Note: I previously covered KWEB back in Fall 2021 at the heat of China’s tech crackdown. We cut our loss in 2022 in the mid 40s/share region. 2 years later from that post, I again believe KWEB represents a tradable opportunity as China’s selling pressure begins to get exhausted and multiple companies inside the index begin to enter a recovery phase. Buying the dip requires tremendous persistence. China still makes a great trade at the right swing lows. Discussed more below.

China’s regulatory environment can sometimes be largely unpredictable, but one thing is for sure – Leaders want to get its economy back on track.

After sinking 60% in 2 years, China’s stock market has essentially convinced that the mass majority of foreign investors that its regulatory environment has been made unsuitable for investing.

At a recent New Year’s Eve party, where the guests were all Chinese, there was not one person who believed China/Hong Kong was investible. Not one. At the slightest mention that China’s valuations make for a great tradable opportunity, I was met with the response “Don’t Invest in China.”

Folks have their reasons for being concerned about the sector, but that’s primarily because most people prefer a Buy & Hold approach to their holdings. This approach has absolutely not worked with China/Hang Seng stocks over the past 2 years, and my opinion is also that it may be too early to say that Holding China is anything more than a bet on (deeply) oversold conditions.

But deeply oversold (and deeply overbought) conditions tend to stack statistically favorable odds in a Trader’s favor. Today’s macro context where Beijing is increasingly concerned with its economy becoming derailed even further makes the current oversold conditions more likely to work for a 5-10% tradable defined target.

If the government wasn’t concerned about its property market and image with foreign investors, then its oversold readings wouldn’t matter. But this time around, I believe policymakers are serious about improving consumer and business confidence.

The broad China Internet ETF, NYSEARCA:KWEB may be a diversified approach to gain exposure to any recovery in the sector.

The Catalysts for KWEB and Fundamental Outlook

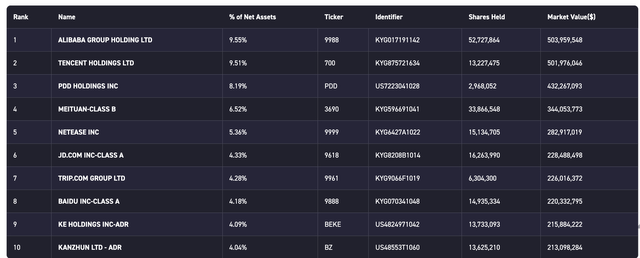

In order to understand the KWEB ETF, we break down the major constituents in the ETF by looking at the top 10 holdings which contribute roughly 50% of its net assets as shown below.

We then formulate a view of the top 10 companies and their trajectory. This is where it becomes subjective.

On E-Commerce (BABA, JD, Meituan, PDD)

For me personally, I see that e-commerce in China should be near a nadir and believe that it won’t take much for rock-bottom valuations in BABA and JD to drift higher. Pinduoduo’s international exposure with their winning TEMU platform should continue to be a winner among consumers as people look for reasonably high-quality products at attractive prices.

I’m more sidelined on Meituan as their food delivery business has razor-thin margins and their latest quarter continued to report falling operating margins. At this moment in time, I do not believe Investors are interested in companies that have negative operating margin trajectories even if there is a possibility for a rebound in the future and Meituan falls in this category. Fund Managers are sticking with proven business models that are likely to endure the incoming conditions.

Overall, 3 out of the 4 ECOM names BABA, JD, and PDD have reasonable roadmaps to have a stronger outlook in 2024. This should be net positive for KWEB.

On Internet (TCTZF, BIDU, NTES)

China’s latest gaming regulation released the day before Christmas shocked investors and sent the Hang Seng Tech index into flash crash mode before it stabilized the following week.

Overnight, we received information that the top regulator responsible for the gaming regulation has been asked to step down from his post. This is quite a strong indirect signal that Beijing does not want to continue to shatter investor confidence and may take a less heavy-handed approach as it attempts to revitalize its local economy and job market.

I believe China will continue to monitor internet platforms very carefully, but this latest news development to remove the regulator who enacted the latest gaming regulations puts this sub-sector’s rating to Neutral/Mildly positive in the near term.

As a result, I believe these 3 companies have mildly net positive effects on the KWEB ETF.

On Travel (TCOM)

Travel is the lesser affected industry in China’s strict regulatory framework, and the latest strong gaming figures from Macau suggest that travel & entertainment are areas that reflect healthy baby boomer spending in China.

I believe TCOM is a net benefit to KWEB’s recovery and have discussed that more in this post.

On Real Estate (BEKE)

Although BEKE is #9 on the list in terms of weight for the KWEB ETF, it has forward-looking qualities for the KWEB Stocks because it is real-estate centric. Where Real Estate goes in China, so will the broader macro sentiment.

Real Estate has been mired in deep struggles over the past 2 years, but companies like BEKE that have exposure to broad gross property transaction value in aggregate rather than specific developers may have an opportunity to bounce back when the entire industry stabilizes. It’s rather important not to make a specific bet on individual real estate developers but instead the entire industry as a whole in terms of transaction volume.

Because BEKE captures gross property transaction value rather than being an individual real estate developer, I rate BEKE to also be a net benefit to KWEB’s recovery as I do see China Real Estate stabilizing.

Other Comments

I’m not yet fully familiar with Kanzhun so I cannot comment on that company for now.

Risks & Thoughts on Entry

Out of the top 10 companies within KWEB, I have a cautiously favorable opinion on 8 of them from on intermediate-term timeframes so my net outlook for the KWEB ETF is modestly positive.

China continues to be extraordinarily volatile, but in 2024, where investors look for value-oriented stocks that simultaneously have growth potential, sectors that are potentially on investors’ radars include Energy, Healthcare, and China.

Risks in the China sector ETF include the following: they include regulatory uncertainty in China, deep foreign investor pessimism, and a structurally changed real estate landscape that has prevented Consumers from feeling as confident about spending as before. These risks manifest themselves in sporadic intense mean-reverting behavior where big rallies are eventually violently reversed, but certain sell-offs also trap short-sellers with large subsequent rallies.

We entered KWEB and associated positions when Hang Seng traded the low 16,000s. Given the intense volatility of the sector, I rate it a cautious Buy from a trading perspective.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.