Krystal Biotech’s Market Success and Promising Pipeline Developments

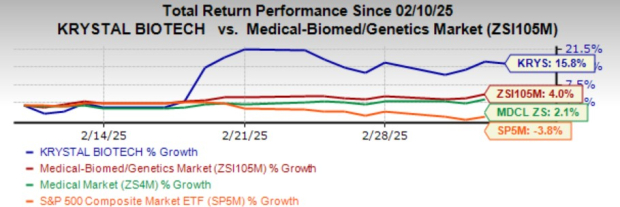

Shares of Krystal Biotech (KRYS) have seen a robust increase of 15.8% over the past month, significantly outperforming the industry growth of 4%. In this period, the stock has surpassed both industry and sector benchmarks.

In its fourth-quarter 2024 earnings report released last month, while Krystal’s earnings exceeded analysts’ expectations, sales figures fell short. Nonetheless, the stock experienced a surge following the quarterly results, largely due to strong uptake of Vyjuvek and positive advancements in its pipeline.

KRYS Leads Against Industry, Sector & S&P 500

Image Source: Zacks Investment Research

Strong Sales Growth for Vyjuvek

May 2023 marked a significant milestone for Krystal with the FDA’s approval of Vyjuvek, the first-ever reversible gene therapy for patients aged six months or older diagnosed with dystrophic epidermolysis bullosa (DEB).

DEB is a rare, severe genetic condition characterized by fragile skin and mucosal tissues, stemming from mutations in the COL7A1 gene.

Vyjuvek employs a non-invasive, topical, redosable approach to deliver two copies of the COL7A1 gene when applied directly to wounds associated with DEB. The company reported strong Vyjuvek sales of $290.5 million, a significant increase from $50.7 million in 2023. Krystal has made considerable progress in securing access and reimbursement for Vyjuvek since its U.S. market launch.

As of February 2025, Krystal has obtained over 510 reimbursement approvals for Vyjuvek across the U.S., maintaining extensive access, including favorable coverage for 97% of lives under commercial and Medicaid plans.

Furthermore, Krystal is pushing for Vyjuvek approval in additional markets. The European Medicines Agency’s (“EMA”) Committee for Medicinal Products for Human Use has issued a favorable opinion recommending Vyjuvek (beremagene geperpavec-svdt, or B-VEC) for treating DEB wounds.

In October, Krystal submitted a new drug application to Japan’s Pharmaceuticals and Medical Devices Agency, with a decision anticipated in the latter half of 2025.

Encouraging Pipeline Developments for Krystal

Krystal is also advancing a promising pipeline of genetic medicines across various medical fields, including respiratory, oncology, dermatology, ophthalmology, and aesthetics.

Currently, the company is investigating KB407 for cystic fibrosis treatment. In December 2024, Krystal announced that both single and repeat dosing of KB407 demonstrated safety and tolerability in patients from the initial cohorts of the ongoing CORAL-1 study. Interim molecular data for Cohort 3 is expected around mid-2025.

Another candidate, KB408, targets alpha-1 antitrypsin deficiency (AATD). December’s interim update indicated successful SERPINA1 gene delivery and therapeutic-level expression of alpha-1 antitrypsin. As a result of positive initial findings, Krystal is expanding Cohort 2 and initiating Cohort 3 of the SERPENTINE-1 study, with results projected for release in the second half of 2025.

Moreover, KB707 is being studied for the treatment of lung solid tumors, and enrollment for the KYANITE-1 study is ongoing.

Another ongoing phase I/II trial, OPAL-1, is evaluating intratumoral KB707 as either a standalone therapy or in combination therapy for patients with advanced solid tumors.

In aesthetics, KB301 is focused on treating dynamic wrinkles of the décolleté. Jeune Aesthetics, Krystal’s fully-owned subsidiary, previously announced positive interim safety and efficacy results from the PEARL-1 study. With this data in hand, Jeune Aesthetics is preparing to launch a phase II study for the same indication in the latter half of 2025.

Additionally, in November 2024, Jeune Aesthetics began dosing subjects in the randomized and placebo-controlled phase I PEARL-2 study, aimed at evaluating its second investigational product, KB304.

Valuation and Earnings Estimate for KRYS

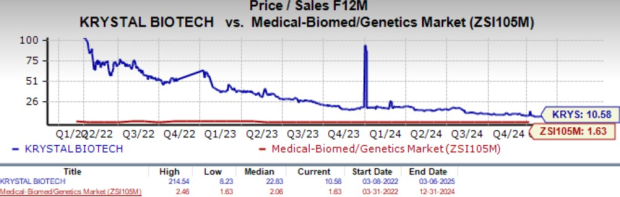

Currently, Krystal’s shares trade at a price/sales ratio of 10.58x forward sales, which is lower than its average of 22.83x but higher than the 1.63x average for the pharmaceutical industry.

Image Source: Zacks Investment Research

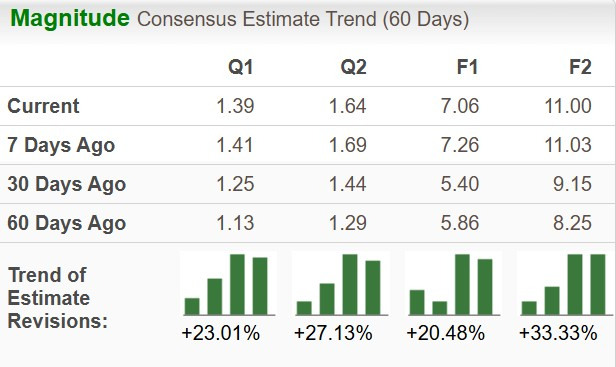

The Zacks Consensus Estimate for 2025 earnings per share (EPS) has risen to $7.07 from $5.40 in the past 30 days. Similarly, the EPS estimate for 2025 has increased to $11.03 from $9.15 over the same period.

Image Source: Zacks Investment Research

Consider Investing in KRYS

Large biotech companies often attract investors seeking stability in this sector. KRYS stands out as a potential buy, given its solid fundamentals and favorable growth outlook.

The future looks promising for Krystal, especially with Vyjuvek being the first FDA-approved gene therapy for DEB. Gaining approval in other regions will likely enhance sales. Additionally, the successful development of other candidates in its pipeline should contribute positively.

With a robust cash balance of $749.6 million as of December 31, 2024, Krystal appears well-equipped to advance its development initiatives.

Krystal’s Zacks Rank & Notable Stock Comparisons

Presently, Krystal holds a Zacks Rank #2 (Buy).

Top-ranked competitors in the biotech sector include Gilead Sciences (GILD) and BioMarin Pharmaceutical (BMRN), both currently holding a Zacks Rank #2.

Key Financial Insights: Gilead and BioMarin Show Positive EPS Trends

Discover today’s Zacks #1 Rank (Strong Buy) stocks here.

Gilead Sciences

Over the last 30 days, Gilead Sciences has seen its earnings per share (EPS) estimate for 2025 rise from $7.60 to $7.87. Meanwhile, the 2026 EPS estimate increased from $7.92 to $8.27.

Moreover, GILD has outperformed earnings expectations for the past four quarters, achieving an average surprise of 19.47%.

BioMarin Pharmaceutical

In the same 30-day period, BioMarin Pharmaceutical’s EPS estimate for 2025 has jumped from $4.01 to $4.24. The estimate for 2026 has also adjusted upward to $5.25 from $5.20. Notably, BMRN has beaten earnings estimates in its last four quarters, with a remarkable average surprise of 32.36%.

Zacks Highlights a Leading Semiconductor Stock

Zacks recently named a top semiconductor stock that, despite being only 1/9,000th of NVIDIA’s size, has exhibited significant growth potential. NVIDIA has surged over 800% since its recommendation, yet this new chip stock presents an opportunity for further gains.

With robust earnings growth and a rapidly expanding customer base, this company is poised to meet the soaring demand for technologies like Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor market is anticipated to grow from $452 billion in 2021 to $803 billion by 2028.

Explore this stock now for free >>

Interested in more investment opportunities? You can download Zacks’ latest report on the 7 Best Stocks for the Next 30 Days. Click here to access this free report.

Individual Stock Analysis Reports:

- BioMarin Pharmaceutical Inc. (BMRN): Free Stock Analysis

- Gilead Sciences, Inc. (GILD): Free Stock Analysis

- Krystal Biotech, Inc. (KRYS): Free Stock Analysis

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.