing 32K shares akin to a nostalgic melody of 0.38% ownership in the company, experiencing no change in the last quarter.

In this grand ensemble, witness Dfa Investment Trust Co – The Japanese Small Company Series articulating its composition with 30K shares, capturing 0.36% ownership with unchanged vigor in the last quarter.

The grand finale features DFIEX – International Core Equity Portfolio – Institutional Class proudly showcasing 29K shares embodying 0.34% ownership, maintaining a steady rhythm with no changes in the last quarter.

Fintel stands as a beacon of investing research, illuminating paths for individual investors, traders, financial advisors, and small hedge funds alike.

Our data, a treasure trove covering the world’s financial landscape, illuminates fundamentals, analyst reports, ownership data, fund sentiment, insider trading, options flow, and much more. Our exclusive stock picks, a melody composed by advanced quantitative models, resonate for improved profits. Tap into this symphony of success and Click to Learn More.

This narrative originally found its heartbeat on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.